Question: Please complete in the formats and fields provided. Thank you in advance. A local company has just approached a venture capitalist for financing to develop

Please complete in the formats and fields provided. Thank you in advance.

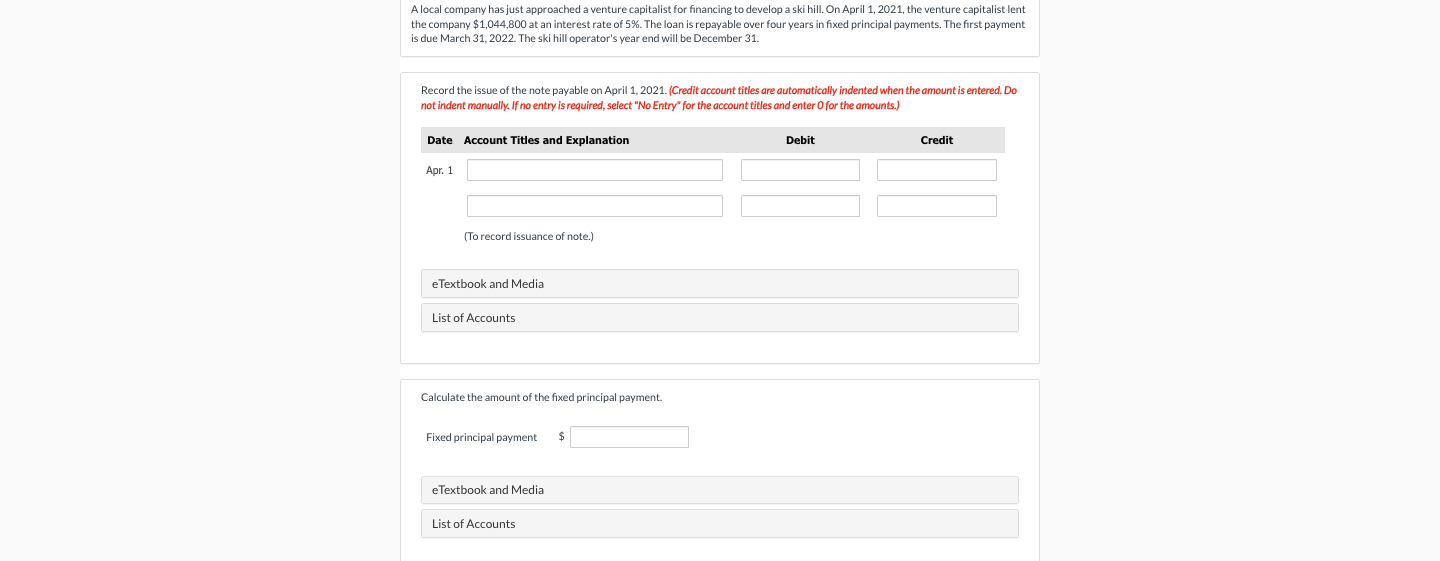

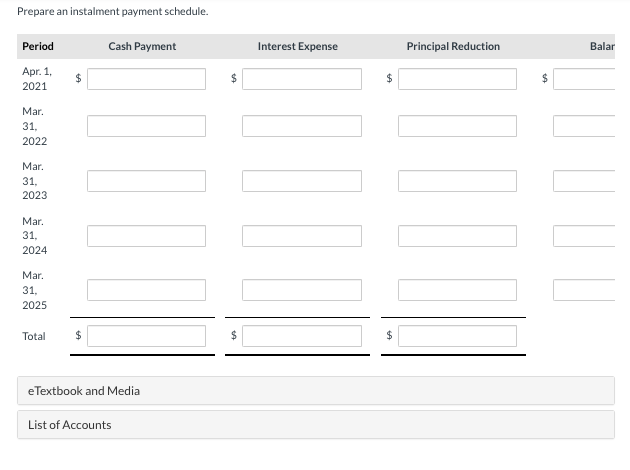

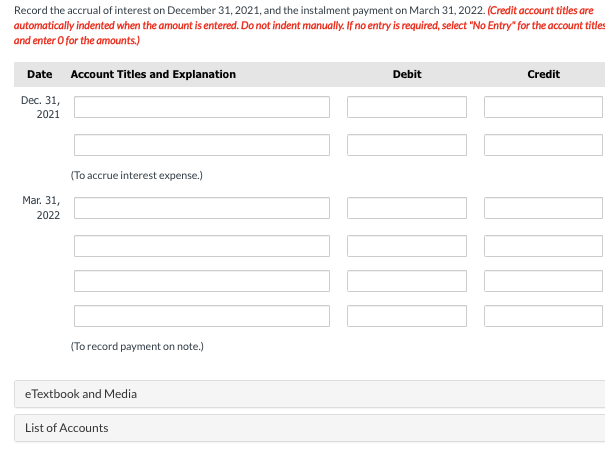

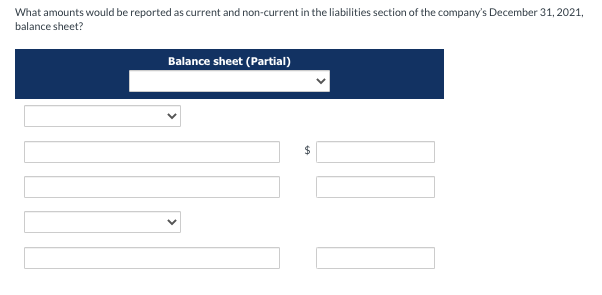

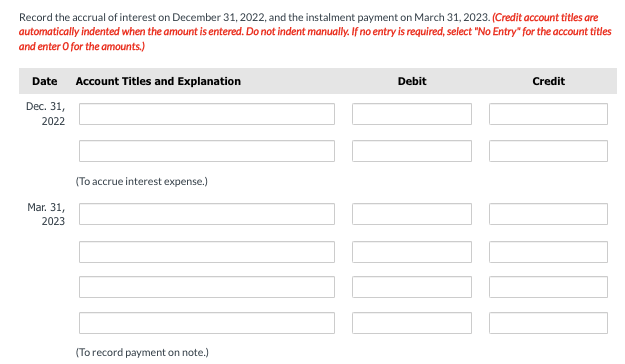

A local company has just approached a venture capitalist for financing to develop a ski hill. On April 1, 2021, the venture capitalist lent the company $1,044,800 at an interest rate of 5%. The loan is repayable over four years in fixed principal payments. The first payment is due March 31, 2022. The ski hill operator's year end will be December 31. Record the issue of the note payable on April 1, 2021. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry for the account titles and enter for the amounts.) Date Account Titles and Explanation Debit Credit Apr. 1 (To record issuance of note.) e Textbook and Media List of Accounts Calculate the amount of the fixed principal payment. Fixed principal payment $ e Textbook and Media List of Accounts Prepare an instalment payment schedule. Period Cash Payment Interest Expense Principal Reduction Balar Apr. 1. 2021 $ $ $ Mar. 31. 2022 Mar. 31, 2023 Mar. 31, 2024 Mar. 31. 2025 Total $ $ $ eTextbook and Media List of Accounts Record the accrual of interest on December 31, 2021, and the instalment payment on March 31, 2022. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter for the amounts.) Debit Credit Date Account Titles and Explanation Dec. 31, 2021 (To accrue interest expense.) Mar. 31, 2022 (To record payment on note.) e Textbook and Media List of Accounts What amounts would be reported as current and non-current in the liabilities section of the company's December 31, 2021, balance sheet? Balance sheet (Partial) $ Record the accrual of interest on December 31, 2022, and the instalment payment on March 31, 2023. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter for the amounts.) Debit Credit Date Account Titles and Explanation Dec 31, 2022 (To accrue interest expense.) Mar. 31, 2023 (To record payment on note.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts