Question: Help Save & Exit Subm Check my work mode : This shows what is correct or incorrect for the work you have completed so far,

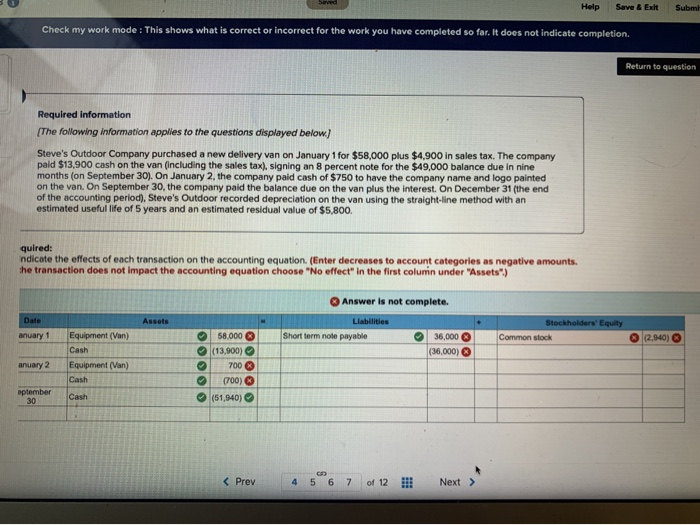

Help Save & Exit Subm Check my work mode : This shows what is correct or incorrect for the work you have completed so far, it does not indicate completion Return to question Required information (The following information applies to the questions displayed below) Steve's Outdoor Company purchased a new delivery van on January 1 for $58,000 plus $4.900 in sales tax. The company paid $13,900 cash on the van (including the sales tax), signing an 8 percent note for the $49.000 balance due in nine months (on September 30). On January 2, the company paid cash of $750 to have the company name and logo painted on the van. On September 30, the company paid the balance due on the van plus the interest. On December 31 (the end of the accounting period), Steve's Outdoor recorded depreciation on the van using the straight-line method with an estimated useful life of 5 years and an estimated residual value of $5,800. quired: ndicate the effects of each transaction on the accounting equation. (Enter decreases to account categories as negative amounts. the transaction does not impact the accounting equation choose "No effect" in the first colunin under "Assets") Answer is not complete. Assets Liabilities Date anuary 1 Stockholders' Equity Common stock Short term note payable (2.940) 36,000 ( 1000) anuary 2 Equipment (Van) Cash Equipment (Van) Cash Cash 58.000 (13,900) 700 (700) (51,940) paber

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts