Question: Please complete and plot the reamining SBU's on the BCG matrix . SBU A has already been done . Note you must calculate relative market

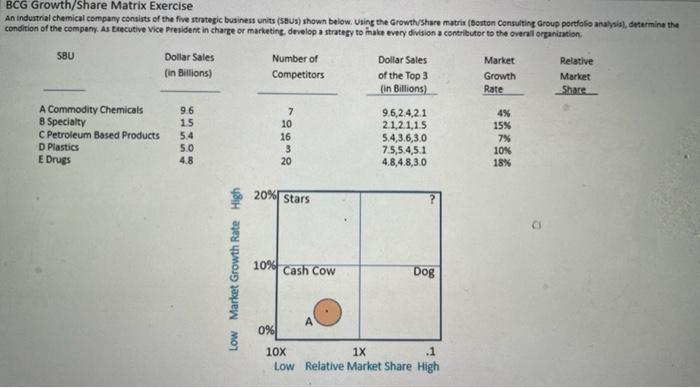

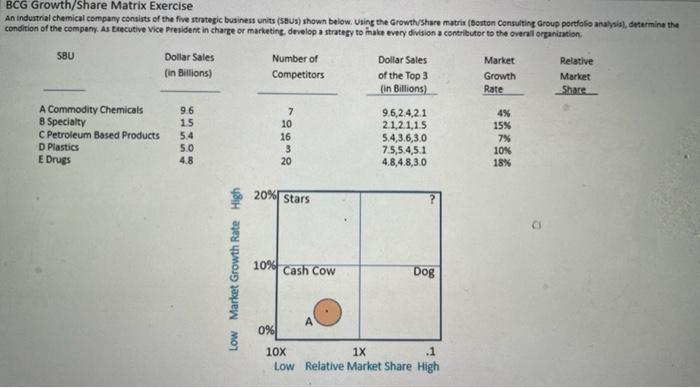

Please complete and plot the reamining SBU's on the BCG matrix . SBU A has already been done . Note you must calculate relative market share, by dividing your sales dvidided by your largest competitor. (for example 9.6/2.4=4) Once done plotting develop a strategy to makes every SBU a contributor to the overall organization. Also not the diameter of the circle of each SBU plot is in relationship to its sales compared to the other SBU 's in the company.

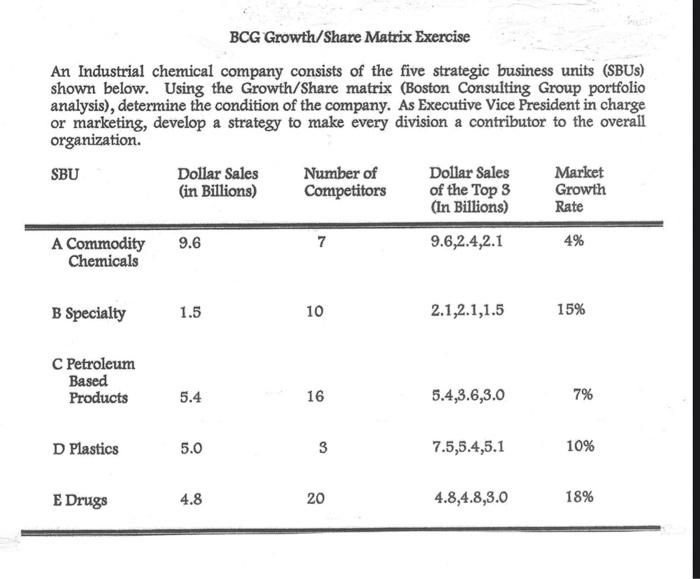

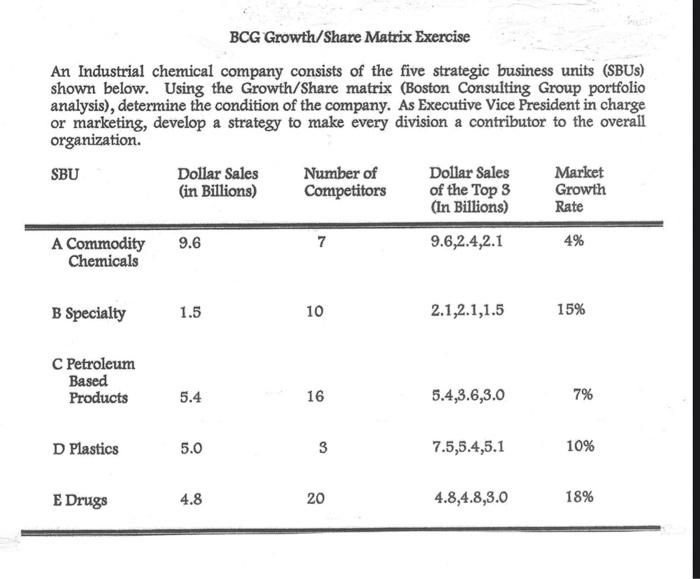

BCG Growth/Share Matrix Exercise An Industrial chemical company consists of the five strategic business units (SBU) shown below. Using the Growth/Share matrix (Boston Consulting Group portfolio analysis), determine the condition of the company. As Executive Vice President in charge or marketing, develop a strategy to make every division a contributor to the overall organization. SBU Dollar Sales Number of Dollar Sales Market (in Billions) Competitors of the Top 3 Growth (In Billions) Rate A Commodity 9.6 7 9.6,2.4,2.1 4% Chemicals B Specialty 1.5 10 2.1.2.1,1.5 15% C Petroleum Based Products 5.4 16 5.4,3.6,3.0 7% D Plastics 5.0 3 7.5,5.4,5.1 10% E Drugs 4.8 20 4.8,4.8,3.0 18% BCG Growth/Share Matrix Exercise An industrial chemical company consists of the five strategic business units (S&Us) shown below. Using the Growth/Share matrix (Boston Consulting Group portfolio analysis), determ condition of the company. As trecutive Vice President in charge or marketing, develop a strategy to inake every division a contributor to the overall organization termine the SBU Dollar Sales (in Billions) Number of Competitors Dollar Sales of the Top 3 (in Billions) Market Growth Rate Relative Market Share A Commodity Chemicals 8 Specialty C Petroleum Based Products D Plastics E Drugs 96 15 5.4 5.0 4.8 7 10 16 3 20 9.6.2.4.2.1 21,2 1,15 5.4,36,3.0 7.5,5,4,5.1 4.8.4.8,3.0 4% 15% 7% 10% 18% O 20% Stars C Low Market Growth Rate High 10% Cash Cow Dog A 0% 10X 1x .1 Low Relative Market Share High BCG Growth/Share Matrix Exercise An Industrial chemical company consists of the five strategic business units (SBU) shown below. Using the Growth/Share matrix (Boston Consulting Group portfolio analysis), determine the condition of the company. As Executive Vice President in charge or marketing, develop a strategy to make every division a contributor to the overall organization. SBU Dollar Sales Number of Dollar Sales Market (in Billions) Competitors of the Top 3 Growth (In Billions) Rate A Commodity 9.6 7 9.6,2.4,2.1 4% Chemicals B Specialty 1.5 10 2.1.2.1,1.5 15% C Petroleum Based Products 5.4 16 5.4,3.6,3.0 7% D Plastics 5.0 3 7.5,5.4,5.1 10% E Drugs 4.8 20 4.8,4.8,3.0 18% BCG Growth/Share Matrix Exercise An industrial chemical company consists of the five strategic business units (S&Us) shown below. Using the Growth/Share matrix (Boston Consulting Group portfolio analysis), determ condition of the company. As trecutive Vice President in charge or marketing, develop a strategy to inake every division a contributor to the overall organization termine the SBU Dollar Sales (in Billions) Number of Competitors Dollar Sales of the Top 3 (in Billions) Market Growth Rate Relative Market Share A Commodity Chemicals 8 Specialty C Petroleum Based Products D Plastics E Drugs 96 15 5.4 5.0 4.8 7 10 16 3 20 9.6.2.4.2.1 21,2 1,15 5.4,36,3.0 7.5,5,4,5.1 4.8.4.8,3.0 4% 15% 7% 10% 18% O 20% Stars C Low Market Growth Rate High 10% Cash Cow Dog A 0% 10X 1x .1 Low Relative Market Share High

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock