Question: Please complete in the fields provided. Also include any calculations. Thank you in advance. On January 1, 2021, the ledger of Ivanhoe Company contains the

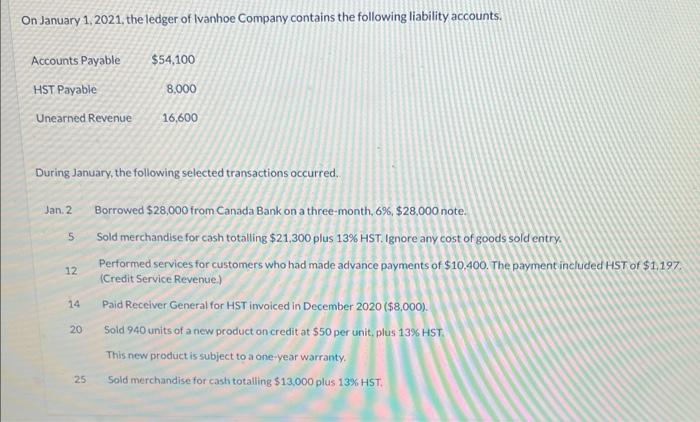

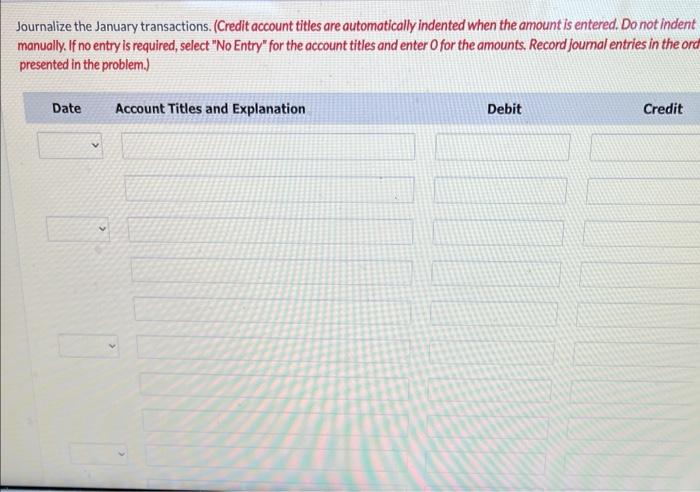

On January 1, 2021, the ledger of Ivanhoe Company contains the following liability accounts. During January, the following selected transactions occurred. Jan. 2 Borrowed $28,000 from Canada Bank on a three-month, 6%,$28,000 note. 5 Sold merchandise for cash totalling $21,300 plus 13% HST. Ignore any cost of goods sold entry. 12 Performed services for customers who had made advance payments of $10,400. The payment included HST of $1,197. (Credit Service Revenue) 14 Paid Receiver General for HST invoiced in December 2020($8,000). 20 Sold 940 units of a new product on credit at $50 per unit, plus 13% HST. This new product is subject to a one-year warranty. 25 Sold merchandise for cash totalling $13,000 plus 13% HST, Journalize the January transactions. (Credit account titles are outomatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. Record joumal entries in the ora presented in the problem.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts