Question: Please be sure that your answer is correct, If you do not know the answer, do not give me wrong answer thank you : 7.

Please be sure that your answer is correct, If you do not know the answer, do not give me wrong answer thank you :

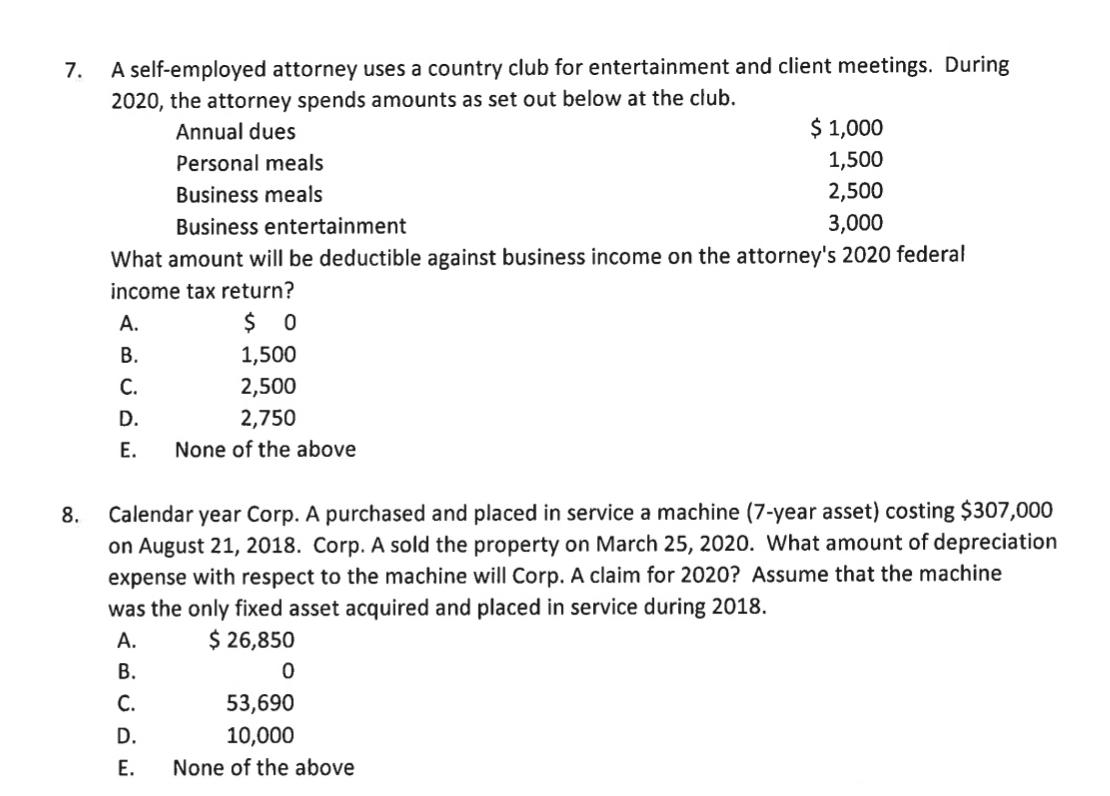

7. A self-employed attorney uses a country club for entertainment and client meetings. During 2020, the attorney spends amounts as set out below at the club. 8. Annual dues Personal meals Business meals Business entertainment 3,000 What amount will be deductible against business income on the attorney's 2020 federal income tax return? A. B. C. D. E. $0 1,500 2,500 2,750 None of the above $ 1,000 1,500 2,500 Calendar year Corp. A purchased and placed in service a machine (7-year asset) costing $307,000 on August 21, 2018. Corp. A sold the property on March 25, 2020. What amount of depreciation expense with respect to the machine will Corp. A claim for 2020? Assume that the machine was the only fixed asset acquired and placed in service during 2018. A. $ 26,850 B. 0 C. D. E. 53,690 10,000 None of the above

Step by Step Solution

3.40 Rating (147 Votes )

There are 3 Steps involved in it

Answers 7 E 8 B Explanations Question 7 The amount deductible against business ... View full answer

Get step-by-step solutions from verified subject matter experts