Question: Please complete missing information. Will rate highly for complete and correct. Required information [The following information applies to the questions displayed below.] On January 1,

![information [The following information applies to the questions displayed below.] On January](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/10/66fbbc336a48a_74666fbbc330057a.jpg) Please complete missing information. Will rate highly for complete and correct.

Please complete missing information. Will rate highly for complete and correct.

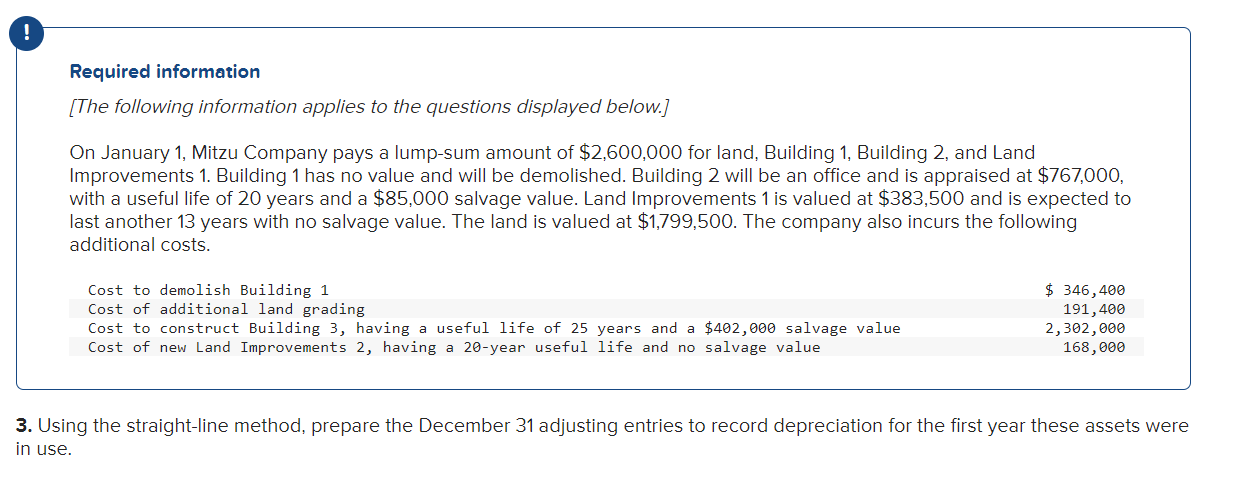

Required information [The following information applies to the questions displayed below.] On January 1, Mitzu Company pays a lump-sum amount of $2,600,000 for land, Building 1 , Building 2, and Land Improvements 1 . Building 1 has no value and will be demolished. Building 2 will be an office and is appraised at $767,000, with a useful life of 20 years and a $85,000 salvage value. Land Improvements 1 is valued at $383,500 and is expected to last another 13 years with no salvage value. The land is valued at $1,799,500. The company also incurs the following additional costs. Cost to demolish Building 1 Cost of additional land grading Cost to construct Building 3, having a useful life of 25 years and a $402,000 salvage value Cost of new Land Improvements 2, having a 20-year useful life and no salvage value . Using the straight-line method, prepare the December 31 adjusting entries to record depreciation for the first year these assets were use. View transaction list View journal entry worksheet

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts