Question: Please complete Exercise as follows: Remember when doing NPV & IRR, use my in - class assignment as a guide and utilize the PVA table.

Please complete Exercise as follows:

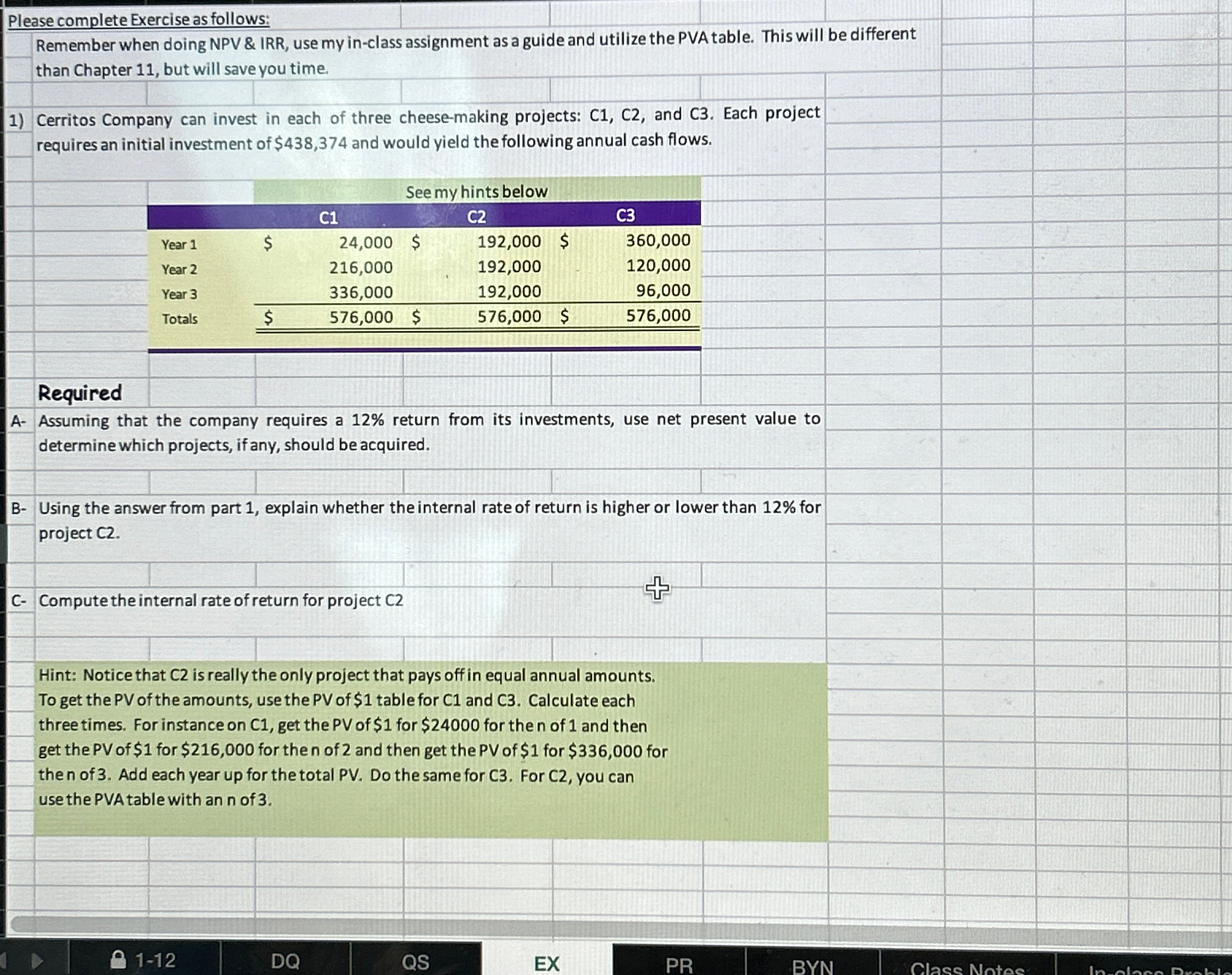

Remember when doing NPV & IRR, use my inclass assignment as a guide and utilize the PVA table. This will be different than Chapter but will save you time.

Cerritos Company can invest in each of three cheesemaking projects: C C and C Each project requires an initial investment of $ and would yield the following annual cash flows.

tableSee my hints belowCCCYear $$$Year Year Totals$$$

Required

A Assuming that the company requires a return from its investments, use net present value to determine which projects, if any, should be acquired.

B Using the answer from part explain whether the internal rate of return is higher or lower than for project C

C Compute the internal rate of return for project

Hint: Notice that C is really the only project that pays off in equal annual amounts. To get the PV of the amounts, use the PV of $ table for and C Calculate each three times. For instance on C get the PV of $ for $ for the of and then get the PV of $ for $ for the of and then get the PV of $ for $ for the n of Add each year up for the total PV Do the same for C For C you can use the PVA table with an of

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock