Question: please can you do question 5 B D E 2 F C 1 Question 5 - Cash Budget (30 marks) Mountain Sports has aquired an

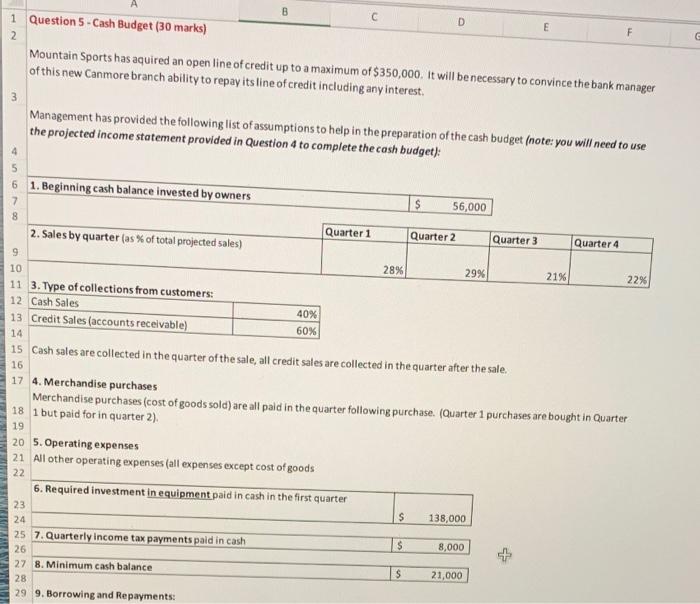

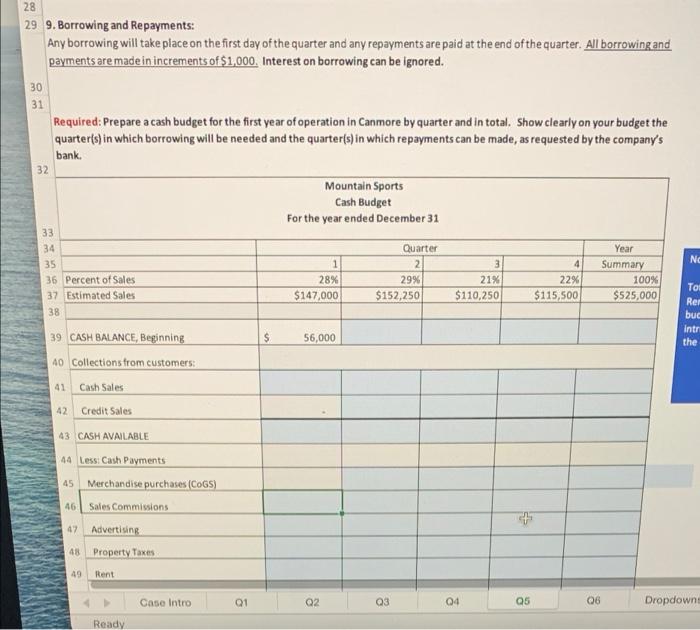

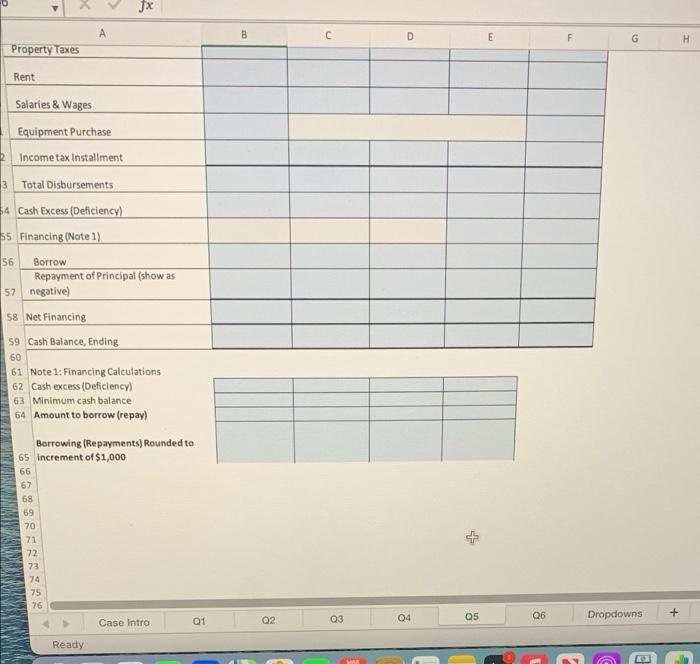

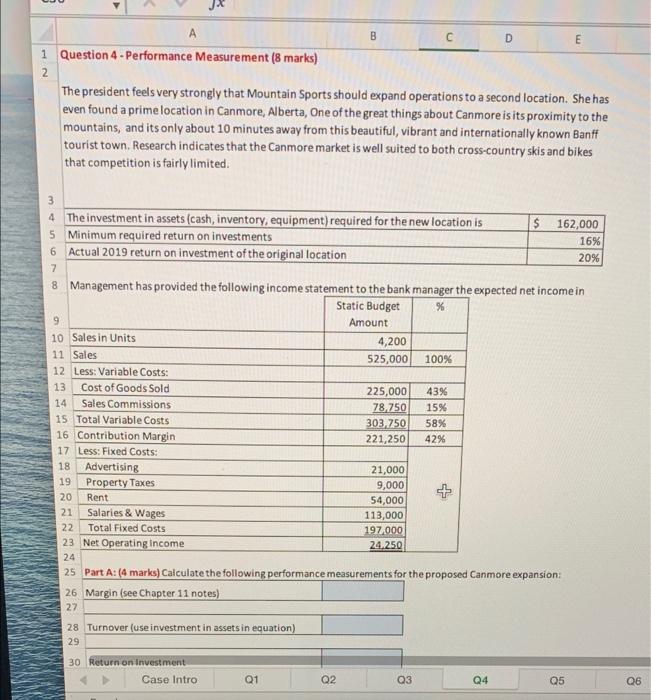

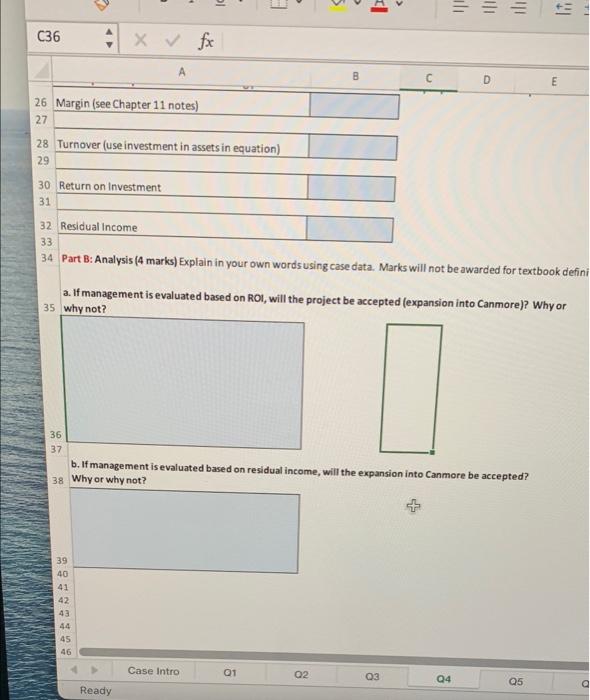

B D E 2 F C 1 Question 5 - Cash Budget (30 marks) Mountain Sports has aquired an open line of credit up to a maximum of $350,000. It will be necessary to convince the bank manager of this new Canmore branch ability to repay its line of credit including any interest. 3 Management has provided the following list of assumptions to help in the preparation of the cash budget (note: you will need to use the projected income statement provided in Question 4 to complete the cash budget): 6 1. Beginning cash balance invested by owners S 56,000 2. Sales by quarter (as % of total projected sales) Quarter 1 Quarter 2 Quarter 3 Quarter 4 9 22% 16 28% 29% 21% 10 11 3. Type of collections from customers: 12 Cash Sales 40% 13 Credit Sales (accounts receivable) 60% 14 15 Cash sales are collected in the quarter of the sale, all credit sales are collected in the quarter after the sale. 17 4. Merchandise purchases Merchandise purchases (cost of goods sold) are all paid in the quarter following purchase. (Quarter 1 purchases are bought in Quarter 18 1 but paid for in quarter 2). 19 20 5. Operating expenses 21 All other operating expenses (all expenses except cost of goods 22 6. Required investment in equipment paid in cash in the first quarter 23 138,000 24 25 7. Quarterly income tax payments paid in cash 8,000 26 27 8. Minimum cash balance $ 21,000 28 29 9. Borrowing and Repayments: S $ + 28 29 9. Borrowing and Repayments: Any borrowing will take place on the first day of the quarter and any repayments are paid at the end of the quarter. All borrowing and payments are made in increments of $1,000. Interest on borrowing can be ignored. 30 31 Required:Prepare a cash budget for the first year of operation in Canmore by quarter and in total. Show clearly on your budget the quarter(s) in which borrowing will be needed and the quarter(s) in which repayments can be made, as requested by the company's bank 32 Mountain Sports Cash Budget For the year ended December 31 NG 33 34 35 36 Percent of Sales 37 Estimated Sales 38 1 28% $147,000 Quarter 2 29% $152,250 3 21% $110,250 4 22% $115,500 Year Summary 100% $525,000 Rer buc Intr $ 56,000 the 39 CASH BALANCE, Beginning 40 Collections from customers: 41 Cash Sales 42 Credit Sales 43 CASH AVAILABLE 44 Less: Cash Payments 45 Merchandise purchases (COGS) 46 Sales Commissions 47 Advertising 48 Property Taxes 49 Rent Case Intro 21 Q2 Q3 04 Q5 06 Dropdown Ready x A B D E F G H Property Taxes Rent Salaries & Wages Equipment Purchase Income tax installment 3 Total Disbursements 54 Cash Excess (Deficiency) 55 Financing (Note 1) 56 Borrow Repayment of Principal (show as negative) 57 58 Net Financing 59 Cash Balance, Ending 60 61 Note 1: Financing Calculations 62 Cash excess (Deficiency 63 Minimum cash balance 64 Amount to borrow (repay) Borrowing (Repayments) Rounded to 65 increment of $1,000 66 67 68 69 70 71 72 73 74 75 76 01 03 04 Q6 Q2 Dropdowns Case Intro 05 Ready B D E 1 Question 4 - Performance Measurement (8 marks) 2 The president feels very strongly that Mountain Sports should expand operations to a second location. She has even found a prime location in Canmore, Alberta, One of the great things about Canmore is its proximity to the mountains, and its only about 10 minutes away from this beautiful, vibrant and internationally known Banff tourist town. Research indicates that the Canmore market is well suited to both cross-country skis and bikes that competition is fairly limited 3 4 The investment in assets (cash, inventory, equipment) required for the new location is $ 162,000 5 Minimum required return on investments 16% 6 Actual 2019 return on investment of the original location 20% 7 8 Management has provided the following income statement to the bank manager the expected net income in Static Budget % 9 Amount 10 Sales in Units 4,200 11 Sales 525,000 100% 12 Less: Variable Costs: 13 Cost of Goods Sold 225,000 43% 14 Sales Commissions 78,750 15% 15 Total Variable Costs 303,750 58% 16 Contribution Margin 221,250 42% 17 Less: Fixed Costs: 18 Advertising 21,000 19 Property Taxes 9,000 20 Rent 54,000 21 Salaries & Wages 113,000 22 Total Fixed Costs 197,000 23 Net Operating Income 24.250 24 25 Part A: (4 marks) Calculate the following performance measurements for the proposed Canmore expansion: 26 Margin (see Chapter 11 notes) 27 28 Turnover (use investment in assets in equation) 29 30 Return on Investment Case Intro Q1 22 Q3 Q4 Q5 Q6 IC 5 111 ili 1 C36 x fx A B D E 26 Margin (see Chapter 11 notes) 27 28 Turnover (use investment in assets in equation) 29 30 Return on investment 31 32 Residual income 33 34 Part B: Analysis (4 marks) Explain in your own words using case data. Marks will not be awarded for textbook defini a. If management is evaluated based on ROI, will the project be accepted (expansion into Canmore)? Why or 35 why not? 36 37 b. If management is evaluated based on residual income, will the expansion into Canmore be accepted? 38 Why or why not? 39 40 41 42 43 44 45 46 Case Intro 01 02 03 Q4 2 Q5 a Ready

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts