Question: please be sure to add reference/cite the ASC. thanks. Acme Inc., a public company, entered into a two-year contract with a Canadian Co. to buy

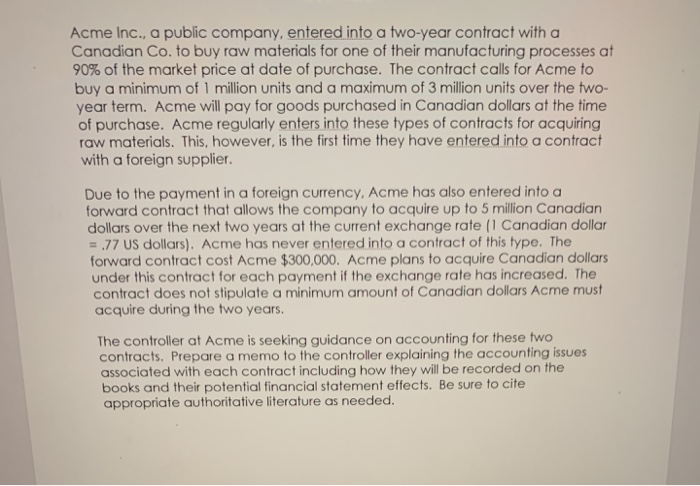

Acme Inc., a public company, entered into a two-year contract with a Canadian Co. to buy raw materials for one of their manufacturing processes at 90% of the market price at date of purchase. The contract calls for Acme to buy a minimum of 1 million units and a maximum of 3 million units over the two- year term. Acme will pay for goods purchased in Canadian dollars at the time of purchase. Acme regularly enters into these types of contracts for acquiring raw materials. This, however, is the first time they have entered into a contract with a foreign supplier. Due to the payment in a foreign currency, Acme has also entered into a forward contract that allows the company to acquire up to 5 million Canadian dollars over the next two years at the current exchange rate (l Canadian dollar = .77 US dollars). Acme has never entered into a contract of this type. The forward contract cost Acme $300,000. Acme plans to acquire Canadian dollars under this contract for each payment if the exchange rate has increased. The contract does not stipulate a minimum amount of Canadian dollars Acme must acquire during the two years. The controller at Acme is seeking guidance on accounting for these two contracts. Prepare a memo to the controller explaining the accounting issues associated with each contract including how they will be recorded on the books and their potential financial statement effects. Be sure to cite appropriate authoritative literature as needed

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts