Question: Please check my work and provide answer on how to do journal and trial balance sheets. The Lunt Theater, owned by Beth S axena, will

Please check my work and provide answer on how to do journal and trial balance sheets.

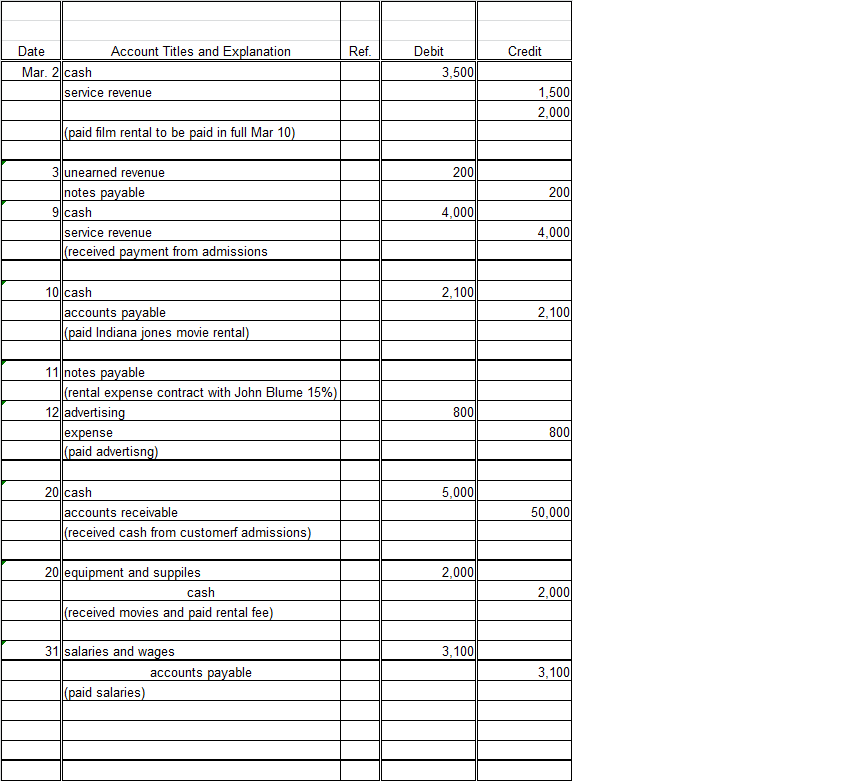

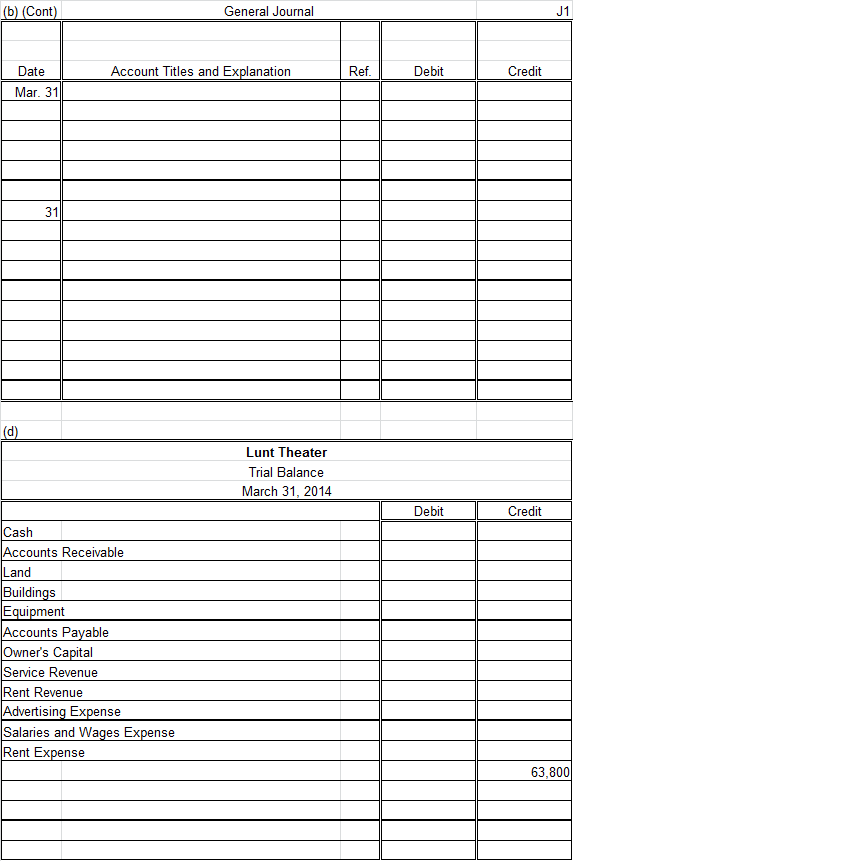

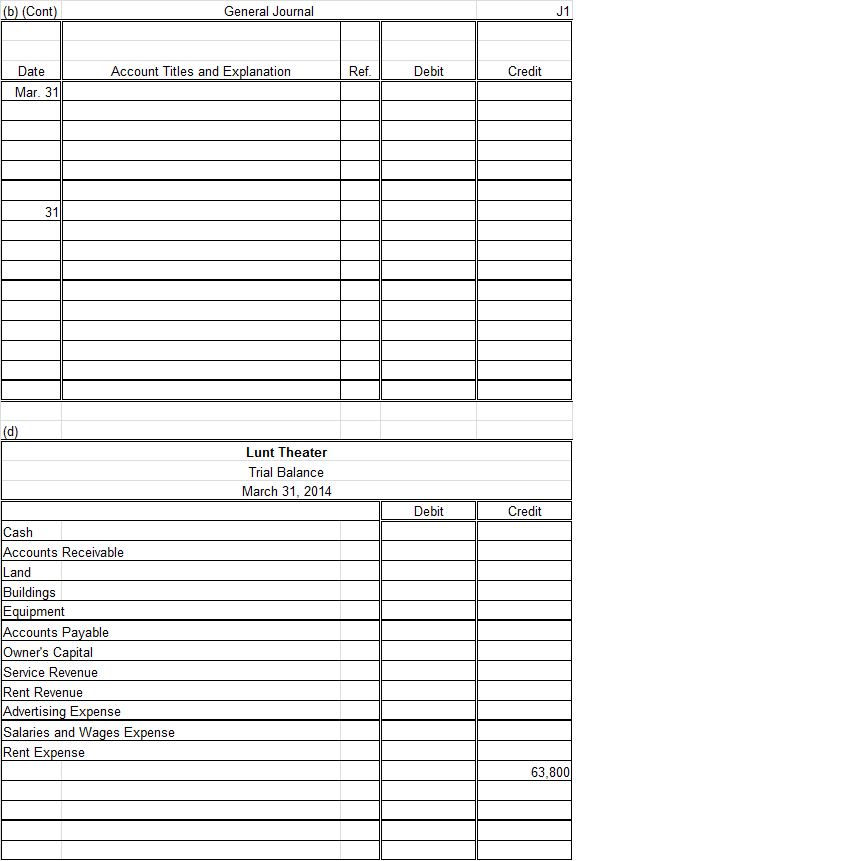

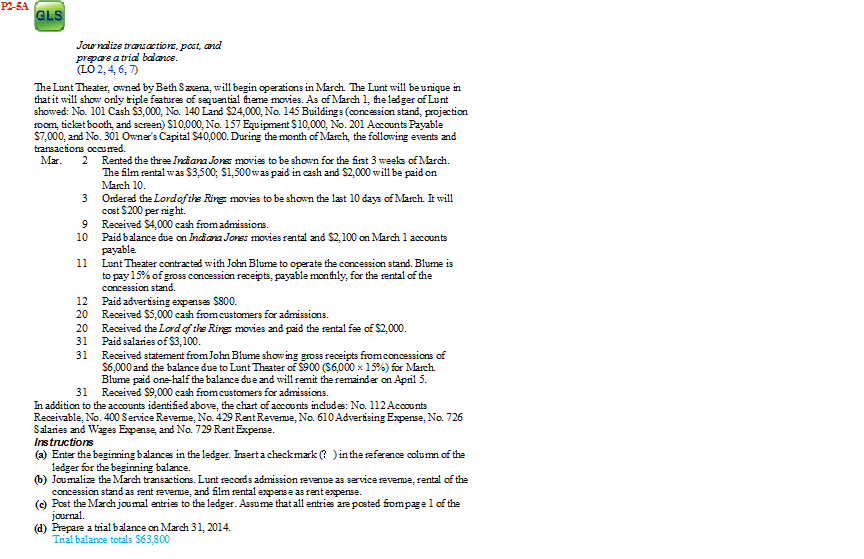

The Lunt Theater, owned by Beth S axena, will begin operations in March. The Lunt will be unique in that it will show only triple features of sequential theme movies. As of March 1, the ledger of Lunt showed: No. 101 Cash $3,000, No. 140 Land $24,000, No. 145 Buildings (concession stand, projection room, ticket booth, and screen) $10,000, No. 157 Equipment $10,000, No. 201 Accounts Payable $7,000, and No. 301 Owner's Capital $40,000. During the month of March the following events and transactions occurred. In addition to the accounts identified above, the chart of accounts induces: No. 112 Accounts Receivable, No. 400 Service Revenue, No. 429 Rent Revenue, No. 610 Advertising Expense, No. 726 Salaries and Wages Expense, and No. 729 Rent Expense. Enter the beginning balances in the ledger. Insert a checkmark (? ) in the reference column of the ledger for the beginning balance. Journalize the March transactions. Lunt records admission revenue as service revenue, rental of the concession stand as rent revenue, and film rental expense as rent expense. post the March journal entries to the ledger. Assume that all entries are posted from page 1 of the journal. Prepare a trial balance on March 31,2014. Trial balance totals $63,800 The Lunt Theater, owned by Beth S axena, will begin operations in March. The Lunt will be unique in that it will show only triple features of sequential theme movies. As of March 1, the ledger of Lunt showed: No. 101 Cash $3,000, No. 140 Land $24,000, No. 145 Buildings (concession stand, projection room, ticket booth, and screen) $10,000, No. 157 Equipment $10,000, No. 201 Accounts Payable $7,000, and No. 301 Owner's Capital $40,000. During the month of March the following events and transactions occurred. In addition to the accounts identified above, the chart of accounts induces: No. 112 Accounts Receivable, No. 400 Service Revenue, No. 429 Rent Revenue, No. 610 Advertising Expense, No. 726 Salaries and Wages Expense, and No. 729 Rent Expense. Enter the beginning balances in the ledger. Insert a checkmark (? ) in the reference column of the ledger for the beginning balance. Journalize the March transactions. Lunt records admission revenue as service revenue, rental of the concession stand as rent revenue, and film rental expense as rent expense. post the March journal entries to the ledger. Assume that all entries are posted from page 1 of the journal. Prepare a trial balance on March 31,2014. Trial balance totals $63,800

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts