Question: (PLEASE COMPLETE PART 1,2,3 USE THE FORMS PROVIDED PLEASE ) part 1 part 2 part 3 - Based on the facts below, prepare for Shelli

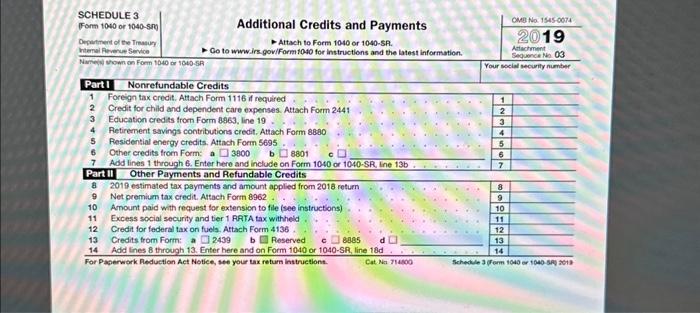

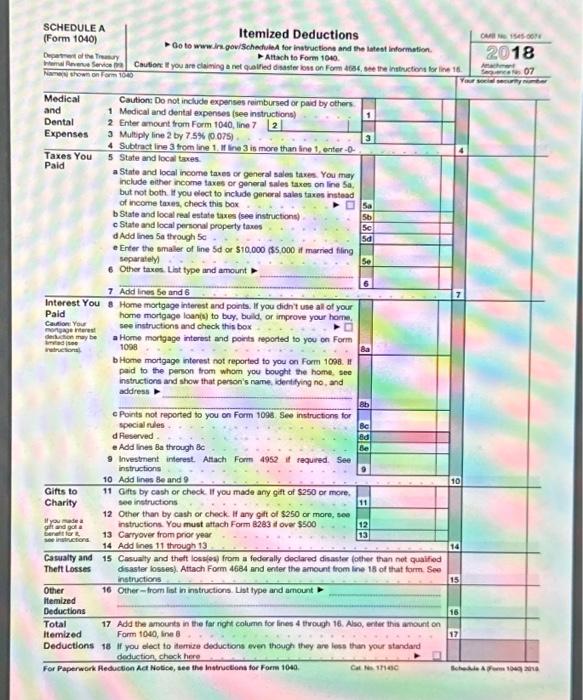

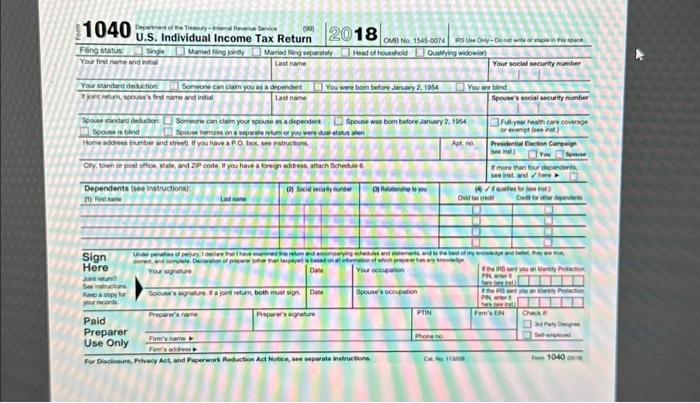

- Based on the facts below, prepare for Shelli Thomson her US (federal) individual income tax return (Form 1040), her Schedule A (Itemized Deductions), Schedule 3 (Additional Credits and Payments). 2. Shelli Thomson's a. Birthday is January 1,1970 ; b. Social Security number is 111-11-1113; c. Address is 7605 Walnut Street, Los Angeles, CA 90013 ; d. Tax return filing status is single; and c. Her ordinary income tax rate is 10%. 3. For line 11 of the Form 1040, multiply the total amount of income you entered on line 10 of the Form 1040 by 10% (Shelli's income tax rate) and enter that amount on line 11. 4. For the taxable year, Shelli: a. Earned $50,000 in wages as a chemist b. Her employer, Sargent Chemical Corp, did not withhold federal and state income taxes: c. Received $200 of interest on her savings bank account; d. Paid 57,000 in out-of-pocket medical expenses including co-pays for prescription drugs and doctor appointments; e. Paid property (real estate) taxes of $5,000 to the city of Los Angeles; f. Paid $10,000 in home mortgage interest on her home mortgage. Her mortgage was $100,000 and was secured by her home: g. Incurred a $2,000 theft loss: h. Incurred a $3,000 casualty loss after her home was damaged by a tornado in a federally declared disaster area; i. Donated $200 in cash to a tax-exempt charity; and j. Can claim a $500 American Opportunity Credit. SCHEDULE 3 FFon 1040 or 10405n Oepatment of the Treatury hemenal Aeverus Service Additional Credits and Payments - Attach to Form 1040 or 1040-5A. Co to wwwirs. goviForm 1040 for instructions and the latest information. Your social securlly number Part I Nonrefundable Credits 1 Foreign tax credit. Attach Form 1116 if required 2 Credit for child and dependent care expenses. Attach Form 2441 3 Education credits trom Form 8963, line 19 4 Aetirement savings contributions credit. Attach Form 8880 5 Pesidential energy credits. Attach Form 5695 6 Other credits from Form: a 3800 b 801 o 7 Add lines 1 through 6 . Enter here and include on form 1040 or 1040-SR, Ine 13b \begin{tabular}{|l|} \hline 1 \\ \hline 2 \\ \hline 3 \\ \hline 4 \\ \hline 5 \\ \hline 6 \\ \hline 7 \\ \hline \end{tabular} Part iI Other Payments and Refundable Credits 8 2019 estimated tax payments and amount applied from 2016 retum 9 Net premium tax credit. Attach Form 8962 . 10 Amount paid with request for extension to file (see instructions) 11 Excess social security and tier 1 AATA tax withheid 12 Credi for federal tax on fuels. Attach Form 4136 . 13 Credits from Form: a 2439 b Peserved c G888 d [ 14 Add lines 8 through 13. Enter here and on Form 1040 or 1040-SP, line 18d \begin{tabular}{|c|} \hline 8 \\ \hline 9 \\ \hline 10 \\ \hline 11 \\ \hline 12 \\ \hline 13 \\ \hline 14 \\ \hline \end{tabular} For Paperwark Aeduction Act Notice, ste your tax return linttructiont. Cat Nia Tlasoo Sichedile 3 (rerm 1040 ar t640 spy a613 SCHEDULE A (Form 1040) Itemized Deductions Oo to wav lin-gowischeduleA for instructiont and the latest information. P Athach to Form 1040 Caution if you are claining a net qualfied disaster kost on Fonm a6s4, bee the insteuctons for line is. 7 Add lines 5e and 6 Interest You 8 Home mortgage interest and points. If you didn't use all of your Paid Cadulion Your deri. itich mayy be lerthd fise home mortgage loan(0) to buy, buld, or improve your home. see instructions and check this box a Horne mortgage interest and pointe reported to you on Form 1096 b Home mortgage interest not reported to you on Form 1096. If paid to the person trom whom you bought the home, see instructions and show that person's name, identifying no, and address o c Points not reported to you on Form 1096. See instructons for special nules d Feserved e Add lnes Ba through BC 9 Investment interest. Attach Form 4952 if required. See instructions 10 Add lines 8 and 9 Gifts to 11 Gifts by cash or check. It you made any gitt of $250 or more. Charity see instructions 12 Other than by cash or check. If any git of $250 cr more, soe instructions. You must attach Form 8283 it over $500 H1 you made a ifrend got seneritarctors 13 Caryyover from pror year 14 Add lines 11 through 13

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts