Question: (PLEASE COMPLETE PART 1 ,2,3) USE THE FORM PROVIDED PLEASE part A part B part C - Based on the facts below, prepare for Shelli

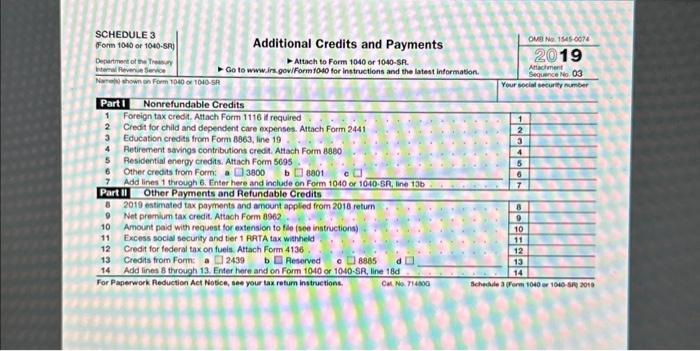

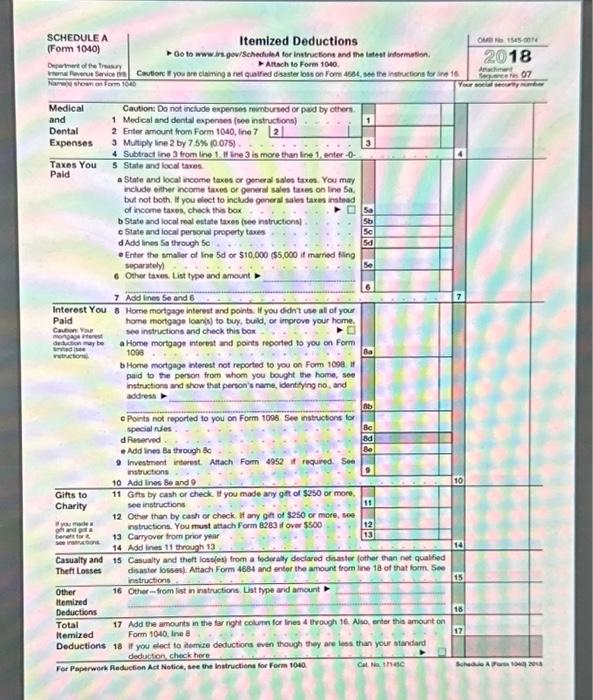

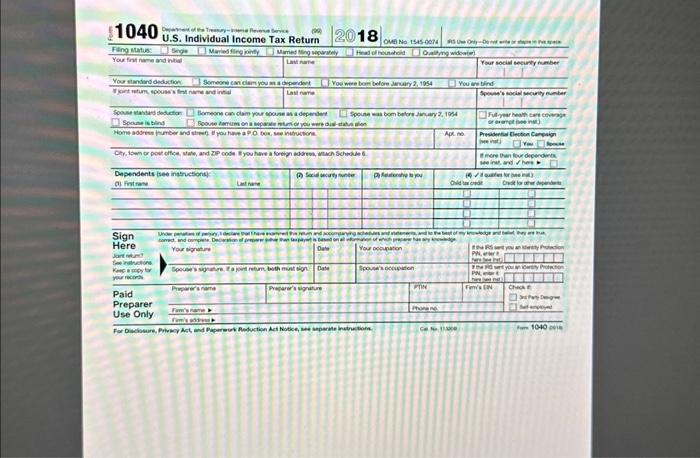

- Based on the facts below, prepare for Shelli Thomson her US (federal) individual income tax return (Form 1040), her Schedule A (Itemized Deductions), Schedule 3 (Additional Credits and Payments). 1. Shelli Thomson works as a chemist for Sargent Chemical Corp. 2. Shelli Thomson's a. Birthday is January 1,1970 ; b. Social Security number is 111-11-1113; c. Address is 7605 Walnut Street, Los Angeles, CA 90013 ; d. Tax return filing status is single; and e. Her ordinary income tax rate is 10%. 3. For line 11 of the Form 1040, multiply the total amount of income you entered on line 10 of the Form 1040 by 10% (Shelli's income tax rate) and enter that amount on line 11 . 4. For the taxable year, Shelli: 2. Earned $50,000 in wages as a chemist b. Her employer, Sargent Chemical Corp, did not withhold federal and state income taxes; c. Received $200 of interest on her savings bank account; d. Paid $7,000 in out-of-pocket medical expenses including co-pays for prescription drugs and doctor appointments: c. Paid property (real estate) taxes of $5,000 to the city of Los Angeles; f. Paid $10,000 in home mortgage interest on her home mortgage. Her mortgage was $100,000 and was secured by her home: g. Incurred a $2,000 theft loss: h. Incurred a $3,000 easualty loss after her home was damaged by a tomado in a federally declared disaster area; i. Donated $200 in cash to a tax-exempt charity; and j. Can claim a 5500 American Opportunity Credit. - Based on the facts below, prepare for Shelli Thomson her US (federal) individual income tax return (Form 1040), her Schedule A (Itemized Deductions), Schedule 3 (Additional Credits and Payments). 1. Shelli Thomson works as a chemist for Sargent Chemical Corp. 2. Shelli Thomson's a. Birthday is January 1,1970 ; b. Social Security number is 111-11-1113; c. Address is 7605 Walnut Street, Los Angeles, CA 90013 ; d. Tax return filing status is single; and e. Her ordinary income tax rate is 10%. 3. For line 11 of the Form 1040, multiply the total amount of income you entered on line 10 of the Form 1040 by 10% (Shelli's income tax rate) and enter that amount on line 11 . 4. For the taxable year, Shelli: 2. Earned $50,000 in wages as a chemist b. Her employer, Sargent Chemical Corp, did not withhold federal and state income taxes; c. Received $200 of interest on her savings bank account; d. Paid $7,000 in out-of-pocket medical expenses including co-pays for prescription drugs and doctor appointments: c. Paid property (real estate) taxes of $5,000 to the city of Los Angeles; f. Paid $10,000 in home mortgage interest on her home mortgage. Her mortgage was $100,000 and was secured by her home: g. Incurred a $2,000 theft loss: h. Incurred a $3,000 easualty loss after her home was damaged by a tomado in a federally declared disaster area; i. Donated $200 in cash to a tax-exempt charity; and j. Can claim a 5500 American Opportunity Credit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts