Question: please complete for up rating 1 points Save Answer QUESTION 9 Eva received $62.000 in compensation payments from JAZZ Corp. during 2021. Eva incurred $5,000

please complete for up rating

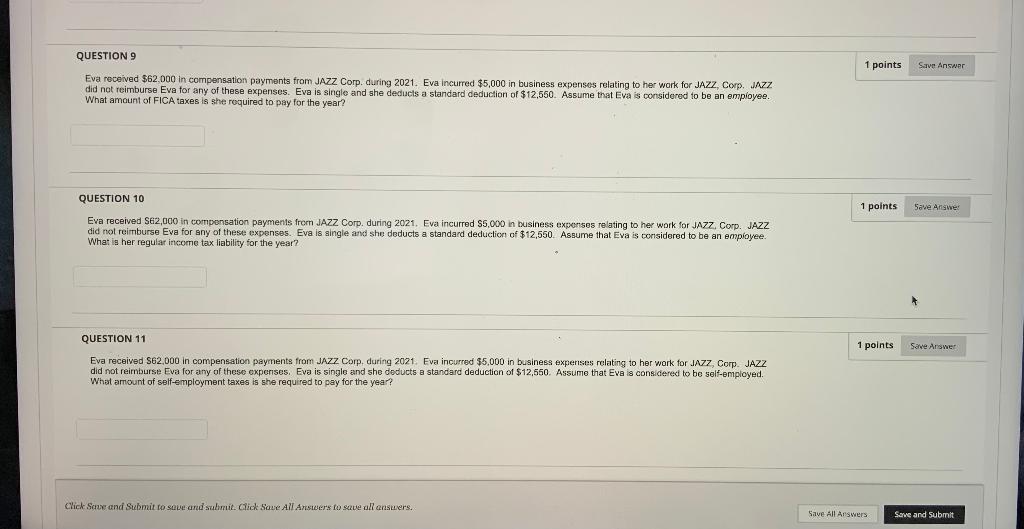

1 points Save Answer QUESTION 9 Eva received $62.000 in compensation payments from JAZZ Corp. during 2021. Eva incurred $5,000 in business expenses relating to her work for JAZZ, Corp. JAZZ did not reimburse Eva for any of these expenses. Eva is single and she deducts a standard deduction of $12,660. Assume that Eva is considered to be an employee What amount of FICA taxes is she required to pay for the year? 1 points Sever we QUESTION 10 Eva received 862,000 in compensation payments from JAZZ Corp. during 2021. Eva incurred $5,000 in business expenses relating to her work for JAZZ, Corp. JAZZ did not reimburse Eva for any of these expenses. Eva is single and she deducts a standard deduction of $12,550. Assume that Eva is considered to be employee. What is her regular income tax liability for the year? QUESTION 11 1 points Save Answer Eva received S62.000 in compensation payments from JAZZ Corp, during 2021. Eva incurred $5,000 in business expenses relating to her work for JAZZ, Corp. JAZZ did not reimburse Eva for any of these expenses. Eva is single and she deducts a standard deduction of $12,550. Assume that Eva is considered to be self-employed. What amount of self-employment taxes is she required to pay for the year? Click Save and Submit to save and submit. Click Save All Answers to save all answers. Save All Answers Save and submit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts