Question: Please complete in the fields provided. Also include any calculations. Thank you in advance. On January 1, 2021, the capital balances in Ivanhoe Partnership are

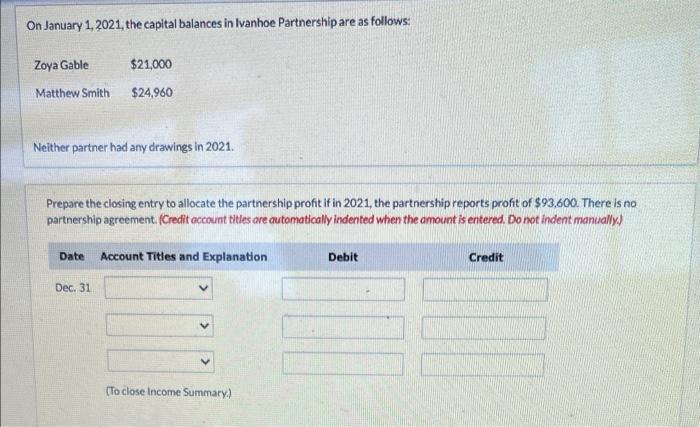

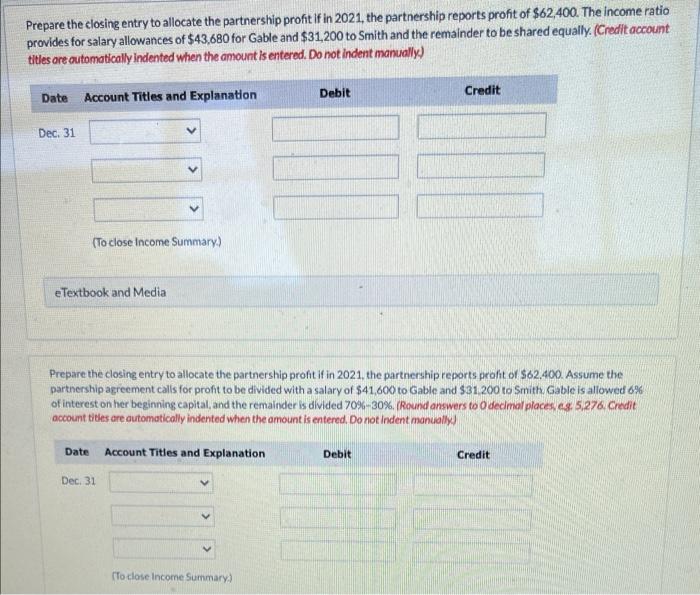

On January 1, 2021, the capital balances in Ivanhoe Partnership are as follows: Neither partner had any drawings in 2021. Prepare the closing entry to allocate the partnership profit if in 2021 , the partnership reports profit of $93,600. There is no partnership agreement. (Credit occount titles are automatically indented when the amount is entered. Do not indent manually.) Prepare the closing entry to allocate the partnership profit if in 2021 , the partnership reports profit of \$62,400. The income ratio provides for salary allowances of $43,680 for Gable and $31,200 to Smith and the remainder to be shared equally. (Credit occount titles are outomatically indented when the amount is entered. Do not indent manually) Prepare the closing entry to allocate the partnership profit if in 2021, the partnership reports profit of $62,400. Assume the partnership agreement calls for profit to be divided with a salary of $41,600 to 6 able and $31.200 to $ mith. 6able is allowed 6% : of interest on her beginning capital, and the remainder is divided 70%,30%. (Round answers to O decimal places. es. 5,276, Credit account tites are dutomatically indented when the amount is entered. Do not indent manually

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts