Question: Please can you answer this question, thank you File 3 - Boris Jackson Boris is a married man aged 56. He is semi-retired but still

Please can you answer this question, thank you

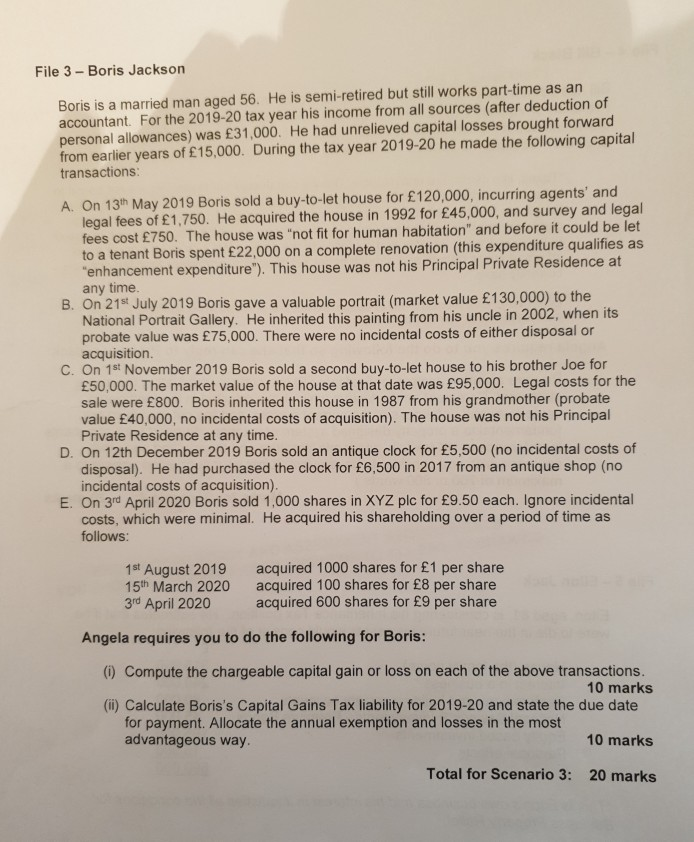

File 3 - Boris Jackson Boris is a married man aged 56. He is semi-retired but still works part-time as an accountant. For the 2019-20 tax year his income from all sources (after deduction of personal allowances) was 31,000. He had unrelieved capital losses brought forward from earlier years of 15,000. During the tax year 2019-20 he made the following capital transactions: A. On 13th May 2019 Boris sold a buy-to-let house for 120,000, incurring agents' and legal fees of 1,750. He acquired the house in 1992 for 45,000, and survey and legal fees cost 750. The house was "not fit for human habitation" and before it could be let to a tenant Boris spent 22,000 on a complete renovation (this expenditure qualifies as "enhancement expenditure"). This house was not his Principal Private Residence at any time. B. On 21st July 2019 Boris gave a valuable portrait (market value 130,000) to the National Portrait Gallery. He inherited this painting from his uncle in 2002, when its probate value was 75,000. There were no incidental costs of either disposal or acquisition C. On 1st November 2019 Boris sold a second buy-to-let house to his brother Joe for 50,000. The market value of the house at that date was 95,000. Legal costs for the sale were 800. Boris inherited this house in 1987 from his grandmother (probate value 40,000, no incidental costs of acquisition). The house was not his Principal Private Residence at any time. D. On 12th December 2019 Boris sold an antique clock for 5,500 (no incidental costs of disposal). He had purchased the clock for 6,500 in 2017 from an antique shop (no incidental costs of acquisition). E. On 3rd April 2020 Boris sold 1,000 shares in XYZ plc for 9.50 each. Ignore incidental costs, which were minimal. He acquired his shareholding over a period of time as follows: 1st August 2019 acquired 1000 shares for 1 per share 15th March 2020 acquired 100 shares for 8 per share 3rd April 2020 acquired 600 shares for 9 per share Angela requires you to do the following for Boris: (0) Compute the chargeable capital gain or loss on each of the above transactions. 10 marks m) Calculate Boris's Capital Gains Tax liability for 2019-20 and state the due date for payment. Allocate the annual exemption and losses in the most advantageous way. 10 marks Total for Scenario 3: 20 marks File 3 - Boris Jackson Boris is a married man aged 56. He is semi-retired but still works part-time as an accountant. For the 2019-20 tax year his income from all sources (after deduction of personal allowances) was 31,000. He had unrelieved capital losses brought forward from earlier years of 15,000. During the tax year 2019-20 he made the following capital transactions: A. On 13th May 2019 Boris sold a buy-to-let house for 120,000, incurring agents' and legal fees of 1,750. He acquired the house in 1992 for 45,000, and survey and legal fees cost 750. The house was "not fit for human habitation" and before it could be let to a tenant Boris spent 22,000 on a complete renovation (this expenditure qualifies as "enhancement expenditure"). This house was not his Principal Private Residence at any time. B. On 21st July 2019 Boris gave a valuable portrait (market value 130,000) to the National Portrait Gallery. He inherited this painting from his uncle in 2002, when its probate value was 75,000. There were no incidental costs of either disposal or acquisition C. On 1st November 2019 Boris sold a second buy-to-let house to his brother Joe for 50,000. The market value of the house at that date was 95,000. Legal costs for the sale were 800. Boris inherited this house in 1987 from his grandmother (probate value 40,000, no incidental costs of acquisition). The house was not his Principal Private Residence at any time. D. On 12th December 2019 Boris sold an antique clock for 5,500 (no incidental costs of disposal). He had purchased the clock for 6,500 in 2017 from an antique shop (no incidental costs of acquisition). E. On 3rd April 2020 Boris sold 1,000 shares in XYZ plc for 9.50 each. Ignore incidental costs, which were minimal. He acquired his shareholding over a period of time as follows: 1st August 2019 acquired 1000 shares for 1 per share 15th March 2020 acquired 100 shares for 8 per share 3rd April 2020 acquired 600 shares for 9 per share Angela requires you to do the following for Boris: (0) Compute the chargeable capital gain or loss on each of the above transactions. 10 marks m) Calculate Boris's Capital Gains Tax liability for 2019-20 and state the due date for payment. Allocate the annual exemption and losses in the most advantageous way. 10 marks Total for Scenario 3: 20 marks

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts