Question: Please calculate the total cost using the total cost analysis worksheet. Pacific Systems Corporation, Inc. (PSC) is a medium-sized high technology company located north of

Please calculate the total cost using the total cost analysis worksheet.

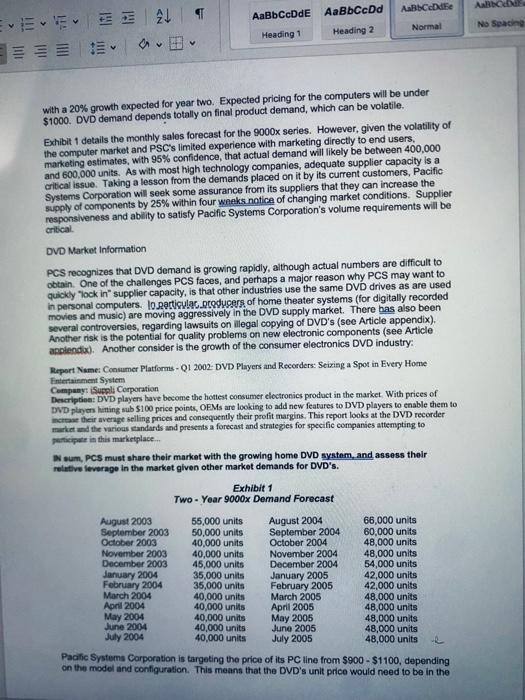

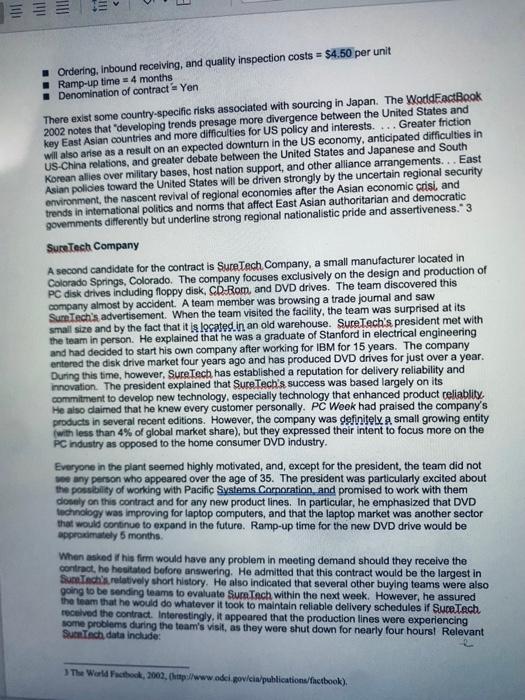

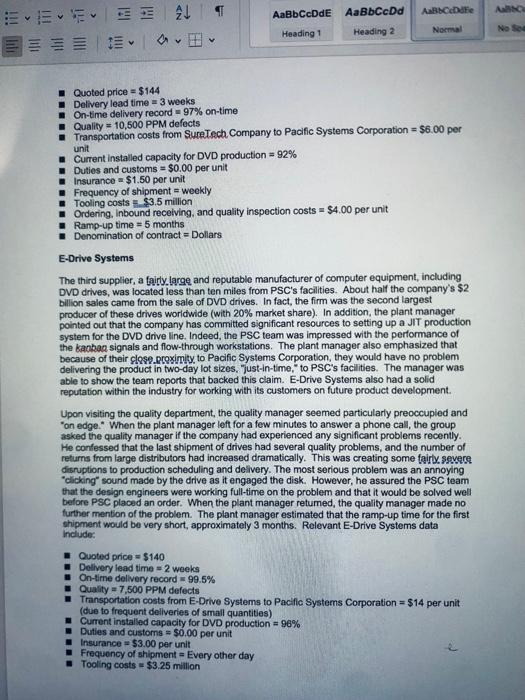

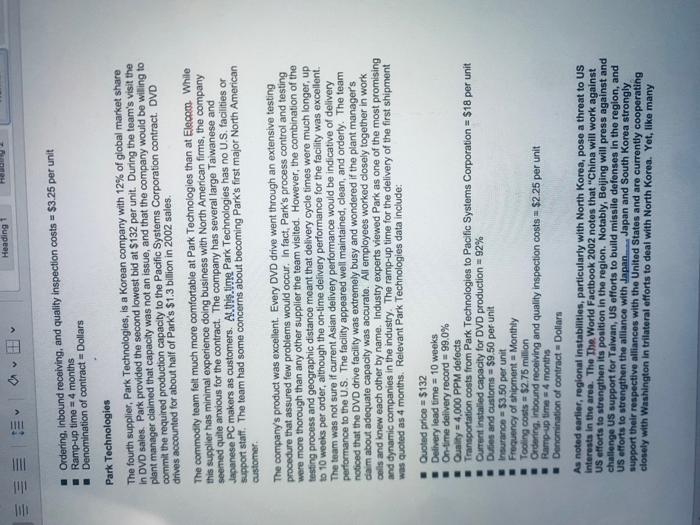

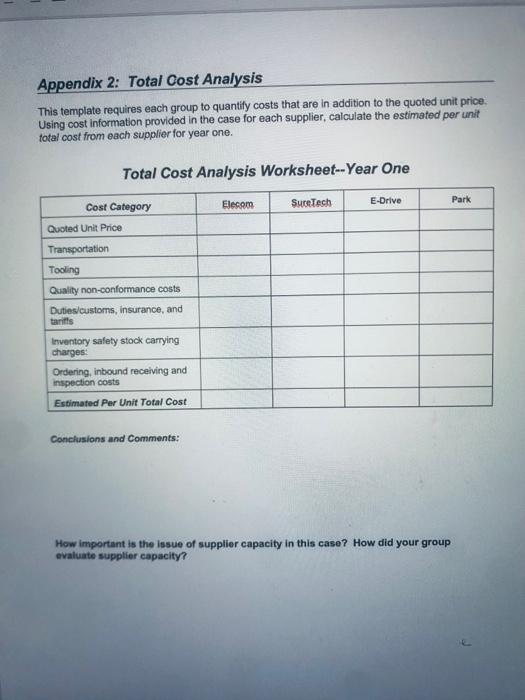

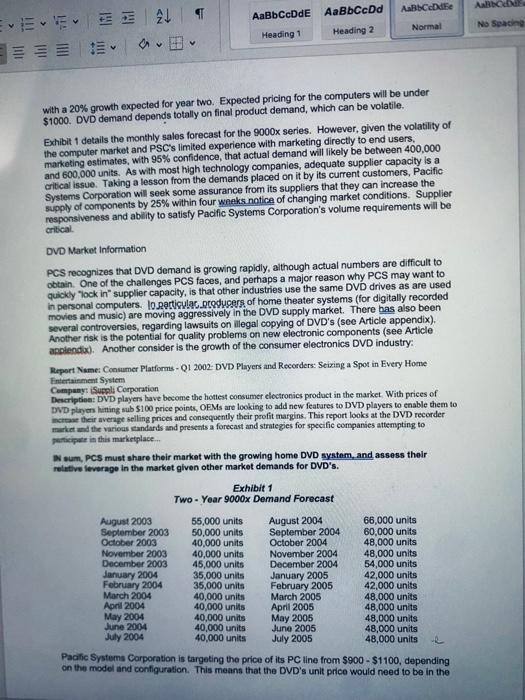

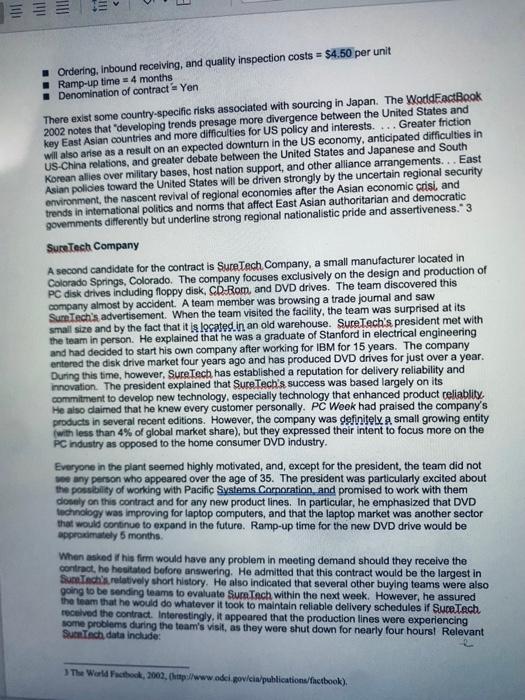

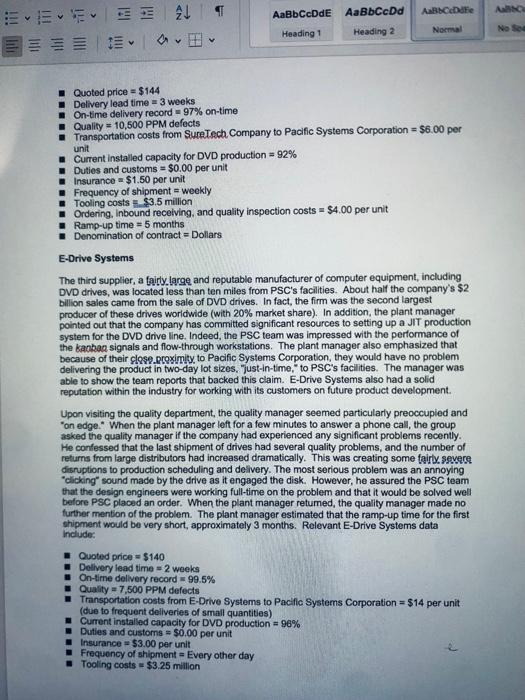

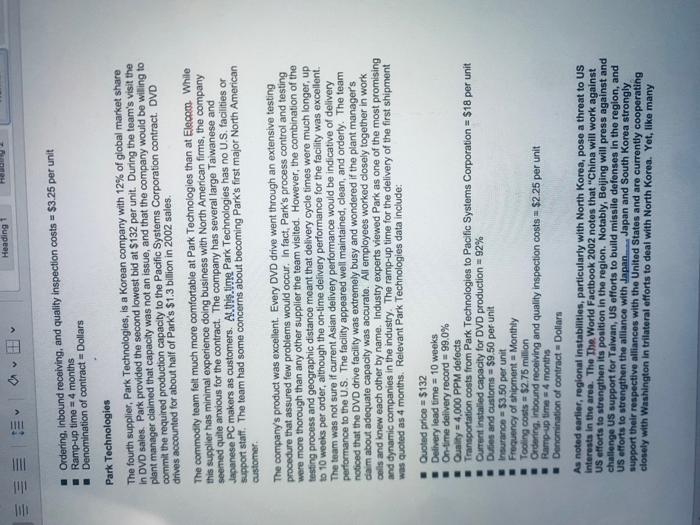

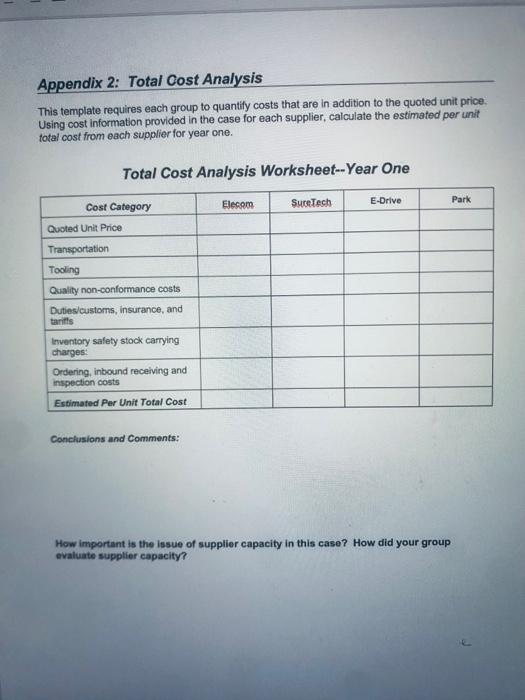

Pacific Systems Corporation, Inc. (PSC) is a medium-sized high technology company located north of San Francisco. In its early years PSC produced component parts and subsystems for: personal computers and engineering workstations. In 2000 , PSC added its own line of engineering workstations to its product offering. Recently, the company decided to expand its: product line to include fully assembled personal computers (PCs). The company, recognized as a well-established component and subsystem manufacturer, has grown from a single product manufacturer with annual sales of $2.5 million, to a multi-product $3 billion firm in just ten years. This growth was helped in part through acquisitions in server markets and related computer industries. Pacific Systems Corporation has a strong reputation for manufacturing high quality. products with on-time customer delivery. The company also emphasizes state-of-the-art technology in its product design, production, information, and delivery systems. PSC's decision to enter the personal computer market occurred during the peak of the Intemet boom in late 1999. In particular, the marketing department decided to focus on the home PC user, to exploit the booming growth in home computer use. The projected growth rate of U.S. PC shipments to the home sector in the 1990 s exceeded the business sector, and was predicted to surpass the business sector in total share of shipments. 1 Although Pacific Systems Corporation was a small player in this market the company decided to pursue an aggressive strategy of selling high quality computers at affordable prices. The new line of computers, called the 9000x series, would come with a Pentium 600MHz microprocessor, 128 megabytes of memory, 8-14 gigabytes of hard disk space, a read/write CD-ROM/DVD (digital video disc) drive, and a 17-inch flat screen color monitor. Athough industry forecasts have certainly been downgraded, PCS is betting that in 2003 the computer industry will grow at a slow but steady state as consumers upgrade their computers with the predicted slow but steady growth in the economy. This decision poses some risks, given that there is a "mixed bag" of opinions regarding the growth of the electronics sector in 2003. The decision was made to pursue the home computer user, through a strategy focused on shipping low-cost, high-quality computers directly to customers as orders are received (make-to-order). This production model is similar to the Dell approach, and appears to be the model that will dominate the PC industry. Because the company does not plan to build finished PCs (Le., make-to-stock) in anticipation of future sales, market demand forecasts, supplier quality, supplier capacity, lead time, and delivery reliability are critical factors. The company is wiling to carry some units in component inventory as safety stock as a buffer against missing customer order commitments. Pacific Systems Corporation will assemble the computers in its own facilities, but intends to outsource many of the key product components and subassemblies, including the DVD drive, a feature that will be standard on each PCS computer. The decision to outsource the DVD drive resulted from an executive-level insourcing/outsourcing study that concluded the cost to manufacture these drives in-house was highly prohibitive. The product requires production capabilities that are beyond PCS's current expertise. Marketing estimates that first year demand for the new PC, and therefore the DVD drives, would be approximately 500,000 units, 1 Thome Computers", Bualiness Week, November 28, 1994, pp. 89.96. With a 20% growth expected for year two. Expected pricing for the computers will be under $1000. DVD demand depends totally on final product demand, which can be volatile. Exhibit 1 details the monthly sales forecast for the 9000x series. However, given the volatility of the computer market and PSC's limited experience with marketing directly to end users. marketing estimates, with 95% confidence, that actual demand will likely be between 400,000 and 600,000 units. As with most high technology companies, adequate supplier capacity is a cribcal issue. Taking a lesson from the demands placed on it by its current customers, Pacific Systems Corporation will seek some assurance from its suppliers that they can increase the supply of components by 25% within four wheks notice of changing market conditions. Supplier responsiveness and ablity to satisfy Pacific Systems Corporation's volume requirements will be critical. DVD Market information PCS recognizes that DVD demand is growing rapidly, although actual numbers are difficult to obtain. One of the challenges PCS faces, and perhaps a major reason why PCS may want to quickly "lock in" supplier capacity, is that other industries use the same DVD drives as are used in personal computers. Io, particulac. produgers of home theater systems (for digitally recorded movies and music) are moving aggressively in the DVD supply market. There has also been several controversies, regarding lawsuits on illegal copying of DVD's (see Article appendix). Another risk is the potential for quality problems on new electronic components (see Article applendix). Another consider is the growth of the consumer electronics DVD industry: Report Nime: Consumer Platforms - Q1 2002. DVD Players and Recorders: Seixing a Spot in Every Home Eintertairment System Companys isuppli Corporation Deseription: DVD playes lave besome the hottest consumer eloctronics product in the market. With prices of DVD plryen himing sub $100 price points, OEMs are looking to add new features to DVD players to enable them to maraie their average selling prices and consequently their profit margins. This report looks at the DVD recorder market and the various eandards and presents a forecast and strategies for specific companies attempting to Taticipute in this marketplace.. M sum, PCs must share their market with the growing home DVD system, and assess their relutive leverage in the market given other market demands for DVD's. Pacific Systems Carporation is targeting the price of its PC line from $900$1100, depending on the model and configuration. This means that the DVD's unit price would need to be in the $125 - 150 range. This is not unreasonable given current market pricing (see Appendix). However, the market for DVD's extends well beyond the computer industry, and is not without its share of uncertainty and disruptions (see Appendix). Another key consideration in the supplier selection decision is that Pacific Systems Corporation expects to control the transportation link from the supplier(s) to its facility in California. The company has decided to assume responsibility for transportation, but not ownership of inventory, from the supplier's facility. The company plans to support its inbound logistics with carriers that offer corporate-negotiated rate discounts. While earty personal computers were notorious for quality-related problems, today's customers demand defect-free products. With intense price competition and narrow profit margins, a single product defect, particularly when the PC is in the customers' hands, can "wipe out" any profit from the sale. Poor quality will also adversely affect market reputation and future sales. Athough exact numbers are difficult to obtain, financial analysts at Pacific Systems Corporation calculate, based on experience and assumptions, that each with a defect will result, on average, in $300 in non-conformance costs that Pacific Systems Corporation must bear (including lost customer goodwill). The company plans to introduce the new line of computers directly to the marketplace in August 2003. It must have inventory by June to begin process proving and pillot production. The August date coincides with back-to-school sales, which is the busiest time of year for PC makers. It is now early January 2003. Pacific Systems Corporation relies on cross-functional commodity teams to develop sourcing strategies for key purchased items. Executive management views the DVD supplier selection decision as a critical part of the 9000x series development. The commodity team has spent the last several weeks visiting four DVD suppliers, and is currently evaluating various supply options. The team expects to begin negotiation with one or more suppliers within the next several weeks, Information regarding the suppliers under consideration is presented in the following section. THE SUPPLY ALTERNATIVES The team developed a market analysis of DVD drive manufacturers, and narrowed their search to four specific suppliers. These four suppliers were selected as final contenders based on: al cont competitveness given Pacific Systems Corporation initial target cost, and/or b) location prowimily to PCs's assembly sites. The team was somewhat divided, as some members felt that PCs should globalize its sourcing initiatives, while others felt that local suppliers would be a betier choice in terms of working arrangements. Engineering supported the commodity team's preliminary efforts by purchasing off-the-shelf DVDis for testing. This helped determine if the suppliers had a product that infially satisfied PSC's expectations. Relying on product samples, while providing preliminary insight into the capability and technology of each supplier, was not cufficient to support a final supplier solection decision. Henco, the need for direct visits by the commodity team became apparent. The team decided to visit four suppliers directly to collect detailed information. The visits ranged from one to two days each, with all four visits completed within a three-week period. These vists wore time-consuming and exhausting, particularly since two suppliers were losated. in Avin. Unfortunately, Pacific Systems Corporation does not have an intemational Purchasing Otfice (PO) to support its intemational procurement actlvities. Furthermore, no one on the leam spoke Korean or Jepanese. Fortunately, the other two suppliers, located in the U.S., were much easier to vialt. In fact, one suppler was located only ten miles from the PCS assembly facility. The following sections summarize data suppliers. Elecom. Technologies Flecom Technologies, located in Nagasaki, Japan, was the largest supplier the team visited (sales of $6.5 bilion). The plant covered ten acres, with a wide variety of computer and electronic components produced in the facility. DVD drives represent a large segment of Elecomis production (Elecom commits 50% of total capacity to DVD drive production and derives 60% of its revenues from DVD drives). Because of its size, however, the company seemed most interested in large contracts ( $150 million or more annually). Elecom, currently controls approximately 30% market share of global DVD sales. Geographic distance from Califomia, along with the need to accommodate the needs of some large customers, made Elecomis quoted lead time the longest of the four suppliers being evaluated. The highest-ranking manager that met with the PCS team was a sales manager, who took the team to visit various departments. The division vice-president and plant manager were in conference with a large DVD customer, who the PSC team found out had formed a strategic supply alliance with Elecom. The PSC commodity team felt a bit "snubbed" at the facility, particularly the group's female members. The facility was efficient, spotiess, and modem. When the team visited engineering, they spoke with a manager in DVD design. The engineer estimated, based on previous experience, that the ramp-up time to begin production that would satisly PSC's specifications would be about 4 months. Furthermore, tooling costs would likely be $3 million. The sales manager was particularly proud of Elecpro's new Internet-based electronic data interchange (EDI) system. This system allowed direct communication with customers. He was also proud that Elecom Technologies was "the price leader" for the industry. and was producing DVD drives for several of the major brand name PC companies. He also talked about the company's extensive investment in research and development. When the sales manager heard that the DVD order, based on 500,000 units in year one, would likely not exceed $75 million per year, he hesitated, saying that he would need to discuss the order with management. Moreover, he indicated that the company typically was not interested in orders of less than $150 million per annum, but that exceptions might be possible. The economics associated with large orders is what made Elecom a low-cost producer. Relevant Elecom. Technologies data include: - Quoted price = $127 per unit (quoted at 120 yen to $1 U.S.) - Delivery lead time =8 weeks . On-time delivery record =95% on-time (for large customers) - Qualify =9,500 PPM defects - Transportation costs from Asia to Pacific Systems Corporation =$18 per unit . Current installed capacity for DVD production 2=98% D Duties and customs =$9.50 per unit = Insurance =$2.00 per unit - Frequency of shipment = Monthly - Tooling costs =$3 million 2 Notes Current instalied capacily indicates that portion of the supplier's DVD production capacity that is cumenty utilized. For example, If current installed capacity la 98%, then this supplier is unilizing 90% of its production capacity and therafore has 2% of is capacity available for nexbusiness. Ordering, inbound receiving, and quality inspection costs =$4.50 per unit Ramp-up time =4 months Denomination of contract = Yen There exist some country-specific risks associated with sourcing in Japan. The WorddFactBook 2002 notes that "developing trends presage more divergence between the United States and key East Asian countries and more difficulities for US policy and interests. ... Greater friction Will also arise as a result on an expected downturn in the US economy, anticipated difficulties in US-China relations, and greater debate between the United States and Japanese and South Korean alies over military bases, host nation support, and other alliance arrangements. .. East Asian policies toward the United States will be driven strongly by the uncertain regional security omvironment, the nascent revival of regional economies after the Asian economic crisi, and trends in intemational politics and norms that affect East Asian authoritarian and democratic govemments differentiy but underline strong regional nationalistic pride and assertiveness. 3 Suretech Company A second candidate for the contract is SureTech Company, a small manufacturer located in Colorado Springs, Colorado. The company focuses exclusively on the design and production of PC disk drives induding floppy disk, CD-Rom, and DVD drives. The team discovered this company almost by accident. A team member was browsing a trade joumal and saw SureTechis advertisement. When the team visited the facility, the team was surprised at its small size and by the fact that it is losated. in an old warehouse. SureTech's president met with the team in person. He explained that he was a graduate of Stanford in electrical engineering and had decided to start his own company after working for IBM for 15 years. The company entered the disk drive market four years ago and has produced DVD drives for just over a year. During this time, however. SureTech has established a reputation for delivery reliability and movation. The president explained that SureTech's success was based largely on its commitment to develop new technology, especially technology that enhanced product reliablity. He aiso daimed that he knew every customer personally. PC Woek had praised the company's products in several recent editions. However, the company was definitely a small growing entity fwith less than 4% of global market share), but they expressed their intent to focus more on the PC industry as opposed to the home consumer DVD industry. Everyone in the plant seemed highly motivated, and, except for the president, the team did not wes any person who appeared over the age of 35. The president was particularly excited about the possbility of working with Pacific Systems Comoration and promised to work with them dosely on this contract and for any new product lines. In particular, he emphasized that DVD technology was improving for laptop computers, and that the laptop market was another sector that would continue to expand in the future. Ramp-up time for the new DVD drive would be approximately 5 months. When asked it his firm would have any problem in meeting demand should they recelve the contract he hesitated before answering. He admitted that this contract would be the largest in Suminchis retatively thort history. He also indicated that several other buying teams were also going to be sending teams to evaluate Suref the team that he would do whatever it took to maintain reliable delivery schedules if SureTech. receved the contract. Interestingly, it appeared that the production lines were experiencing some problems during the team's visit, as they were shut down for nearly four hoursi Relevant Suref Trch data include: Quoted price =$144 Delivery lead time =3 weeks On-time delivery record =97% on-time Quality =10,500 PPM defocts Transportation costs from Suretech Company to Pacific Systems Corporation =$6.00 per unit - Current installed capacity for DVD production =92% Duties and customs =$0.00 per unit Insurance =$1.50 per unit Frequency of shipment = weekly Tooling costs =$3.5 million Ordering, Inbound receiving, and quality inspection costs =$4.00 per unit Ramp-up time =5 months Denomination of contract = Dollars E-Drive Systems The third supplier, a fairly.large and reputable manufacturer of computer equipment, including DVD drives, was located less than ten miles from PSC's facilities. About half the company's \$2 billion sales came from the sale of DVD drives. In fact, the firm was the second largest producer of these drives worldwide (with 20% market share). In addition, the plant manager pointed out that the company has committed significant resources to setting up a JIT production system for the DVD drive line. Indeed, the PSC team was impressed with the performance of the kanban signals and flow-through workstations. The plant manager also emphasized that because of their close proximity, to Pacific Systems Corporation, they would have no problem delivering the product in two-day lot sizes, "just-in-time," to PSC's facilities. The manager was able to show the team reports that backed this claim. E-Drive Systems also had a solid reputation within the industry for working with its customers on future product development. Upon visiting the quality department, the quality manager seemed particularly preoccupied and "on edge." When the plant manager left for a few minutes to answer a phone call, the group asked the quality manager if the company had experienced any significant problems recently. He confessed that the last shipment of drives had several quality problems, and the number of returns from large distributors had increased dramatically. This was creating some fairly severe disruptions to production scheduling and delivery. The most serious problem was an annoying "clicking" sound made by the drive as it engaged the disk. However, he assured the PSC team that the design engineers were working full-time on the problem and that it would be solved well before PSC placed an order. When the plant manager retumed, the quality manager made no further mention of the problem. The plant manager estimated that the ramp-up time for the first shipment would be very short, approximately 3 months. Relevant E-Drive Systems data include: Quoted price =$140 Delivery lead time =2 weeks On-time delivery record =99.5% Quality =7,500 PPM defects Transportation costs from E-Drive Systems to Paciflc Systems Corporation = $14 per unit (due to frequent dellveries of small quantities) - Current installed capacity for DVD production =96% Duties and customs =$0.00 per unit Insurance =$3.00 per unit Frequency of shipment = Every other day Ordering, Inbound recelving, and quality inspection costs =$3.25 per unit Ramp-up time =4 months Denomination of contract = Dollars Park Technologies The fourth supplier, Park Technologies, is a Korean company with 12% of global market share In DVD sales. Park provided the second lowest bid at $132 per unit. During the team's visit the plant manager claimed that capacity was not an issue, and that the company would be willing to commit the required production capacity to the Pacific Systems Corporation contract. DVD drives accounted for about half of Parks $1.3 billion in 2002 sales. The commodity team felt much more comfortable at Park Technologies than at Elecem. While this supplier has minimal experience doing business with North American firms, the company seemed quite anxious for the contract. The company has several large Taiwanese and Japanese PC makers as customers. At. this time Park Technologies has no U.S. facilities or support staff. The team had some concerns about becoming Park's first major North American customer. The company's product was excellent. Every DVD drive went through an extensive testing procedure that assured few problems would occur. In fact, Park's process control and testing were more thorough than any other supplier the team visited. However, the combination of the testing process and geographic distance meant that delivery cyclo times were much longer, up to 10 weeks per order, although the on-time delivery performance for the facility was excellent. The team was not sure if current Asian delivery performance would be indicative of delivery performance to the U.S. The facility appeared well maintained, clean, and orderly. The team noticed that the DVD drive facility was extremely busy and wondered if the plant manager's claim about adequate capacity was accurate. All employees worked closely together in work: celis and iknew each other by name. Industry experts viewed Park as one of the most promising and dynamic companies in the industry. The ramp-up time for the delivery of the first shipment was quoted as 4 months. Relevant Park Technologies data include: - Quoted price =$132 - Delivery lead time =10 weeks - On-time delivery record =99.0% * Cuality =4,000 PPM defects - Transportation costs from Park Technologies to Pacific Systems Corporation = \$18 per unit - Current instalied capacity for DVD production = 92% = Duties and customs =$9,50 per unit 1. Insurance =53.50 per unit E Frequency of shipment = Monthly = Tooling costs =$2.75 million = Ordening, inbound recelving and quality inspection costs = $2.25 per unit = Ramp-up time =4 months - Denomination of contract = Dollars As noted earlier, regional instabinities, particularly with North Korea, pose a threat to US interests in the area. The The. World Factbook 2002 notes that "China will work against US efforts to strengthen its position in the region. Notably, Boijing will press against and challenge US support for Taiwan, US efforts to build missile defenses in the region, and US efforts to strengthen the alliance with Japan. Japan and South Korea strongly. support their respective alliances with the United States and are currently cooperating closely with Washington in trilateral efforts to deai with North Korea. Yot, Hike many This template requires each group to quantify costs that are in addition to the quoted unit price. Using cost information provided in the case for each supplier, calculate the estimated per unit total cost from each supplier for year one. Total Cost Analysis Worksheet-Year One Conelusions and Comments: How important is the issue of supplier capacity in this case? How did your group evaluate supplier capacity

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock