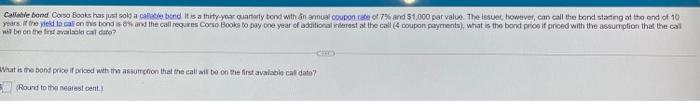

Question: please circle the final answer Callable bond Corso Books has just sok a cable bond it is a thity-year cantaty bond with an annual coupon

Callable bond Corso Books has just sok a cable bond it is a thity-year cantaty bond with an annual coupon rate of 7% and 51,000 per value. The ser however, can call the band starting at the end of 10 years, the yield to calon stond is on and the call requires Conso Booksto pay one year of additional rest at the call (4 coupon payments) what is the bond positroed with the assumption that the call Wir be on the list waale calcato? What is the bond price il priced with the assumption that the call will be on the first available caldato? Roured to the nearestent Callable bond Corso Books has just sold a callatie bond it is a thirty year quarterly bond with an annual coupon rate of 7% and $1.000 por valoe. The issuer, however, can call the bond starting at the end of 10 years. If the yield to call on this bond is 0% and the calfoguires Corso Booksto pay one year of additional interest at the cal (4 coupon payments), what is the bond price il priced with the assumption that the call will be on the first available call date? What is the bond price it priced with the sumption that the cat will be on the trut wable cal tale? Pound to the newest cent)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts