Question: Please Calculate the WACC using BOTH the book value and the market values in the table. P11-12 (similar to) Question Help Book value versus market

Please Calculate the WACC using BOTH the book value and the market values in the table.

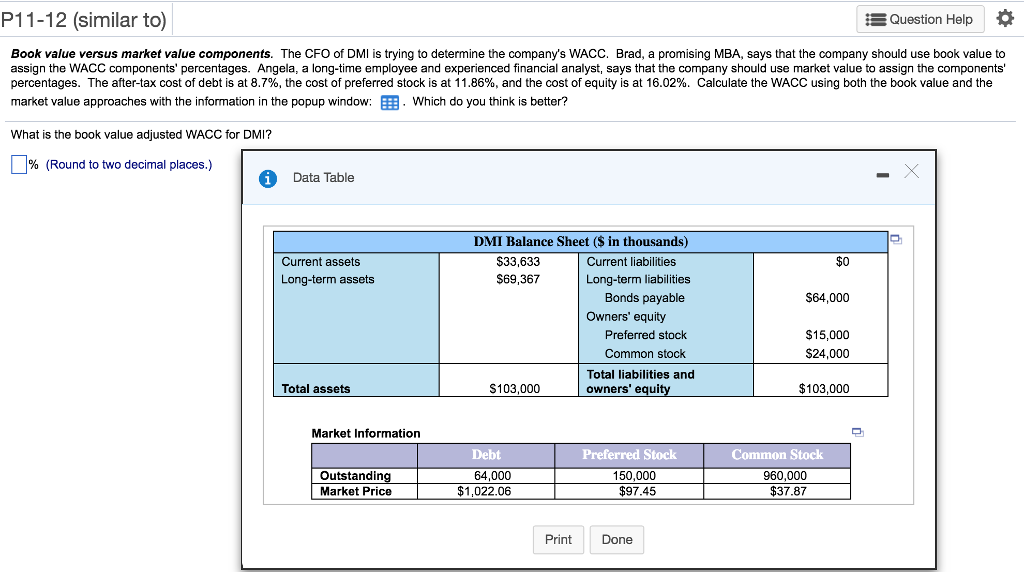

P11-12 (similar to) Question Help Book value versus market value components. The CFO of DMI is trying to determine the company's WACC. Brad, a promising MBA, says that the company should use book value to assign the WACC components' percentages. Angela, a long-time employee and experienced financial analyst, says that the company should use market value to assign the components percentages. The after-tax cost of debt is at 8.7%, the cost of preferred stock is at 11.86%, and the cost of equity is at 16.02%. Calculate the WACC using both the book value and the market value approaches with the information in the popup window:. Which do you think is better? What is the book value adjusted WACC for DMI? % (Round to two decimal places.) Data Table DMI Balance Sheet ($ in thousands) $33,633 $69,367 $0 S64,000 $15,000 Current assets Current liabilities Long-term liabilities Long-term assets Bonds payable Owners' equity Preferred stock Common stock $24,000 Total liabilities and owners' equi Total assets S103,000 $103,000 Market Information Debt Preferred Stock 150,000 $97.45 Stock Outstandin Market Price 960,000 $37.87 64,000 $1,022.06 PrintDone

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts