Question: Please can you answer question 29 - 35? Thanks!1 $7,542 29. Following is selected information from Shallowater's Company's defined benefit retirement plan Projected benefit obligation,

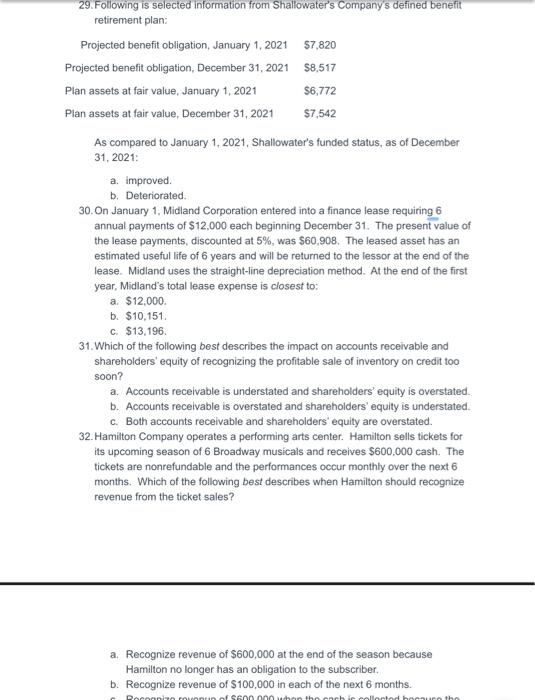

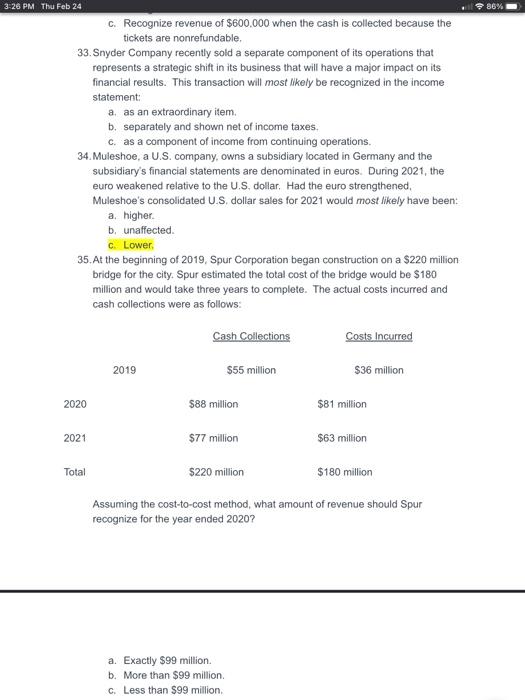

$7,542 29. Following is selected information from Shallowater's Company's defined benefit retirement plan Projected benefit obligation, January 1, 2021 $7.820 Projected benefit obligation, December 31, 2021 $8.517 Plan assets at fair value, January 1, 2021 $6,772 Plan assets at fair value, December 31, 2021 As compared to January 1, 2021, Shallowater's funded status, as of December 31, 2021 a improved b. Deteriorated. 30. On January 1, Midland Corporation entered into a finance lease requiring 6 annual payments of $12,000 each beginning December 31. The present value of the lease payments, discounted at 5%, was $60,908. The leased asset has an estimated useful life of 6 years and will be returned to the lessor at the end of the lease. Midland uses the straight-line depreciation method. At the end of the first year, Midland's total lease expense is closest to: a $12,000. b. $10,151 C. $13,196 31. Which of the following best describes the impact on accounts receivable and shareholders' equity of recognizing the profitable sale of inventory on credit too soon? a. Accounts receivable is understated and shareholders equity is overstated. b. Accounts receivable is overstated and shareholders' equity is understated. c. Both accounts receivable and shareholders' equity are overstated. 32. Hamilton Company operates a performing arts center. Hamilton sells tickets for its upcoming season of 6 Broadway musicals and receives $600,000 cash. The tickets are nonrefundable and the performances occur monthly over the next 6 months. Which of the following best describes when Hamilton should recognize revenue from the ticket sales? a. Recognize revenue of $600,000 at the end of the season because Hamilton no longer has an obligation to the subscriber. b. Recognize revenue of $100,000 in each of the next 6 months. Poronit munnin of Soon tha 3-26 PM Thu Feb 24 86% C. Recognize revenue of $600,000 when the cash is collected because the tickets are nonrefundable. 33. Snyder Company recently sold a separate component of its operations that represents a strategic shift in its business that will have a major impact on its financial results. This transaction will most likely be recognized in the income statement a, as an extraordinary item. b. separately and shown net of income taxes. c. as a component of income from continuing operations. 34. Muleshoe, a U.S. company, owns a subsidiary located in Germany and the subsidiary's financial statements are denominated in euros. During 2021, the euro weakened relative to the U.S. dollar. Had the euro strengthened, Muleshoe's consolidated US dollar sales for 2021 would most likely have been: a higher. b. unaffected C. Lower 35. At the beginning of 2019, Spur Corporation began construction on a $220 million bridge for the city. Spur estimated the total cost of the bridge would be $180 million and would take three years to complete. The actual costs incurred and cash collections were as follows: Cash Collections Costs Incurred 2019 $55 million $36 million 2020 588 million $81 million 2021 $77 million $63 million Total $220 million $180 million Assuming the cost-to-cost method, what amount of revenue should Spur recognize for the year ended 2020? a. Exactly $99 million b. More than $99 million. c. Less than $99 million $7,542 29. Following is selected information from Shallowater's Company's defined benefit retirement plan Projected benefit obligation, January 1, 2021 $7.820 Projected benefit obligation, December 31, 2021 $8.517 Plan assets at fair value, January 1, 2021 $6,772 Plan assets at fair value, December 31, 2021 As compared to January 1, 2021, Shallowater's funded status, as of December 31, 2021 a improved b. Deteriorated. 30. On January 1, Midland Corporation entered into a finance lease requiring 6 annual payments of $12,000 each beginning December 31. The present value of the lease payments, discounted at 5%, was $60,908. The leased asset has an estimated useful life of 6 years and will be returned to the lessor at the end of the lease. Midland uses the straight-line depreciation method. At the end of the first year, Midland's total lease expense is closest to: a $12,000. b. $10,151 C. $13,196 31. Which of the following best describes the impact on accounts receivable and shareholders' equity of recognizing the profitable sale of inventory on credit too soon? a. Accounts receivable is understated and shareholders equity is overstated. b. Accounts receivable is overstated and shareholders' equity is understated. c. Both accounts receivable and shareholders' equity are overstated. 32. Hamilton Company operates a performing arts center. Hamilton sells tickets for its upcoming season of 6 Broadway musicals and receives $600,000 cash. The tickets are nonrefundable and the performances occur monthly over the next 6 months. Which of the following best describes when Hamilton should recognize revenue from the ticket sales? a. Recognize revenue of $600,000 at the end of the season because Hamilton no longer has an obligation to the subscriber. b. Recognize revenue of $100,000 in each of the next 6 months. Poronit munnin of Soon tha 3-26 PM Thu Feb 24 86% C. Recognize revenue of $600,000 when the cash is collected because the tickets are nonrefundable. 33. Snyder Company recently sold a separate component of its operations that represents a strategic shift in its business that will have a major impact on its financial results. This transaction will most likely be recognized in the income statement a, as an extraordinary item. b. separately and shown net of income taxes. c. as a component of income from continuing operations. 34. Muleshoe, a U.S. company, owns a subsidiary located in Germany and the subsidiary's financial statements are denominated in euros. During 2021, the euro weakened relative to the U.S. dollar. Had the euro strengthened, Muleshoe's consolidated US dollar sales for 2021 would most likely have been: a higher. b. unaffected C. Lower 35. At the beginning of 2019, Spur Corporation began construction on a $220 million bridge for the city. Spur estimated the total cost of the bridge would be $180 million and would take three years to complete. The actual costs incurred and cash collections were as follows: Cash Collections Costs Incurred 2019 $55 million $36 million 2020 588 million $81 million 2021 $77 million $63 million Total $220 million $180 million Assuming the cost-to-cost method, what amount of revenue should Spur recognize for the year ended 2020? a. Exactly $99 million b. More than $99 million. c. Less than $99 million

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts