Question: Please complete missing information. Will rate highly for complete and correct. Required information [The following information applies to the questions displayed below.] On July 23

![information [The following information applies to the questions displayed below.] On July](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/10/66fbca2d73a39_32566fbca2d1104b.jpg)

Please complete missing information. Will rate highly for complete and correct.

Please complete missing information. Will rate highly for complete and correct.

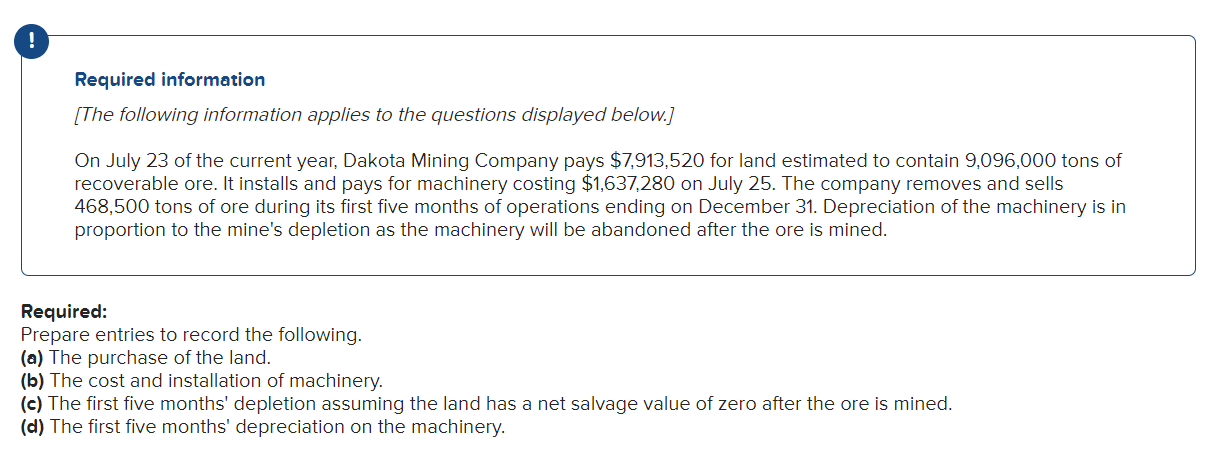

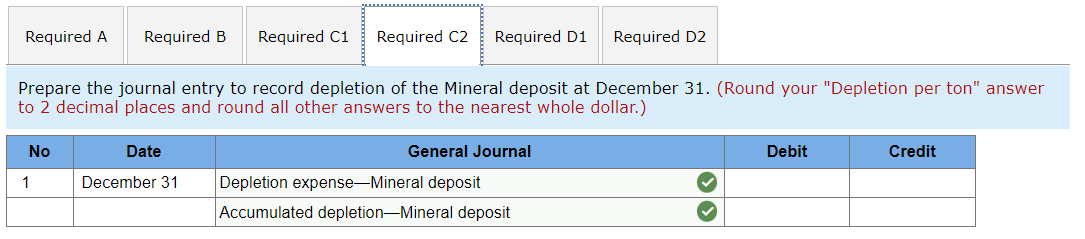

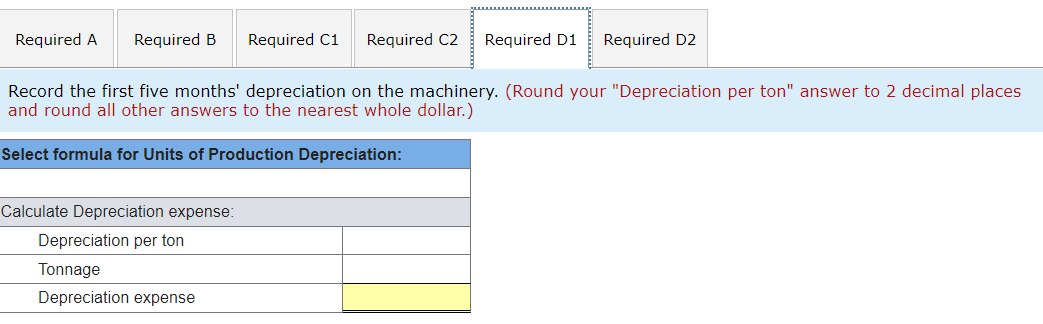

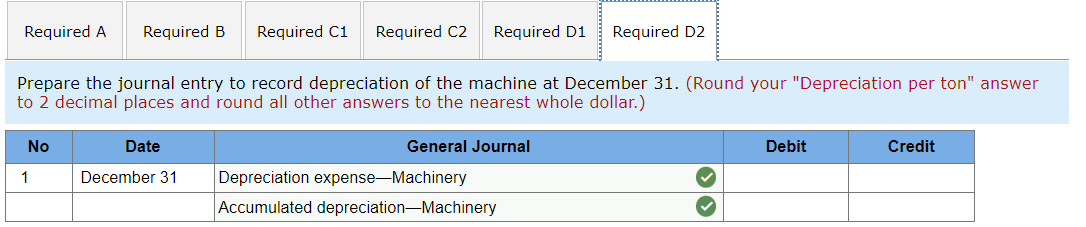

Required information [The following information applies to the questions displayed below.] On July 23 of the current year, Dakota Mining Company pays $7,913,520 for land estimated to contain 9,096,000 tons of recoverable ore. It installs and pays for machinery costing $1,637,280 on July 25 . The company removes and sells 468,500 tons of ore during its first five months of operations ending on December 31 . Depreciation in of the mach in proportion to the mine's depletion as the machinery will be abandoned after the ore is mined. Required: Prepare entries to record the following. (a) The purchase of the land. (b) The cost and installation of machinery. (c) The first five months' depletion assuming the land has a net salvage value of zero after the ore is mined. (d) The first five months' depreciation on the machinery. Record the first five months' depletion assuming the land has a net salvage value of zero after the ore is mined. (Round your Depletion per ton" answer to 2 decimal places and round all other answers to the nearest whole dollar.) Prepare the journal entry to record depletion of the Mineral deposit at December 31 . (Round your "Depletion per ton" answe to 2 decimal places and round all other answers to the nearest whole dollar.) Record the first five months' depreciation on the machinery. (Round your "Depreciation per ton" answer to 2 decimal places and round all other answers to the nearest whole dollar.) Prepare the journal entry to record depreciation of the machine at December 31 . (Round your "Depreciation per ton" ans to 2 decimal places and round all other answers to the nearest whole dollar.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts