Question: Saved Help Save & Exit An employee earns $5,650 per month working for an employer. The Federal Insurance Contributions Act (FICA) tax rate for Social

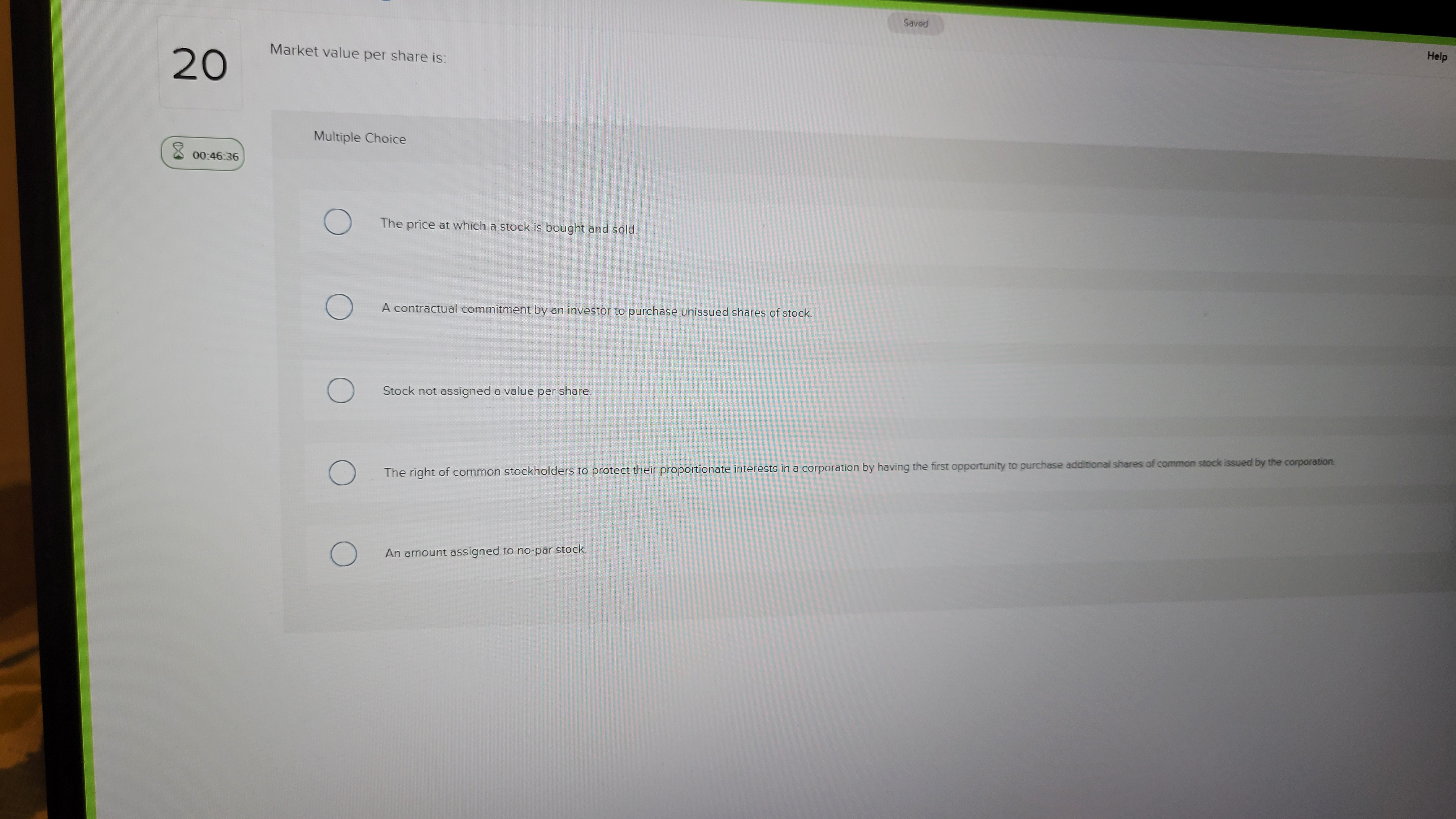

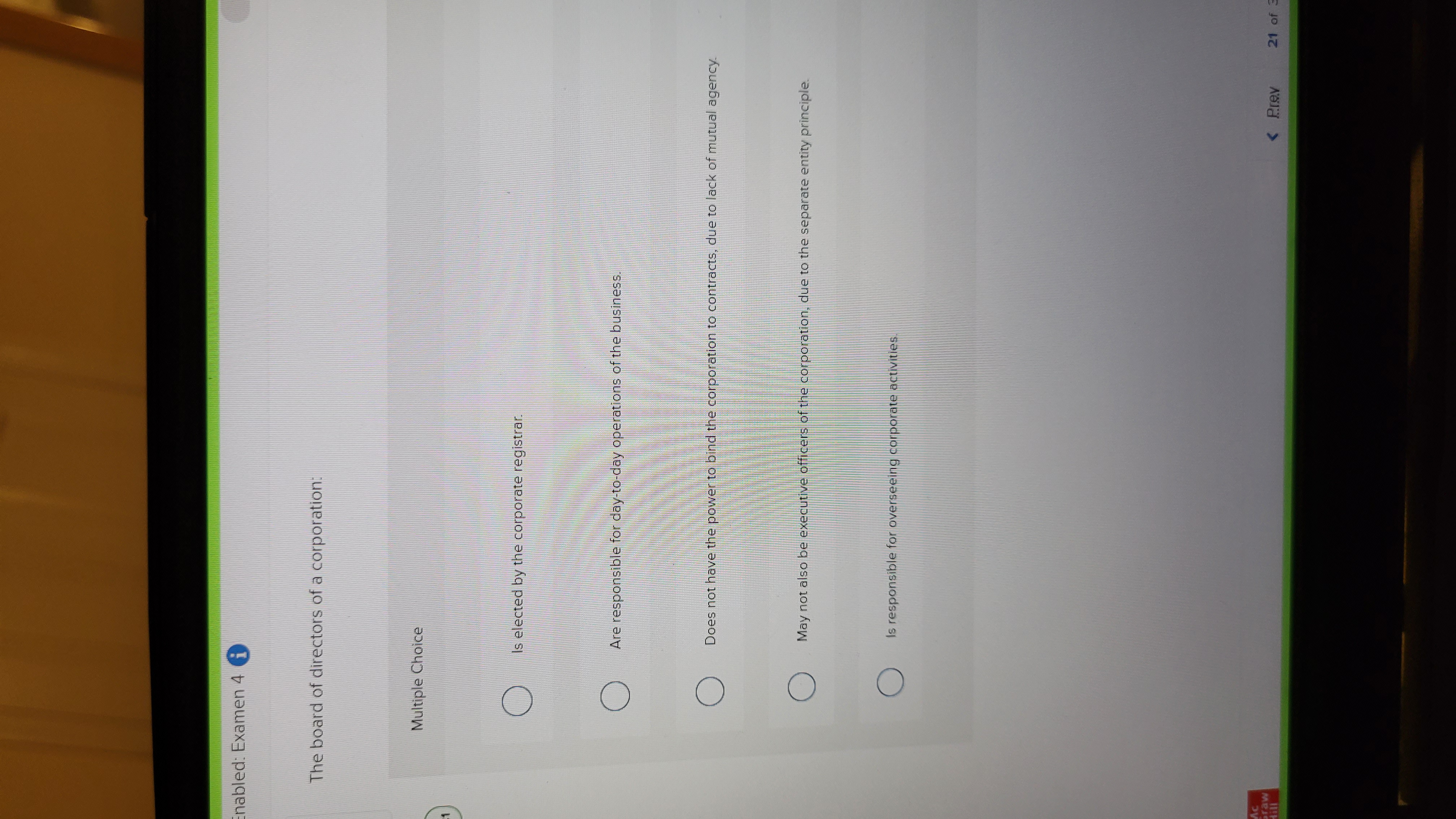

Saved Help Save & Exit An employee earns $5,650 per month working for an employer. The Federal Insurance Contributions Act (FICA) tax rate for Social Security is 6.2% of the first $137,700 earned each calendar year and the Federal Insurance Contributions Act (FICA) tax rate for Medicare is 1.45% of all earnings. The current Federal Unemployment Taxes (FUTA) tax rate is 0.6%, and the State Unemployment Taxes (SUTA) tax rate is 5.4%. Both unemployment taxes are applied to the first $7,000 of an employee's pay. The employee has $188 in federal income taxes withheld. The employee has voluntary deductions for health insurance of $156 and contributes $78 to a retirement plan each month. What is the amount of net pay for the employee for the month of January? (Round your intermediate calculations to two decimal places.) Multiple Choice O $4,445.47 O $4,877.70 O $4,795.77 O $4,490.67 $4,750.57bled: Examen 4 1 Saved Help Save & Exit An employee earned $43,600 during the year working for an employer when the maximum limit for Social Security was $137,700. The Federal Insurance Contributions Act (FICA) tax rate for Social Security is 6.2% and the Federal Insurance Contributions Act (FICA) tax rate for Medicare is 1.45%. The employee's annual Federal Insurance Contributions Act (FICA) taxes amount is: Multiple Choice O $6,038.60. O $6,670.80. $3,335.40. O $2,703.20. O $632.20.ing Enabled: Examen 4 i Saved Hel On November 1, Alan Company signed a 120-day, 12% note payable, with a face value of $9,900. What is the adjusting entry for the accrued interest at December 31 on the note? (Use 360 days a year.) Multiple Choice 47:20 O Debit Interest Payable, $264: credit Interest Expense, $264. O No adjusting entry is required. O Debit Interest Payable, $396; credit Interest Expense, $396 O Debit Interest Expense, $198: credit Interest Payable, $198. O Debit Interest Expense, $132; credit Interest Payable, $132.nabled: Examen 4 i Saved Help On December 1, Victoria Company signed a 90-day, 6% note payable, with a face value of $16,800. What amount of interest expense is accrued at December 31 on the note? (Use 360 days a year.) Multiple Choice $1,008 O $168 O $84 $252 O $OOn November 1, Alan Company signed a 120-day, 8% note payable, with a face value of $9:000 What is the maturity rest of the note on March !" (Use 260 days e year ) Multiple Choice 0:47:03 O $9.000 O $720 O $9120 O $9,720 O $9,240oring Enabled: Examen 4 Saved Help Sa 7 On November 1, Alan Company signed a 120-day, 8% note payable, with a face value of $9,000. What is the maturity value (principal plus interest) of the note on March 1? (Use 360 days a year.) Multiple Choice 0:47:00 $9,000 $720 O $9,120 $9,720 O $9,240Enabled: Examen 4 i Saved upon signing the note? Help Save & Exit Submit On December 1, Watson Enterprises signed a $24,000, 60-day, 4% note payable as replacement of an account payable with Erikson Company. What is the journal entry that should be recorded by Watson Enterprises Multiple Choice O Debit Accounts Receivable $24,000; credit Notes Receivable $24,000. Quiz Tools O Debit Accounts Payable $24,000; credit Notes Payable $24,000. 100% O Debit Accounts Payable $24,160; credit Notes Payable $24,160. C. Collapse O Debit Notes Payable $24,000; debit Interest Expense $160; credit Accounts Payable $24,160. Debit Notes Payable $24,000; debit Interest Expense $160; credit Cash $24,160. Oring Enabled: Examen 4 i Saved 19 Help Save & Exit Submit On November 1, Alan Company signed a 120-day, 8% note payable, with a face value of $9,000. What is the adjusting entry for the accrued interest at December 31 on the note? (Use 360 days a year.) Multiple Choice 8 00:46:41 O No adjusting entry is required. O Debit Interest Payable, $120; credit Interest Expense, $120. O Debit Interest Expense, $120; credit Interest Payable, $120. 100 Collapse O Debit Interest Expense, $720; credit Interest Payable, $720. O Debit Interest Payable, $240; credit Interest Expense, $240.Saved Help 20 Market value per share is: Multiple Choice 00:46:36 O The price at which a stock is bought and sold. O A contractual commitment by an investor to purchase unissued shares of stock O Stock not assigned a value per share. The right of common stockholders to protect their proportionate interests in a corporation by having the first opportunity to purchase additional shares of common stock issued by the corporation. O O An amount assigned to no-par stock.nabled: Examen 4 1 The board of directors of a corporation: Multiple Choice O Is elected by the corporate registrar. Are responsible for day-to-day operations of the business. O Does not have the power to bind the corporation to contracts, due to lack of mutual agency. May not also be executive officers of the corporation, due to the separate entity principle. O Is responsible for overseeing corporate activities