Question: Please choose the correct answer. There will not be partial credits for these questions. 1. If the dividend-to-price ratio Pt follows a stationary autoregressive process

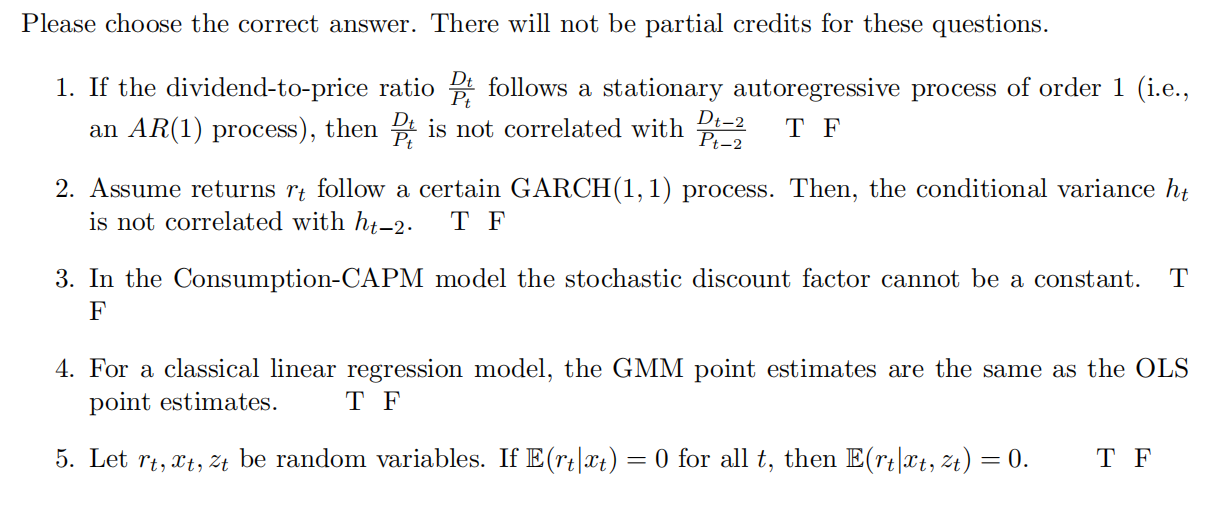

Please choose the correct answer. There will not be partial credits for these questions. 1. If the dividend-to-price ratio Pt follows a stationary autoregressive process of order 1 (i.e., T F an AR(1) process), then P is not correlated with P-2 2. Assume returns rt follow a certain GARCH(1,1) process. Then, the conditional variance ht is not correlated with ht-2. T F T 3. In the Consumption-CAPM model the stochastic discount factor cannot be a constant. F 4. For a classical linear regression model, the GMM point estimates are the same as the OLS point estimates. T F 5. Let rt, Xt, zt be random variables. If E(rt|Xt) = 0 for all t, then E(rt|Xt, zt) = 0. = T F Please choose the correct answer. There will not be partial credits for these questions. 1. If the dividend-to-price ratio Pt follows a stationary autoregressive process of order 1 (i.e., T F an AR(1) process), then P is not correlated with P-2 2. Assume returns rt follow a certain GARCH(1,1) process. Then, the conditional variance ht is not correlated with ht-2. T F T 3. In the Consumption-CAPM model the stochastic discount factor cannot be a constant. F 4. For a classical linear regression model, the GMM point estimates are the same as the OLS point estimates. T F 5. Let rt, Xt, zt be random variables. If E(rt|Xt) = 0 for all t, then E(rt|Xt, zt) = 0. = T F

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts