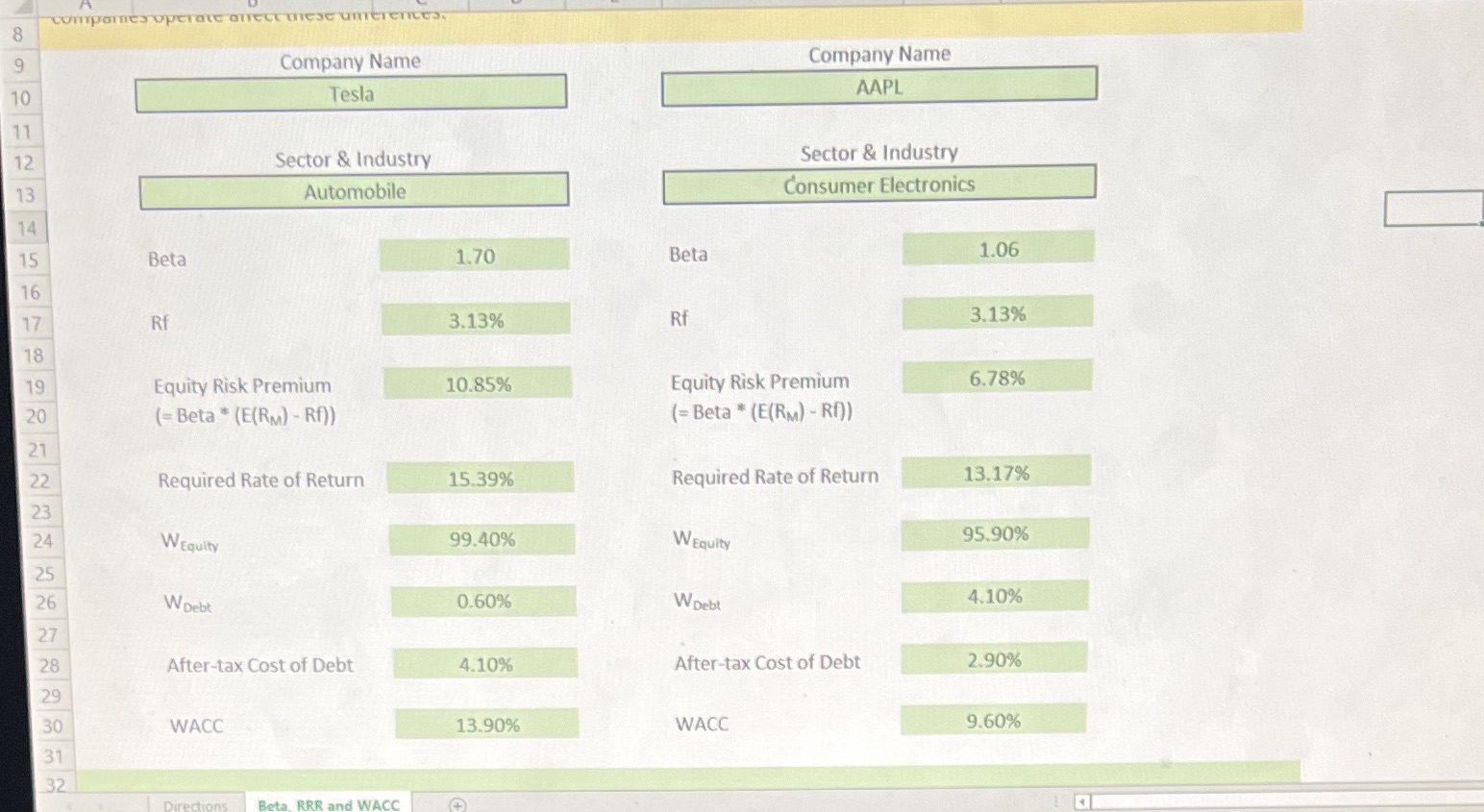

Question: Please comment on the differences in risk between the two companies as reflected in their respective required rates of return and weighted average cost of

Please comment on the differences in risk between the two companies as reflected in their respective required rates of return and weighted average cost of capital. Explain why they are different and how the sectors in which these companies operate affect these differences.

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts