Question: Please can you answer question 36 -46? Thank you!! 84% 3:29 PM Thu Feb 24 36. Which of the following statements about the allowance for

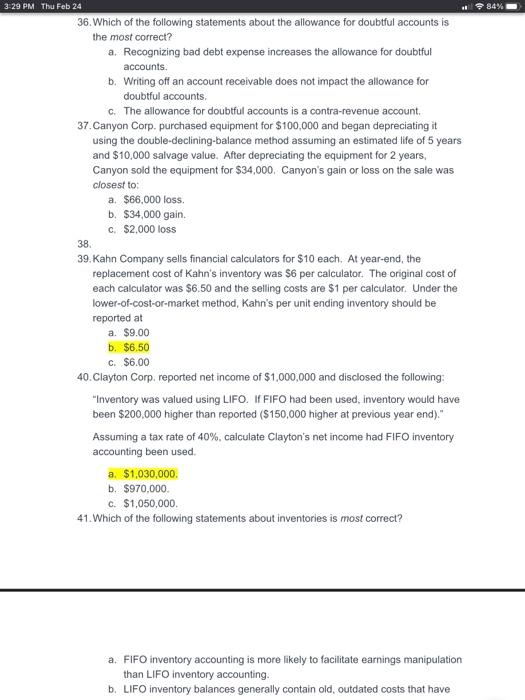

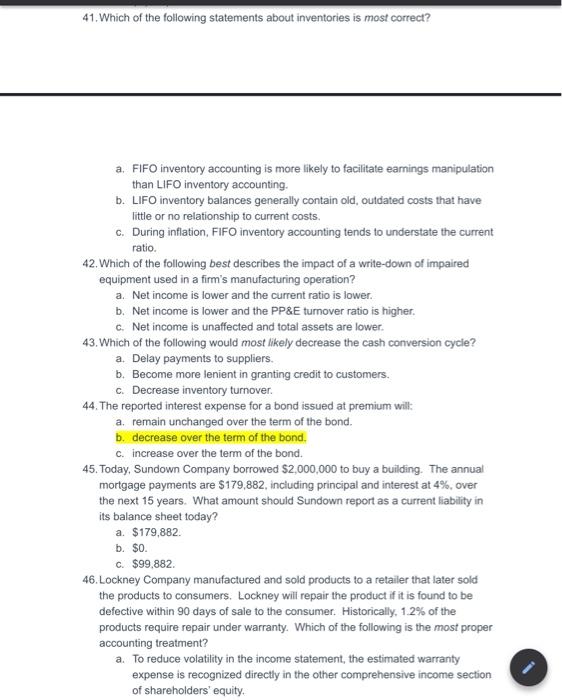

84% 3:29 PM Thu Feb 24 36. Which of the following statements about the allowance for doubtful accounts is the most correct? a. Recognizing bad debt expense increases the allowance for doubtful accounts. b. Writing off an account receivable does not impact the allowance for doubtful accounts. C. The allowance for doubtful accounts is a contra-revenue account. 37. Canyon Corp. purchased equipment for $100,000 and began depreciating it using the double-declining balance method assuming an estimated life of 5 years and $10,000 salvage value. After depreciating the equipment for 2 years, Canyon sold the equipment for $34,000. Canyon's gain or loss on the sale was closest to: a. $66,000 loss. b. $34.000 gain. C. $2,000 loss 38. 39. Kahn Company sells financial calculators for $10 each. At year-end, the replacement cost of Kahn's inventory was $6 per calculator. The original cost of each calculator was $6.50 and the selling costs are $1 per calculator. Under the lower-of-cost-or-market method, Kahn's per unit ending inventory should be reported at a. $9.00 b. $6.50 C. $6.00 40. Clayton Corp. reported net income of $1,000,000 and disclosed the following: "Inventory was valued using LIFO. If FIFO had been used, inventory would have been $200,000 higher than reported ($150,000 higher at previous year end)." Assuming a tax rate of 40%, calculate Clayton's net income had FIFO inventory accounting been used a $1,030,000 b. $970,000 c. $1,050,000 41. Which of the following statements about inventories is most correct? a. FIFO inventory accounting is more likely to facilitate earnings manipulation than LIFO inventory accounting. b. LIFO inventory balances generally contain old, outdated costs that have 41. Which of the following statements about inventories is most correct? a FIFO inventory accounting is more likely to facilitate eamings manipulation than LIFO inventory accounting. b. LIFO inventory balances generally contain old, outdated costs that have little or no relationship to current costs. c. During inflation, FIFO inventory accounting tends to understate the current ratio. 42. Which of the following best describes the impact of a write-down of impaired equipment used in a firm's manufacturing operation? a. Net income is lower and the current ratio is lower. b. Net income is lower and the PP&E turnover ratio is higher. C. Net income is unaffected and total assets are lower. 43. Which of the following would most likely decrease the cash conversion cycle? a. Delay payments to suppliers. b. Become more lenient in granting credit to customers. c. Decrease inventory turnover. 44. The reported interest expense for a bond issued at premium will a remain unchanged over the term of the bond. b. decrease over the term of the bond. C. increase over the term of the bond. 45. Today, Sundown Company borrowed $2,000,000 to buy a building. The annual mortgage payments are $179,882, including principal and interest at 4%, over the next 15 years. What amount should Sundown report as a current liability in its balance sheet today? a. $179,882. b. $0. C. $99.882 46. Lockney Company manufactured and sold products to a retailer that later sold the products to consumers. Lockney will repair the product if it is found to be defective within 90 days of sale to the consumer. Historically, 1.2% of the products require repair under warranty. Which of the following is the most proper accounting treatment? a. To reduce volatility in the income statement, the estimated warranty expense is recognized directly in the other comprehensive income section of shareholders' equity

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts