Question: Please check the full question in picture. Please explain how to calculate this to get an answer like the key above for number 70, 72,

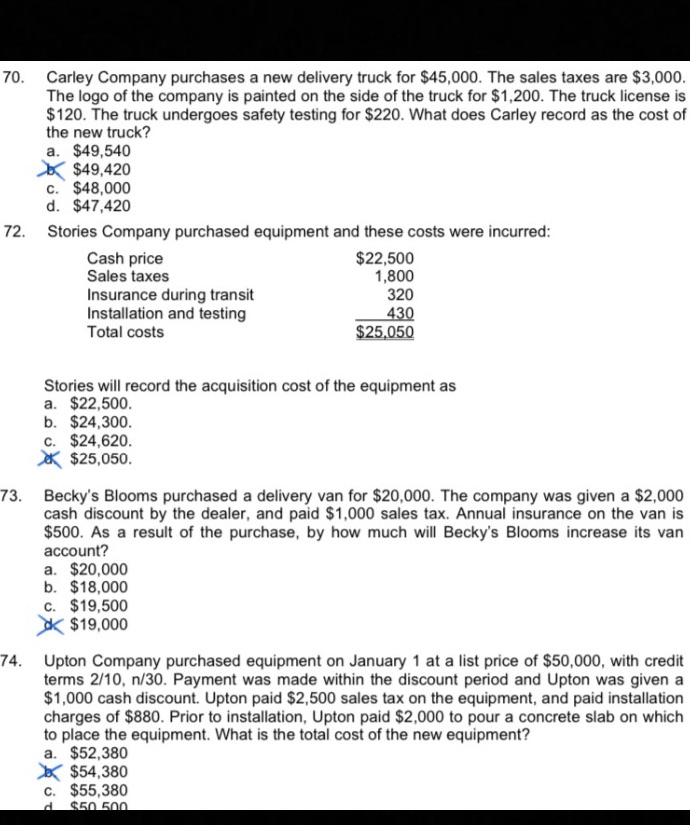

Please check the full question in picture. Please explain how to calculate this to get an answer like the key above for number 70, 72, 73, and 74PLANT ASSETS, NATURAL RESOURCES, AND INTANGIBLE ASSETS70. Carley Company purchases a new delivery truck for $45,000. The sales taxes are $3,000. The logo of the company is painted on the side of the truck for $1,200. The truck license is $120. The truck undergoes safety testing for $220. What does Carley record as the cost of the new truck?72. Stories Company purchased equipment and these costs were incurred: Stories will record the acquisition cost of the equipment as73. Becky's Blooms purchased a delivery van for $20,000. The company was given a $2,000 cash discount by the dealer, and paid $1,000 sales tax. Annual insurance on the van is $500. As a result of the purchase, by how much will Becky's Blooms increase its van account?74. Upton Company purchased equipment on January 1 at a list price of $50,000, with credit terms 2/10, n/30. Payment was made within the discount period and Upton was given a $1,000 cash discount. Upton paid $2,500 sales tax on the equipment, and paid installation charges of $880. Prior to installation, Upton paid $2,000 to pour a concrete slab on which to place the equipment. What is the total cost of the new equipment?

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts