Question: Please CIRCLE the best answer. 1. 10. True or False Sherri owns an interest in a business that is not a passive activity and in

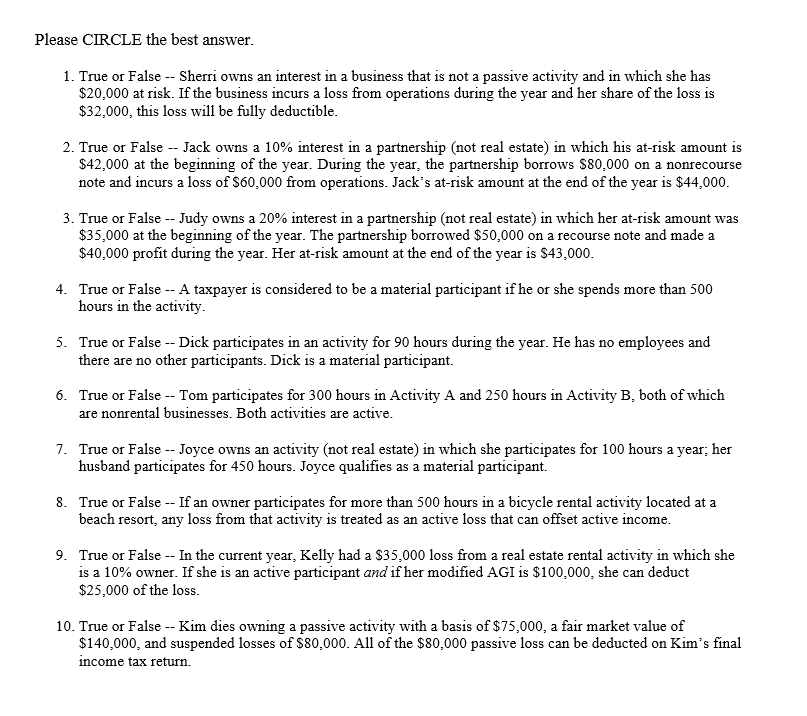

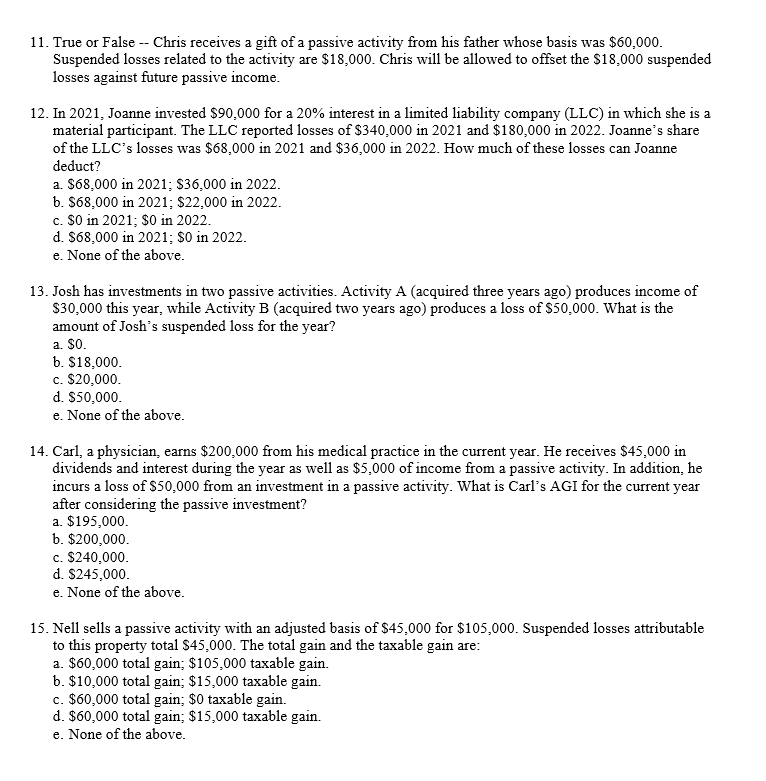

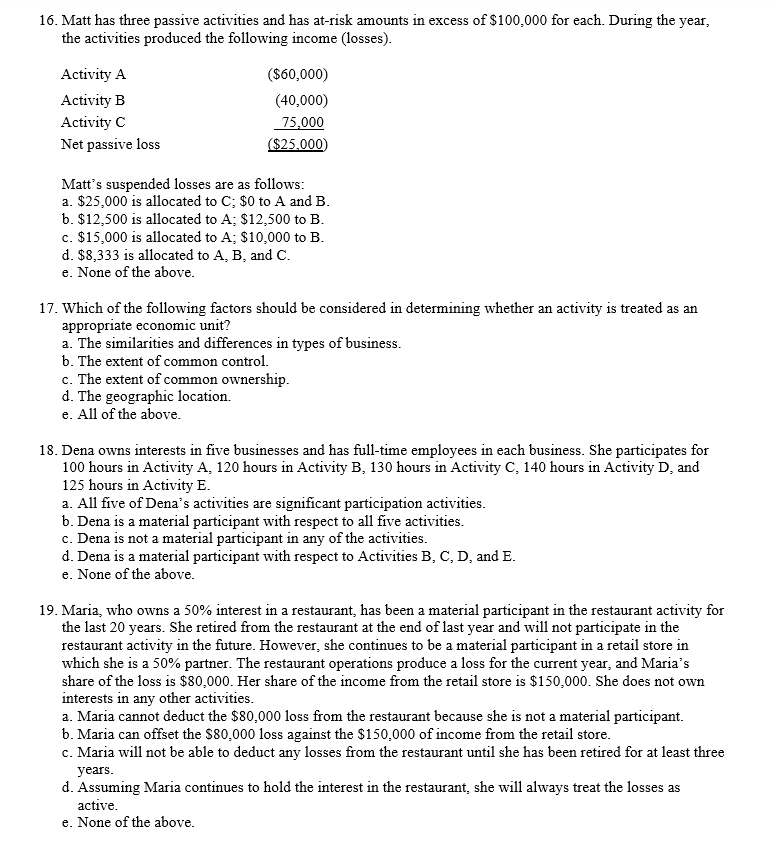

Please CIRCLE the best answer. 1. 10. True or False Sherri owns an interest in a business that is not a passive activity and in which she has $20,000 at rislr. Ifthe business incurs a loss om operations during the year and her share of the loss is $32,000, this loss will be fully deductible. . True or False Jacl: owns a 10% interest in a partnership (not real estate} in which his at-risk amount is $42,000 at the beginning of the year. During the year, the partnership borrows $30,000 on a nonrecourse note and incurs a loss of $60,000 om operations. Jack's atrislr amount at the end of the year is $44,000. . True or False Judy owns a 20% interest in a partnership [not real estate) in which her atrisk amount was $35,000 at the beginning of the year. The partnership borrowed $5 0,000 on a recourse note and made a $40,000 prot during the year. Her atrislr amount at the end of the year is $43,000- True or False A taxpayer is considered to be a material participant if he or she spends more than 500 hours in the activity. True or False Dick participates in an activity for 90 hours during the year. He has no employees and there are no other participants. Dick is a material participant. True or False Tom participates for 300 hours in Activity A and 250 hours in Activity B, both of which are nonrental businesses- Both activities are active- True or False Joyce owns an activity {not real estate) in which she participates for 100 hours a year; her husband participates for 450 hours. Joyce qualies as a material participant- True or False If an owner participates for more than 500 hours in a bicycle rental activity located at a beach resort, any loss from that activity is treated as an active loss that can o'set active income- True or False 1n the current year, Kelly had a $35,000 less om a real estate rental activity in which she is a 10% owner. If she is an active participant and ifhermodied AGI is $100,000, she can deduct $25,000 of the loss. True or False Kim dies owning a passive activity with a basis of $715,000, a fair market value of $140,000, and suspended losses of $80,000. All of the $30,000 passive loss can be deducted on Kim's nal income tax return- 11. True or False -- Chris receives a gift of a passive activity from his father whose basis was $60,000. Suspended losses related to the activity are $18,000. Chris will be allowed to offset the $18,000 suspended losses against future passive income. 12. In 2021, Joanne invested $90,000 for a 20% interest in a limited liability company (LLC) in which she is a material participant. The LLC reported losses of $340,000 in 2021 and $180,000 in 2022. Joanne's share of the LLC's losses was $68,000 in 2021 and $36,000 in 2022. How much of these losses can Joanne deduct a. $68,000 in 2021; $36,000 in 2022. b. $68,000 in 2021; $22,000 in 2022. c. $0 in 2021; $0 in 2022. d. $68,000 in 2021; $0 in 2022. e. None of the above. 13. Josh has investments in two passive activities. Activity A (acquired three years ago) produces income of $30,000 this year, while Activity B (acquired two years ago) produces a loss of $50,000. What is the amount of Josh's suspended loss for the year? a. SO. b. $18,000. c. $20,000. d. $50,000. e. None of the above. 14. Carl, a physician, earns $200,000 from his medical practice in the current year. He receives $45,000 in dividends and interest during the year as well as $5,000 of income from a passive activity. In addition, he incurs a loss of $50,000 from an investment in a passive activity. What is Carl's AGI for the current year after considering the passive investment? a. $195,000. b. $200,000. c. $240,000 d. $245,000. e. None of the above. 15. Nell sells a passive activity with an adjusted basis of $45,000 for $105,000. Suspended losses attributable to this property total $45,000. The total gain and the taxable gain are: a. $60,000 total gain; $105,000 taxable gain. b. $10,000 total gain; $15,000 taxable gain. c. $60,000 total gain; $0 taxable gain. d. $60,000 total gain; $15,000 taxable gain. e. None of the above.16. Matt has three passive activities and has at-risk amounts in excess of $100,000 for each. During the year, the activities produced the following income (losses). Activity A ($60,000) Activity B (40,000) Activity C 75,000 Net passive loss ($25.000) Matt's suspended losses are as follows: a. $25,000 is allocated to C; $0 to A and B. b. $12,500 is allocated to A; $12,500 to B. c. $15,000 is allocated to A; $10,000 to B. d. $8,333 is allocated to A, B, and C. e. None of the above. 17. Which of the following factors should be considered in determining whether an activity is treated as an appropriate economic unit? a. The similarities and differences in types of business. b. The extent of common control c. The extent of common ownership. d. The geographic location. e. All of the above. 18. Dena owns interests in five businesses and has full-time employees in each business. She participates for 100 hours in Activity A, 120 hours in Activity B, 130 hours in Activity C. 140 hours in Activity D, and 125 hours in Activity E. a. All five of Dena's activities are significant participation activities. b. Dena is a material participant with respect to all five activities. c. Dena is not a material participant in any of the activities. d. Dena is a material participant with respect to Activities B, C, D, and E. e. None of the above. 19. Maria, who owns a 50% interest in a restaurant, has been a material participant in the restaurant activity for the last 20 years. She retired from the restaurant at the end of last year and will not participate in the restaurant activity in the future. However, she continues to be a material participant in a retail store in which she is a 50% partner. The restaurant operations produce a loss for the current year, and Maria's share of the loss is $80,000. Her share of the income from the retail store is $150,000. She does not own interests in any other activities. a. Maria cannot deduct the $80,000 loss from the restaurant because she is not a material participant. b. Maria can offset the $80,000 loss against the $150,000 of income from the retail store. c. Maria will not be able to deduct any losses from the restaurant until she has been retired for at least three years. d. Assuming Maria continues to hold the interest in the restaurant, she will always treat the losses as active. e. None of the above.20. 21. 22. 23. 24. Jenny spends 32 hours a week, 50 weeks a year, operating a bicycle rental store that she owns at a resort community. She also owns a music store in another city that is operated by a hilltime employee. Jenny spends 140 hours per year working at the music store- She elects not to group them together as a single activity under the \"appropriate economic unit\" standard- a. Neither store is a passive activity. h. Both stores are passive activities. c. Only the bicycle rental store is a passive activity. d. Only the music store is a passive activity. e. None of the above. Rita earns a salary of $150,000, and invests $40,000 for a 20% interest in a passive activity- Operations of the activity result in a loss of $250,000, of which Rita's share is $50,000. How is her loss characterized? a. $40,000 is suspended under the passive loss rules and $10,000 is suspended under the atrisk rules. b. $40,000 is suspended under the atrislr rules and $10,000 is suspended under the passive loss rules. c. $50,000 is suspended under the passive loss rules- d. $50,000 is suspended under the atrislr rules. e. None of the above. Vic's atrislr amount in a passive activity is $200,000 at the beginning of the current year. His current loss from the activity is $00,000. Vic had no passive activity income during the year. At the end of the current year. a. 1Vic has an atrislr amount in the activity of $120,000 and a suspended passive loss of$30,000. b. Vic has an atrislr amount in the activity of $200,000 and a suspended passive loss of $30,000. c. 1Vic has an atrislr amount in the activity of $120,000 and no suspended passive loss. d. Vic has an at-rislr amount in the activity of $200,000 and no suspended passive loss. e. None of the above. Pablo, who is single, has $95,000 of salary, $10,000 of income orn a limited partnership, and a $22,000 passive loss om a real estate rental activity in which he actively participates. His modied adjusted gross income is $95,000. Of the $22,000 loss, hovtr much is deductible? a $0. 1]. $10,000. 1:. $25,000- d- $22,000. e- None of the above. Kate dies owning a passive activity with an adjusted basis of $100,000. Its fair marlret value at that date is $130,000- Suspended losses relating to the property were $45,000- a. The heir's adjusted basis is $130,000, and Kate's nal deduction is $15,000- b. The heir's adjusted basis is $130,000, and Kate's nal deduction is $45,000- c. The heir's adjusted basis is $100,000, and Kate's nal deduction is $45,000- d. The heir's adjusted basis is $125,000, and Kate has no nal deduction. e. None of the above. 25- True or False The atrislr and passive loss rules can, at times, be confusing

Step by Step Solution

There are 3 Steps involved in it

Sure lets go through the questions False The deductible loss is limited to the atrisk amount which is 20000 Therefore her 32000 loss will not be fully deductible False Nonrecourse debt doesnt increase ... View full answer

Get step-by-step solutions from verified subject matter experts