Question: please complete will up vote 1 points Save Answer QUESTION 12 Eva received $62,000 in compensation payments from JAZZ Corp. during 2021. Eva incurred $5,000

please complete will up vote

please complete will up vote

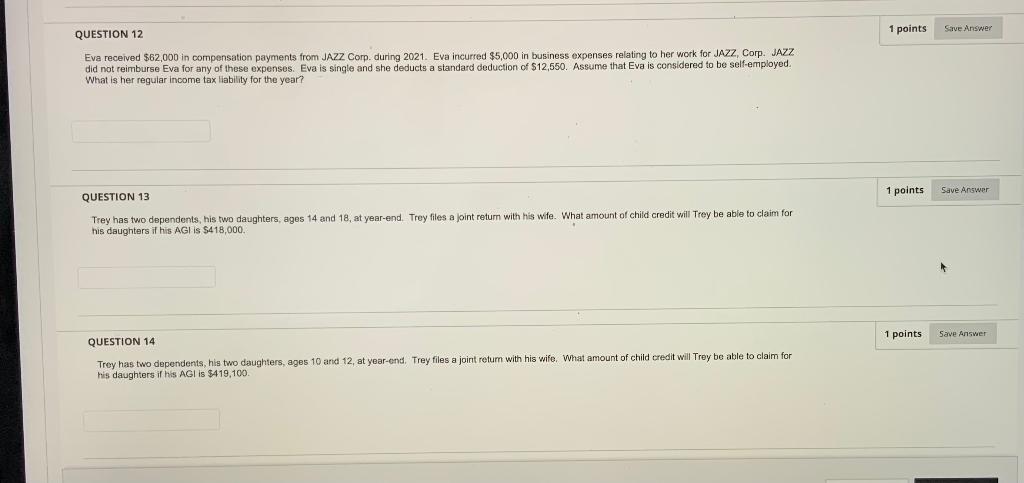

1 points Save Answer QUESTION 12 Eva received $62,000 in compensation payments from JAZZ Corp. during 2021. Eva incurred $5,000 in business expenses relating to her work for JAZZ, Corp. JAZZ did not reimburse Eva for any of these expenses. Eva is single and she deducts a standard deduction of $12,550. Assume that Eva is considered to be self-employed. What is her regular income tax liability for the year? 1 points QUESTION 13 Save Answer Trey has two dependents, his two daughters, ages 14 and 18, at year-end Trey files a joint return with his wife. What amount of child credit will Trey be able to claim for his daughters if his AGI is $418,000. 1 points Save Answer QUESTION 14 Trey has two dependents, his two daughters, ages 10 and 12, at year-end, Trey files a joint return with his wife. What amount of child credit will Trey be able to claim for his daughters if his AGI is $419,100

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts