Question: Your first assignment in your new position as assistant financial analyst at Caledonis Products is to evaluate two now captal-budgoting proposals, Bccause this is your

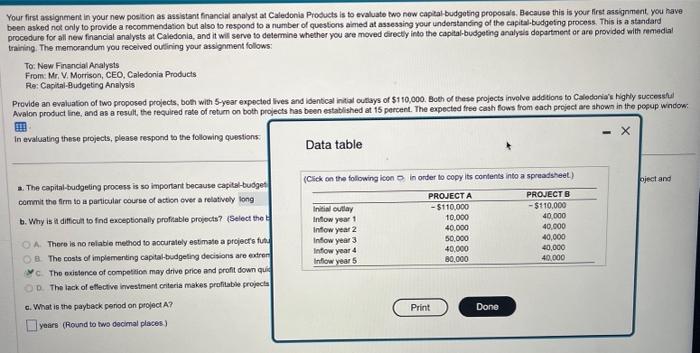

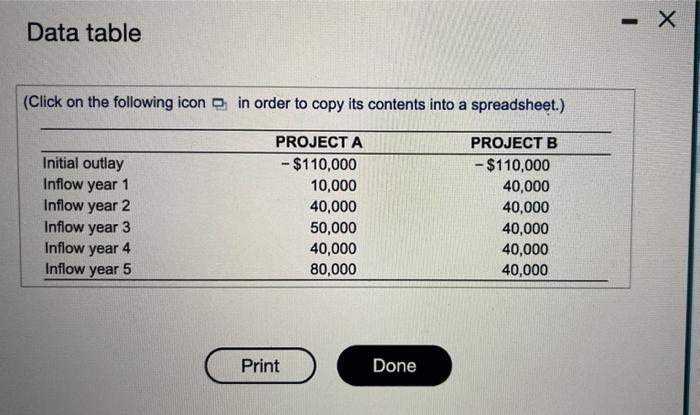

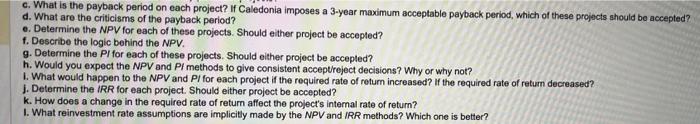

Your first assignment in your new position as assistant financial analyst at Caledonis Products is to evaluate two now captal-budgoting proposals, Bccause this is your first assignment, you have been asked nol only to provide a recommendation but also to respond to a number of questons aimed at assessing your understonding of the capitallbudgeting process. This is a standard procedure for all new fnsncial analysts at Caledonia, and it wils serve to determine whether you are moved directy inte the capital budooting analyals dopartnent or are provided with renedial training. The memorandum you received outining your assignment follows: To. New Finsncial Analysts Frome Mr. V. Morrison, CEO, Caledonia Products Re: Cacital-Budgeting Analysis Provide an evaluation of two proposed projects, both with 5-year expected lives and identical intal outays of $110,000. Boch of these projects involve addtions to Calodoria's highly suscesshil Avalon product line, and as a result, the required rate of return on both projects has been established at 15 percent. The eapected free cash fows trom each project are ahown in the posup window. In evaluating these projects, please respond to the following questions: Data table a. The capital-budgeting process is so important because capits-budget (Cick on the following icon D in order to copy its contents into a spreadsheet) corrmit the firm to a particular course of action over a relativoly b. Why is it difficunt to find exceptionally profiable projects? (Select the of Thore is no relable mehod to acouralely estimate a projects funt 8. The costs of implementing captalbudgeting decisions are extren c. The exislence of competticon may ditive price and profit down quic 10. The lack of eflective investment criteria makes profliabie projects What is the payback penod on project A? years (Round to two decimal places) c. What is the paryback period on each project? If Caledonia imposes a 3-year maximum acceptable payback period, which of these projects ahould be accepted? d. What are the criticisms of the payback period? e. Determine the NPV for each of these projects. Should either project be accepted? f. Describe the logic behind the NPV. 9. Determine the PI for each of these projects. Should either project be accepted? h. Would you expect the NPV and Pi methods to give consistent acceptreject decisions? Why or why not? 1. What would happen to the NPV and PI for each project if the required rate of retum increased? If the required rate of return decreased? 1. Determine the IRR for each project. Should either project be accepted? k. How does a change in the required rate of return affect the project's internal rate of return? I. What reinvestment rate assumptions are implicilly made by the NPV and IRR methods? Which one is better? You first assignment in your now position as assistant financial analyst at Caledonia Products is to evaluoto two new captal.budgeting proposals. Because this is your first assignment, you have been asked not only to provide a recommendation but alco to respond to a number of questions aimed at assessing your understanding of the capitalbudgoting process. This is a standard procedure for all new financial analysts at Caledonia, and it will serve to determino whether you are moved olrecty into the capital-budgeting analysis department or are providod with ramecial traing. The memorandum you received outlining your assignment foliows: To. Now Financial Analysts From: Mr. V, Mortison, CEO, Caledonla Products Re: Capital-Budgeting Analysis Provide an evaluation of two proposed projects, both with 5 -year expected lives and identical initial outlays of 5110,000 . Both of these projects involve adcitions to Caledonla's highly successtit Avalon product ine, and as a result, the required rate of return on both projects has been estabished at 15 percent. The expected froe cash tows from each project are shown in beo popup windon In evaluating these projects, please respond to the following questions: Data table (Click on the following icon in order to copy its contents into a spreadsheet.) c. What is the payback period on each project? If Caledonia imposes a 3-year maximum acceptable payback period, which of these projects should be accepted? d. What are the criticisms of the payback period? e. Determine the NPV for each of these projects. Should either project be accepted? f. Describe the logic behind the NPV. 9. Determine the PI for each of these projects. Should either project be accepled? h. Would you expect the NPV and Pf methods to give consistent acceptreject decisions? Why or why not? 1. What would happen to the NPV and PI for each project if the required rate of retum increased? If the required rate of return decreased? j. Determine the IRR for each project. Should either project be accepted? k. How does a change in the required rate of return affect the project's internal rate of return? I. What reinvestment rate assumptions are implicitly made by the NPV and IRR methods? Which one is better

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts