Question: Please can you answer question 1-6 multiple choice question? Thank you! 1. The comparable companies valuation method uses the discounted value of a firm's free

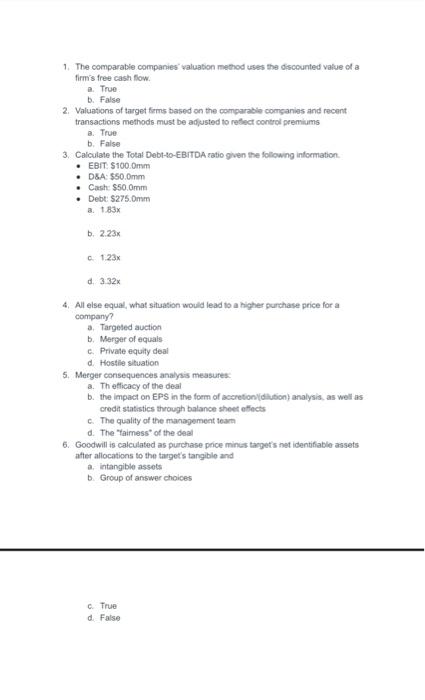

1. The comparable companies "valuation method uses the discounted value of a firm's free cash flow. a. True b. False 2. Valuations of target firms based on the comparable comganies and recent transactions methods must be adjusted to resect control premiums B. True b. False 3. Calculate the Total Debt-to-EBrTDA ratio given the following information. - ebit $100.0mm - DEA.550.0mm - Cash \$50.0mm - Debt 5275.0mm a. 1.83x b. 2.23x c. 1.23x d. 3.32x 4. All else equal, what situation would lead to a higher purchase price for a company? a. Targeted auction b. Merger of equals c. Private equity deal d. Hostlie situation 5. Merger consequences analyis measures: a. Theticacy of the deal b. the impact on EPS in the foem of aceretion(dilution) analysis. as well as credit statistics through balance sheet effects c. The quality of the management teact d. The "taimess" of the deal 6. Goodwill is calculated as purchase price minus target's net identifable assets after allocations to the tagget's tangible and a. intangible assots b. Group of answer choices

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts