Question: PLEASE BE SURE TO USE A COMPUTER AND NOT PEN AND PAPER VERY HARD TO READ HANDWRITING WILL MARK THUMBS UP THANKS 4:28 Aa correct

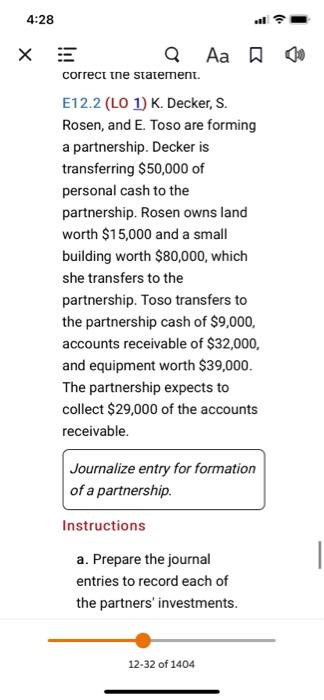

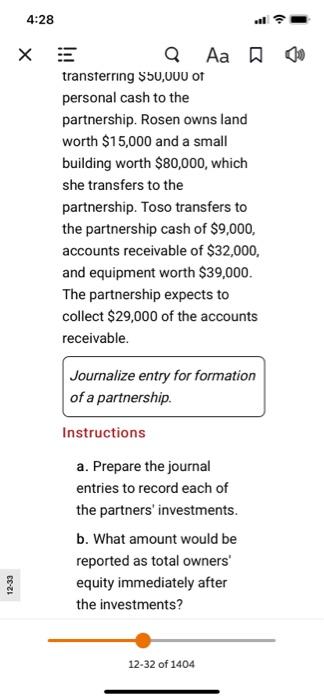

4:28 Aa correct the statement. E12.2 (LO 1) K. Decker, S. Rosen, and E. Toso are forming a partnership. Decker is transferring $50,000 of personal cash to the partnership. Rosen owns land worth $15,000 and a small building worth $80,000, which she transfers to the partnership. Toso transfers to the partnership cash of $9,000, accounts receivable of $32,000, and equipment worth $39,000. The partnership expects to collect $29,000 of the accounts receivable. Journalize entry for formation of a partnership Instructions a. Prepare the journal entries to record each of the partners' investments. 12-32 of 1404 4:28 Q Aa N D transferring $50,000 of personal cash to the partnership. Rosen owns land worth $15,000 and a small building worth $80,000, which she transfers to the partnership. Toso transfers to the partnership cash of $9,000, accounts receivable of $32,000, and equipment worth $39,000. The partnership expects to collect $29,000 of the accounts receivable. Journalize entry for formation of a partnership Instructions a. Prepare the journal entries to record each of the partners' investments. b. What amount would be reported as total owners' equity immediately after the investments? 12-33 12-32 of 1404

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts