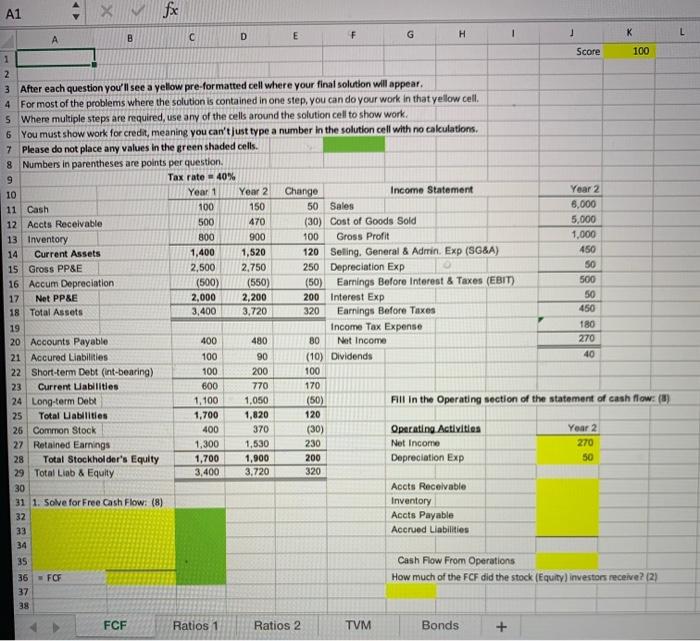

Question: Please show work. A1 4Xfx L B D E F G H 1 1 K 1 Score 100 2 3 After each question you'll see

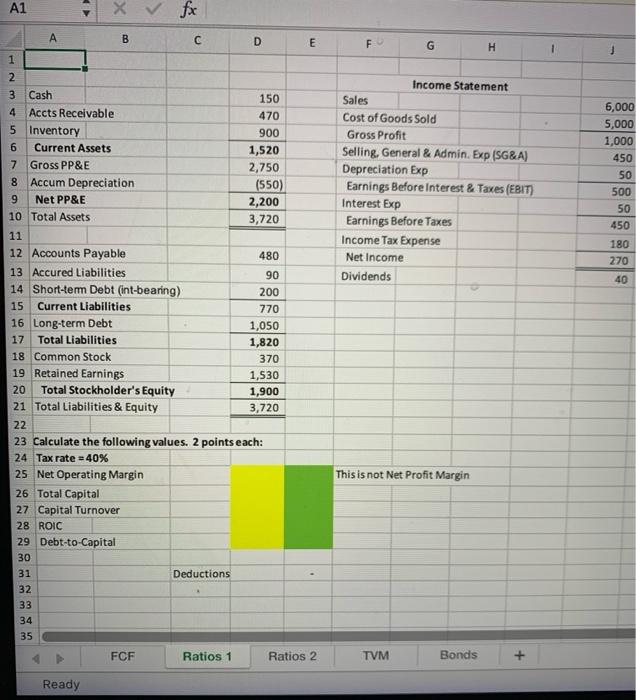

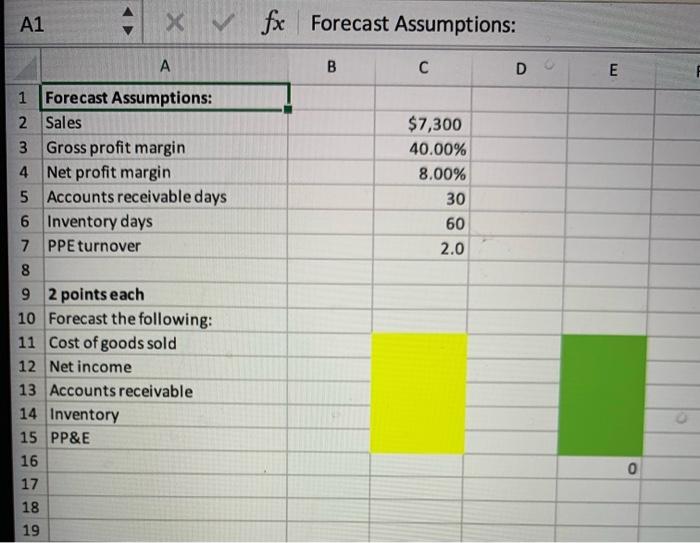

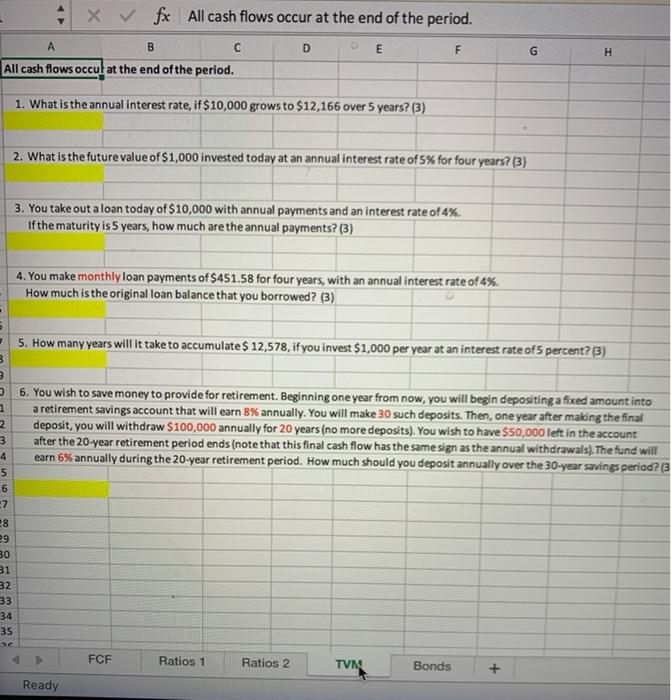

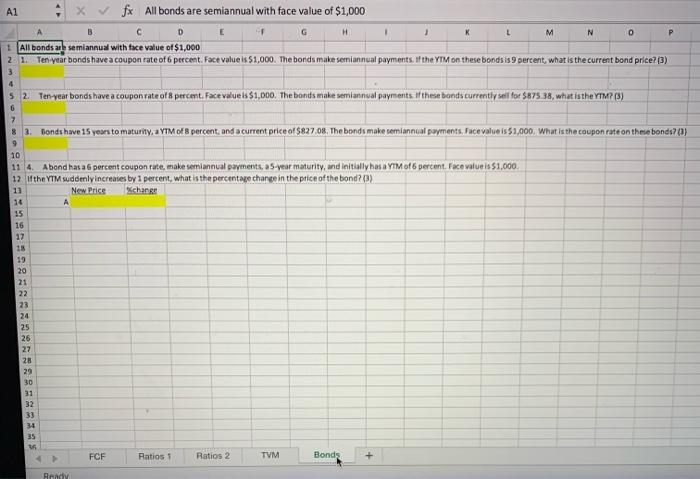

A1 4Xfx L B D E F G H 1 1 K 1 Score 100 2 3 After each question you'll see a yellow pre-formatted cell where your final solution will appear. 4 For most of the problems where the solution is contained in one step, you can do your work in that yellow cell. 5 Where multiple steps are required, use any of the cells around the solution cell to show work. 6 You must show work for credit, meaning you can't just type a number in the solution cell with no calculations. 7 Please do not place any values in the green shaded cells. 8 Numbers in parentheses are points per question. 9 Tax rate -40% 10 Year 1 Year 2 Change Income Statement Year 2 11 Cash 100 150 50 Sales 6,000 12 Accts Receivable 500 470 (30) Cost of Goods Sold 5,000 13 Inventory 800 900 100 Gross Profit 1,000 14 Current Assets 1,400 1,520 120 Seling. General & Admin Exp (SG&A) 450 15 Gross PPSE 2,500 2.750 250 Depreciation Exp 50 16 Accum Depreciation (500) (550) (50) Earnings Before Interest & Taxes (EBIT) 500 17 Net PP&E 2,000 2,200 200 Interest Exp 50 18 Total Assets 3,400 3,720 320 Earnings Before Taxes 450 19 Income Tax Expense 180 20 Accounts Payable 400 480 80 Net Income 21 Accured Liabilities 100 90 (10) Dividends 40 22 Short-term Debt (int-bearing) 100 200 100 23 Current Labilities 600 770 170 24 Long-term Debt 1.100 1,050 (50) Fill in the Operating section of the statement of cash flow: (8) 25 Total Labilities 1,700 1,820 120 26 Common Stock 400 370 (30) Operating Activities Year 2 27 Retained Earnings 1,300 1,530 230 Net Income 270 28 Total Stockholder's Equity 1,700 1,900 200 Depreciation Exp 50 29 Total Liab & Equity 3,400 3.720 320 30 Accts Recevable 31 1. Solve for Free Cash Flow; (8) Inventory 32 Accts Payable 33 Accrued Liabilities 34 35 Cash Flow From Operations 36 - FOF How much of the FCF did the stock (Equity) investors receive? (2) 37 38 FCF Ratios 1 Ratios 2 TVM Bonds + 270 A1 fox B D E F G H Income Statement Sales Cost of Goods Sold Gross Profit Selling, General & Admin Exp (SG&A) Depreciation Exp Earnings Before Interest & Taxes (EBIT) Interest Exp Earnings Before Taxes Income Tax Expense Net Income Dividends 6,000 5,000 1,000 450 50 500 50 450 180 270 40 1 2 3 Cash 150 4 Accts Receivable 470 5 Inventory 900 6 Current Assets 1,520 7 Gross PP&E 2,750 8 Accum Depreciation (550) 9 Net PP&E 2,200 10 Total Assets 3,720 11 12 Accounts Payable 480 13 Accured Liabilities 90 14 Short-tem Debt (int-bearing) 200 15 Current Liabilities 770 16 Long-term Debt 1,050 17 Total Liabilities 1,820 18 Common Stock 370 19 Retained Earnings 1,530 20 Total Stockholder's Equity 1,900 21 Total Liabilities & Equity 3,720 22 23 Calculate the following values. 2 points each: 24 Tax rate 40% 25 Net Operating Margin 26 Total Capital 27 Capital Turnover 28 ROIC 29 Debt-to-Capital 30 31 Deductions 32 33 34 35 FCF Ratios 1 Ratios 2 This is not Net Profit Margin TVM Bonds + Ready A1 4 X fx Forecast Assumptions: B D E $7,300 40.00% 8.00% 30 60 2.0 1 Forecast Assumptions: 2 Sales 3 Gross profit margin 4 Net profit margin 5 Accounts receivable days 6 Inventory days 7 PPE turnover 8 9 2 points each 10 Forecast the following: 11 Cost of goods sold 12 Net income 13 Accounts receivable 14 Inventory 15 PP&E 16 17 18 19 0 x fx All cash flows occur at the end of the period. B D E F G H All cash flows occur at the end of the period. 1. What is the annual interest rate, if$10,000 grows to $12,166 over 5 years? (3) 2. What is the future value of $1,000 invested today at an annual interest rate of 5% for four years? (3) 3. You take out a loan today of $10,000 with annual payments and an interest rate of 4%. If the maturity is 5 years, how much are the annual payments? (3) 4. You make monthly loan payments of $451.58 for four years, with an annual interest rate of 4% How much is the original loan balance that you borrowed? (3) . 5. How many years will it take to accumulate $ 12,578, if you invest $1,000 per year at an interest rate of 5 percent? (B) 3 2 6. You wish to save money to provide for retirement. Beginning one year from now, you will begin depositing a fixed amount into a retirement savings account that will earn 8% annually. You will make 30 such deposits. Then, one year after making the final deposit, you will withdraw $100,000 annually for 20 years (no more deposits). You wish to have $50,000 left in the account after the 20-year retirement period ends (note that this final cash flow has the same sign as the annual withdrawals). The fund will earn 6% annually during the 20-year retirement period. How much should you deposit annually over the 30-year savings period? (3 1 2 3 4 5 6 7 28 9 30 31 32 33 34 35 FCF Ratios 1 Ratios 2 TVM Bonds + Ready A1 B C K L M 0 X fx All bonds are semiannual with face value of $1,000 D G H N 1 All bondsar semiannual with face value of $1,000 2.1. Ten year bonds have a coupon rate of 6 percent. Face value is $1,000. The bands make semiannual payments. If the YTM on these bonds is 9 percent, what is the current bond price?(3) 3 4 5 2. Ter-year bonds have a coupon rate ol 8 percent. Face value is $1,000. The bands make semiannual payments. If these bands currently sell for $875.38, what is the YTM? (3) 6 7 8 3. Bonds have 15 years to maturity, a YTM of 8 percent, and a current price of $827.08. The bonds make semiannual payments, Face value is $1,000. What is the coupon rate on the bonds? ) 9 10 11 4 Aband has a 6 percent coupon rate, make semiannual payments, a 5-year maturity, and initially has a YTM of 6 percent. Face value is $1,000 12 the YTM suddenly increases by 1 percent, what is the percentage change in the price of the bond? (3) 13 New Price Xchange 14 A 15 16 37 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 FCF Ratios 1 Ratios 2 TVM Bonds Ready A1 4Xfx L B D E F G H 1 1 K 1 Score 100 2 3 After each question you'll see a yellow pre-formatted cell where your final solution will appear. 4 For most of the problems where the solution is contained in one step, you can do your work in that yellow cell. 5 Where multiple steps are required, use any of the cells around the solution cell to show work. 6 You must show work for credit, meaning you can't just type a number in the solution cell with no calculations. 7 Please do not place any values in the green shaded cells. 8 Numbers in parentheses are points per question. 9 Tax rate -40% 10 Year 1 Year 2 Change Income Statement Year 2 11 Cash 100 150 50 Sales 6,000 12 Accts Receivable 500 470 (30) Cost of Goods Sold 5,000 13 Inventory 800 900 100 Gross Profit 1,000 14 Current Assets 1,400 1,520 120 Seling. General & Admin Exp (SG&A) 450 15 Gross PPSE 2,500 2.750 250 Depreciation Exp 50 16 Accum Depreciation (500) (550) (50) Earnings Before Interest & Taxes (EBIT) 500 17 Net PP&E 2,000 2,200 200 Interest Exp 50 18 Total Assets 3,400 3,720 320 Earnings Before Taxes 450 19 Income Tax Expense 180 20 Accounts Payable 400 480 80 Net Income 21 Accured Liabilities 100 90 (10) Dividends 40 22 Short-term Debt (int-bearing) 100 200 100 23 Current Labilities 600 770 170 24 Long-term Debt 1.100 1,050 (50) Fill in the Operating section of the statement of cash flow: (8) 25 Total Labilities 1,700 1,820 120 26 Common Stock 400 370 (30) Operating Activities Year 2 27 Retained Earnings 1,300 1,530 230 Net Income 270 28 Total Stockholder's Equity 1,700 1,900 200 Depreciation Exp 50 29 Total Liab & Equity 3,400 3.720 320 30 Accts Recevable 31 1. Solve for Free Cash Flow; (8) Inventory 32 Accts Payable 33 Accrued Liabilities 34 35 Cash Flow From Operations 36 - FOF How much of the FCF did the stock (Equity) investors receive? (2) 37 38 FCF Ratios 1 Ratios 2 TVM Bonds + 270 A1 fox B D E F G H Income Statement Sales Cost of Goods Sold Gross Profit Selling, General & Admin Exp (SG&A) Depreciation Exp Earnings Before Interest & Taxes (EBIT) Interest Exp Earnings Before Taxes Income Tax Expense Net Income Dividends 6,000 5,000 1,000 450 50 500 50 450 180 270 40 1 2 3 Cash 150 4 Accts Receivable 470 5 Inventory 900 6 Current Assets 1,520 7 Gross PP&E 2,750 8 Accum Depreciation (550) 9 Net PP&E 2,200 10 Total Assets 3,720 11 12 Accounts Payable 480 13 Accured Liabilities 90 14 Short-tem Debt (int-bearing) 200 15 Current Liabilities 770 16 Long-term Debt 1,050 17 Total Liabilities 1,820 18 Common Stock 370 19 Retained Earnings 1,530 20 Total Stockholder's Equity 1,900 21 Total Liabilities & Equity 3,720 22 23 Calculate the following values. 2 points each: 24 Tax rate 40% 25 Net Operating Margin 26 Total Capital 27 Capital Turnover 28 ROIC 29 Debt-to-Capital 30 31 Deductions 32 33 34 35 FCF Ratios 1 Ratios 2 This is not Net Profit Margin TVM Bonds + Ready A1 4 X fx Forecast Assumptions: B D E $7,300 40.00% 8.00% 30 60 2.0 1 Forecast Assumptions: 2 Sales 3 Gross profit margin 4 Net profit margin 5 Accounts receivable days 6 Inventory days 7 PPE turnover 8 9 2 points each 10 Forecast the following: 11 Cost of goods sold 12 Net income 13 Accounts receivable 14 Inventory 15 PP&E 16 17 18 19 0 x fx All cash flows occur at the end of the period. B D E F G H All cash flows occur at the end of the period. 1. What is the annual interest rate, if$10,000 grows to $12,166 over 5 years? (3) 2. What is the future value of $1,000 invested today at an annual interest rate of 5% for four years? (3) 3. You take out a loan today of $10,000 with annual payments and an interest rate of 4%. If the maturity is 5 years, how much are the annual payments? (3) 4. You make monthly loan payments of $451.58 for four years, with an annual interest rate of 4% How much is the original loan balance that you borrowed? (3) . 5. How many years will it take to accumulate $ 12,578, if you invest $1,000 per year at an interest rate of 5 percent? (B) 3 2 6. You wish to save money to provide for retirement. Beginning one year from now, you will begin depositing a fixed amount into a retirement savings account that will earn 8% annually. You will make 30 such deposits. Then, one year after making the final deposit, you will withdraw $100,000 annually for 20 years (no more deposits). You wish to have $50,000 left in the account after the 20-year retirement period ends (note that this final cash flow has the same sign as the annual withdrawals). The fund will earn 6% annually during the 20-year retirement period. How much should you deposit annually over the 30-year savings period? (3 1 2 3 4 5 6 7 28 9 30 31 32 33 34 35 FCF Ratios 1 Ratios 2 TVM Bonds + Ready A1 B C K L M 0 X fx All bonds are semiannual with face value of $1,000 D G H N 1 All bondsar semiannual with face value of $1,000 2.1. Ten year bonds have a coupon rate of 6 percent. Face value is $1,000. The bands make semiannual payments. If the YTM on these bonds is 9 percent, what is the current bond price?(3) 3 4 5 2. Ter-year bonds have a coupon rate ol 8 percent. Face value is $1,000. The bands make semiannual payments. If these bands currently sell for $875.38, what is the YTM? (3) 6 7 8 3. Bonds have 15 years to maturity, a YTM of 8 percent, and a current price of $827.08. The bonds make semiannual payments, Face value is $1,000. What is the coupon rate on the bonds? ) 9 10 11 4 Aband has a 6 percent coupon rate, make semiannual payments, a 5-year maturity, and initially has a YTM of 6 percent. Face value is $1,000 12 the YTM suddenly increases by 1 percent, what is the percentage change in the price of the bond? (3) 13 New Price Xchange 14 A 15 16 37 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 FCF Ratios 1 Ratios 2 TVM Bonds Ready

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts