Question: please complete a b and c for a thumbs up:) The annual profit from an investment is $20,000 each year for 5 years and the

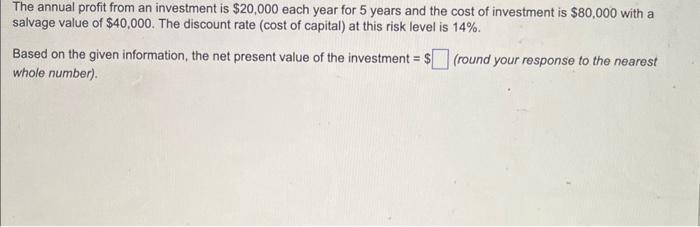

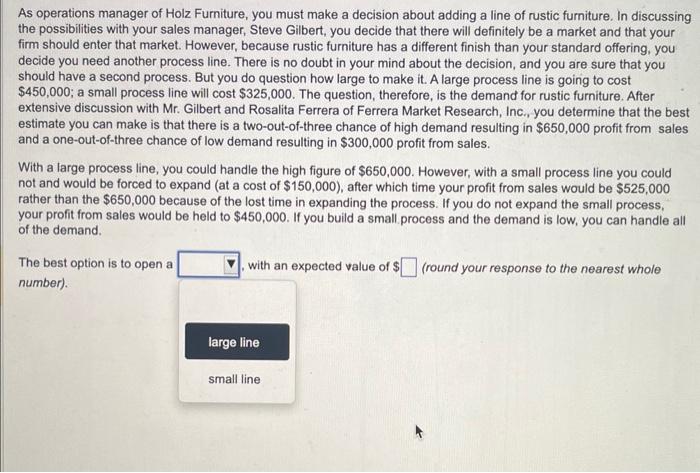

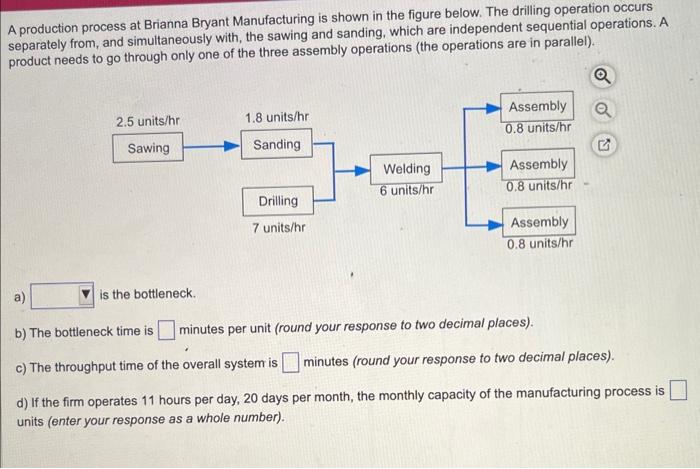

The annual profit from an investment is $20,000 each year for 5 years and the cost of investment is $80,000 with a salvage value of $40,000. The discount rate (cost of capital) at this risk level is 14%. Based on the given information, the net present value of the investment =$ (round your response to the nearest whole number). As operations manager of Holz Furniture, you must make a decision about adding a line of rustic furniture. In discussing the possibilities with your sales manager, Steve Gilbert, you decide that there will definitely be a market and that your firm should enter that market. However, because rustic furniture has a different finish than your standard offering, you decide you need another process line. There is no doubt in your mind about the decision, and you are sure that you should have a second process. But you do question how large to make it. A large process line is going to cost $450,000; a small process line will cost $325,000. The question, therefore, is the demand for rustic furniture. After extensive discussion with Mr. Gilbert and Rosalita Ferrera of Ferrera Market Research, Inc., you determine that the best estimate you can make is that there is a two-out-of-three chance of high demand resulting in $650,000 profit from sales and a one-out-of-three chance of low demand resulting in $300,000 profit from sales. With a large process line, you could handle the high figure of $650,000. However, with a small process line you could not and would be forced to expand (at a cost of $150,000 ), after which time your profit from sales would be $525,000 rather than the $650,000 because of the lost time in expanding the process. If you do not expand the small process, your profit from sales would be held to $450,000. If you build a small process and the demand is low, you can handle all of the demand. The best option is to open a number). with an expected value of $ (round your response to the nearest whole A production process at Brianna Bryant Manufacturing is shown in the figure below. The drilling operation occurs separately from, and simultaneously with, the sawing and sanding, which are independent sequential operations. A product needs to go through only one of the three assembly operations (the operations are in parallel). a) is the bottleneck. b) The bottleneck time is minutes per unit (round your response to two decimal places). c) The throughput time of the overall system is minutes (round your response to two decimal places). d) If the firm operates 11 hours per day, 20 days per month, the monthly capacity of the manufacturing process is units (enter your response as a whole number)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts