Question: See Chegg link for case study. If you answer today I will appreciate it and I will give you thumbs Up. https://www.chegg.com/homework-help/questions-and-answers/read-attached-term-sheet-negotiations-case-study-compare-two-term-sheets-provide-detailed--q41735376 5. Please read

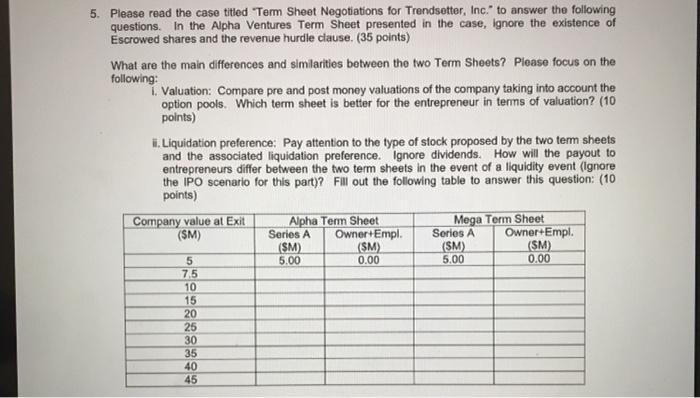

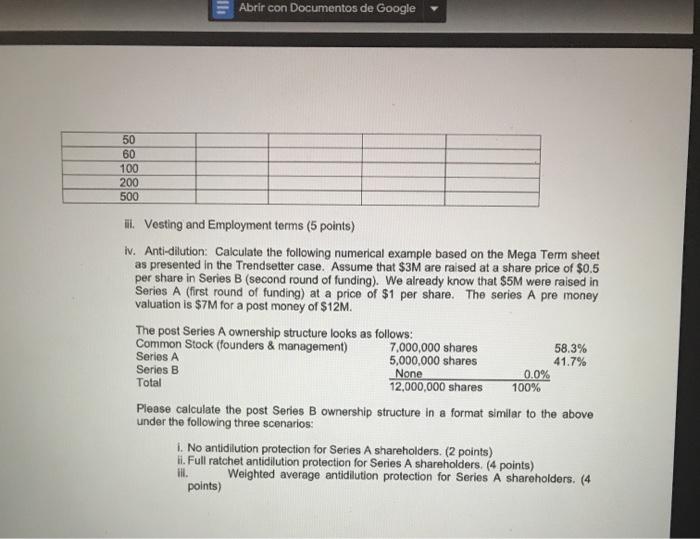

5. Please read the case titled Term Sheet Negotiations for Trendsetter, Inc. to answer the following questions. In the Alpha Ventures Term Sheet presented in the case, Ignore the existence of Escrowed shares and the revenue hurdle clause (35 points) What are the main differences and similarities between the two Term Sheets? Please focus on the following: 1. Valuation: Compare pre and post money valuations of the company taking into account the option pools. Which term sheet is better for the entrepreneur in terms of valuation? (10 points) Liquidation preference: Pay attention to the type of stock proposed by the two term sheets and the associated liquidation preference. Ignore dividends. How will the payout to entrepreneurs differ between the two term sheets in the event of a liquidity event (Ignore the IPO scenario for this party? Fill out the following table to answer this question: (10 points) Company value at Exit Alpha Term Sheet Mega Term Sheet (SM) Series A Owner+Empl. Series A Owner+Empl. (SM) (SM) (SM) (SM) 5.00 5.00 0.00 7,5 10 15 20 25 30 35 40 45 5 0.00 Abrir con Documentos de Google 50 60 100 200 500 Hi. Vesting and Employment terms (5 points) iv. Anti-dilution: Calculate the following numerical example based on the Mega Term sheet as presented in the Trendsetter case. Assume that $3M are raised at a share price of $0.5 per share in Series B (second round of funding). We already know that $5M were raised in Series A (first round of funding) at a price of $1 per share. The series A pre money valuation is $7M for a post money of $12M. The post Series A ownership structure looks as follows: Common Stock (founders & management) 7,000,000 shares 58.3% Series A 5,000,000 shares 41.7% Series B 0.0% Total 12,000,000 shares 100% Please calculate the post Series B ownership structure in a format similar to the above under the following three scenarios: 1. No antidilution protection for Series A shareholders. (2 points) li. Full ratchet antidilution protection for Series A shareholders. (4 points) . Weighted average antidilution protection for Series A shareholders. (4 points) None 5. Please read the case titled Term Sheet Negotiations for Trendsetter, Inc. to answer the following questions. In the Alpha Ventures Term Sheet presented in the case, Ignore the existence of Escrowed shares and the revenue hurdle clause (35 points) What are the main differences and similarities between the two Term Sheets? Please focus on the following: 1. Valuation: Compare pre and post money valuations of the company taking into account the option pools. Which term sheet is better for the entrepreneur in terms of valuation? (10 points) Liquidation preference: Pay attention to the type of stock proposed by the two term sheets and the associated liquidation preference. Ignore dividends. How will the payout to entrepreneurs differ between the two term sheets in the event of a liquidity event (Ignore the IPO scenario for this party? Fill out the following table to answer this question: (10 points) Company value at Exit Alpha Term Sheet Mega Term Sheet (SM) Series A Owner+Empl. Series A Owner+Empl. (SM) (SM) (SM) (SM) 5.00 5.00 0.00 7,5 10 15 20 25 30 35 40 45 5 0.00 Abrir con Documentos de Google 50 60 100 200 500 Hi. Vesting and Employment terms (5 points) iv. Anti-dilution: Calculate the following numerical example based on the Mega Term sheet as presented in the Trendsetter case. Assume that $3M are raised at a share price of $0.5 per share in Series B (second round of funding). We already know that $5M were raised in Series A (first round of funding) at a price of $1 per share. The series A pre money valuation is $7M for a post money of $12M. The post Series A ownership structure looks as follows: Common Stock (founders & management) 7,000,000 shares 58.3% Series A 5,000,000 shares 41.7% Series B 0.0% Total 12,000,000 shares 100% Please calculate the post Series B ownership structure in a format similar to the above under the following three scenarios: 1. No antidilution protection for Series A shareholders. (2 points) li. Full ratchet antidilution protection for Series A shareholders. (4 points) . Weighted average antidilution protection for Series A shareholders. (4 points) None

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts