Question: Please complete in 1 hour by 3:41 eastern, thank you! Sunny Inc. has a defined benefits pension plan for its workers. On Jan 1, 2011,

Please complete in 1 hour by 3:41 eastern, thank you!

Sunny Inc. has a defined benefits pension plan for its workers. On Jan 1, 2011, the following balances related to this plan:

Plant assets - fair value: $7,000

Projected benefit obligations: 8,400

Pension asset/liability 1,400 Crredit

Accumulated OCI-PSC 1,600 Dr

From the operation of the plan in 2011, their actuary gave them additional information at Dec 31, 2011:

Service cost for 2011: $1,400

Actual return on plan assets for 2011: 900

Amortization of prior service cost: 150

Contributions in 2011: 2,600

Benefits paid to retireed employees in 2011: 800

Settlement rate percent: 8%

Expected return rate: 9%

Change in the acturary's assuptions that lead up to Dec 31, 2011 PBO: $10,862

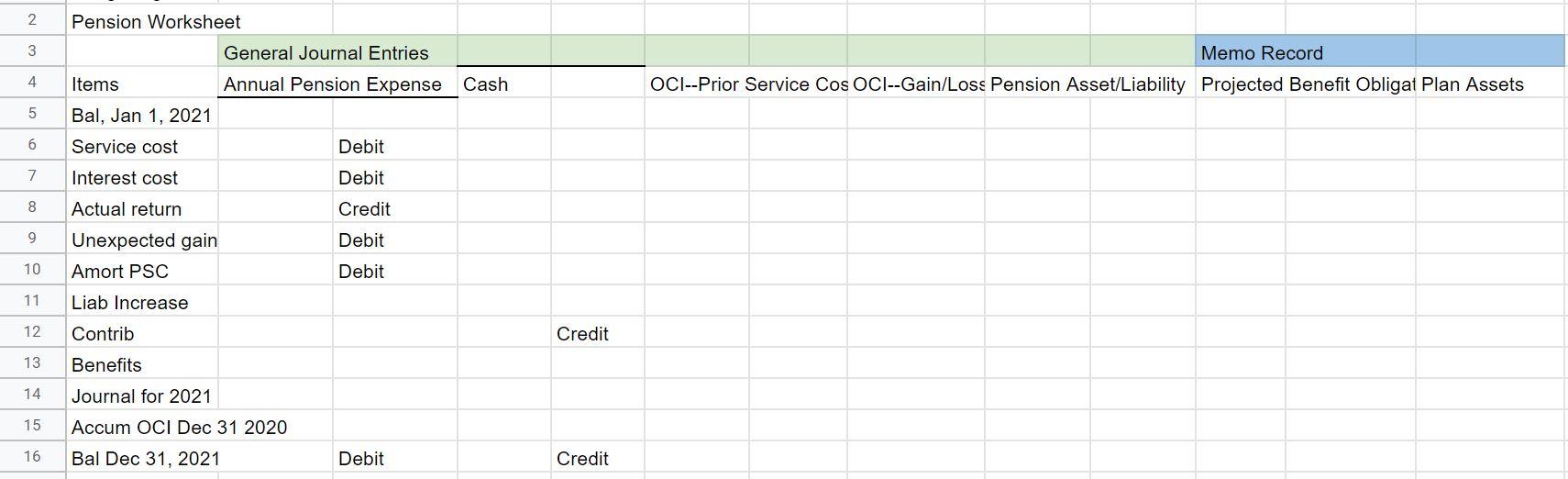

Calculate pension expense for Sunny Inc. in 2011 by filling in the pension worksheet:

2 3 Memo Record OCI--Prior Service Cos OCI--Gain/Loss Pension Asset/Liability Projected Benefit Obligat Plan Assets 4 Cash 5 6 Pension Worksheet General Journal Entries Items Annual Pension Expense Bal, Jan 1, 2021 Service cost Debit Interest cost Debit Actual return Credit Unexpected gain Debit Amort PSC Debit Liab Increase 7 8 9 10 11 12 Contrib Credit 13 Benefits 14 Journal for 2021 15 Accum OCI Dec 31 2020 16 Bal Dec 31, 2021 Debit Credit 2 3 Memo Record OCI--Prior Service Cos OCI--Gain/Loss Pension Asset/Liability Projected Benefit Obligat Plan Assets 4 Cash 5 6 Pension Worksheet General Journal Entries Items Annual Pension Expense Bal, Jan 1, 2021 Service cost Debit Interest cost Debit Actual return Credit Unexpected gain Debit Amort PSC Debit Liab Increase 7 8 9 10 11 12 Contrib Credit 13 Benefits 14 Journal for 2021 15 Accum OCI Dec 31 2020 16 Bal Dec 31, 2021 Debit Credit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts