Question: Please be sure to round how the instructions specify. Your company has been doing well, reaching $1 million in earnings, and is considering launching a

Please be sure to round how the instructions specify.

Please be sure to round how the instructions specify.

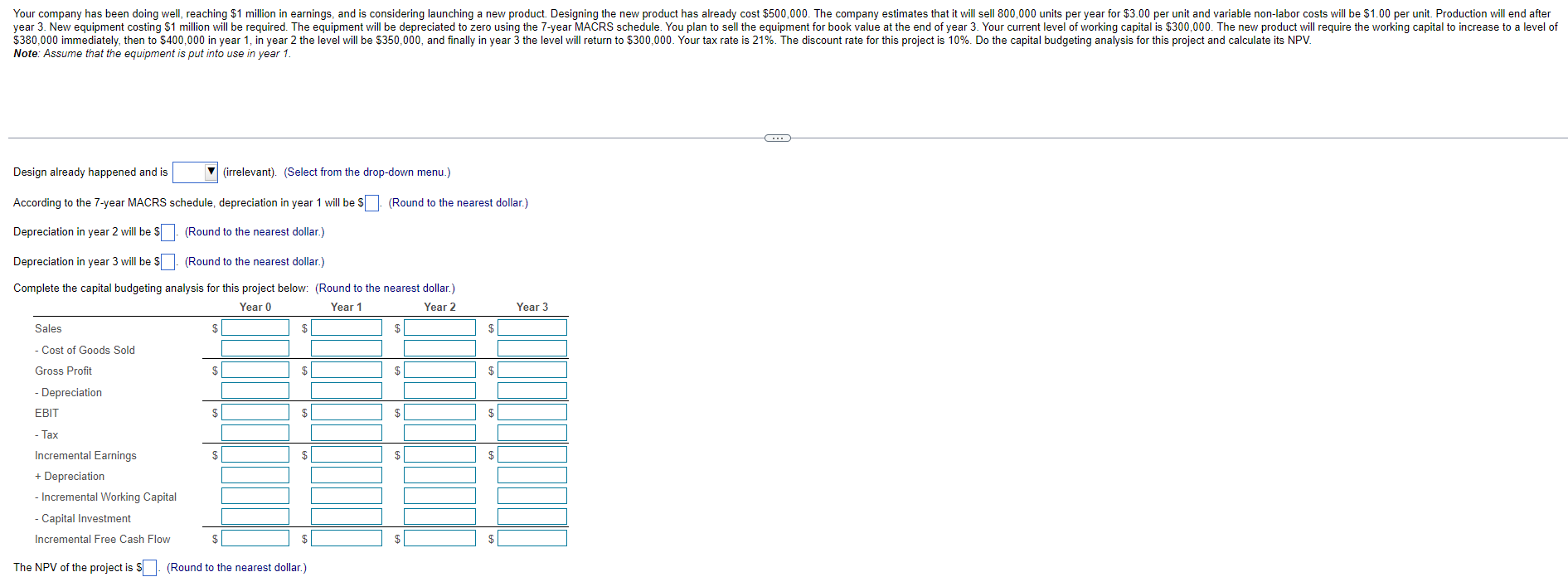

Your company has been doing well, reaching $1 million in earnings, and is considering launching a new product. Designing the new product has already cost $500,000. The company estimates that it will sell 800,000 units per year for $3.00 per unit and variable non-labor costs will be $1.00 per unit. Production will end after year 3. New equipment costing S1 million will be required. The equipment will be depreciated to zero using the 7-year MACRS schedule. You plan to sell the equipment for book value at the end of year 3. Your current level of working capital is $300,000. The new product will require the working capital to increase to a level of $380,000 immediately, then to $400,000 in year 1, in year 2 the level will be $350,000, and finally in year 3 the level will return to $300,000. Your tax rate is 21%. The discount rate for this project is 10%. Do the capital budgeting analysis for this project and calculate its NPV. Note: Assume that the equipment is put into use in year 1. ... Design already happened and is (irrelevant). (Select from the drop-down menu.) According to the 7-year MACRS schedule, depreciation in year 1 will be $(Round to the nearest dollar.) Depreciation in year 2 will be $ (Round to the nearest dollar.) Depreciation in year 3 will be $ (Round to the nearest dollar.) Complete the capital budgeting analysis for this project below: (Round to the nearest dollar.) Year 0 Year 1 Year 2 Sales $ $ Year 3 $ Cost of Goods Sold Gross Profit $ $ $ $ - Depreciation EBIT $ $ $ $ $ $ - Tax Incremental Earnings + Depreciation - Incremental Working Capital Capital Investment Incremental Free Cash Flow $ The NPV of the project is $ (Round to the nearest dollar.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts