Question: Please complete all Chapter 4: Using Tax Concepts for Planning 1. Help the Sampsons estimate their Federal Income Contributions Act (FICA) tax, which consists of

Please complete all

Please complete all

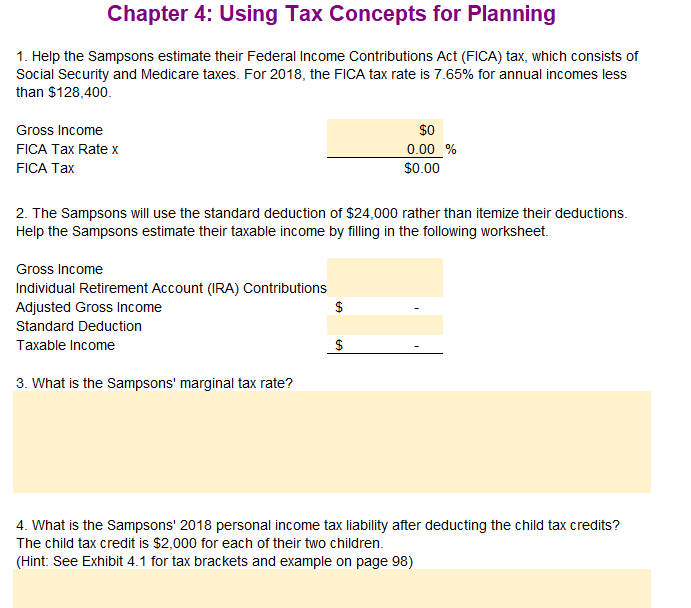

Chapter 4: Using Tax Concepts for Planning 1. Help the Sampsons estimate their Federal Income Contributions Act (FICA) tax, which consists of Social Security and Medicare taxes. For 2018, the FICA tax rate is 7.65% for annual incomes less than $128,400. $0 Gross Income FICA Tax Rate x FICA Tax 0.00 % $0.00 2. The Sampsons will use the standard deduction of $24,000 rather than itemize their deductions Help the Sampsons estimate their taxable income by filling in the following worksheet. Gross Income Individual Retirement Account (IRA) Contributions Adjusted Gross Income Standard Deduction Taxable income 3. What is the Sampsons' marginal tax rate? 4. What is the Sampsons' 2018 personal income tax liability after deducting the child tax credits? The child tax credit is $2,000 for each of their two children. (Hint: See Exhibit 4.1 for tax brackets and example on page 98)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts