Question: please complete question 7-9 Question 7 Stocks offer an expected rate of return of 18%, with a standard deviation of 22% Gold offers an expected

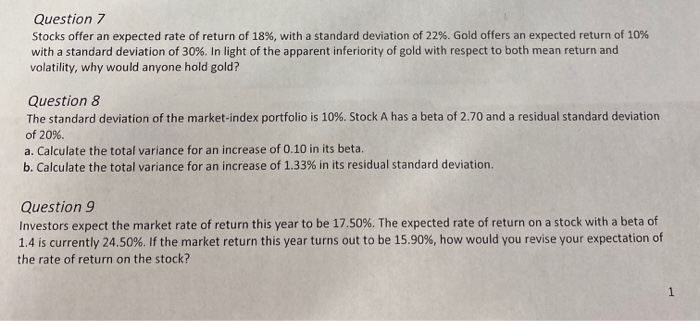

Question 7 Stocks offer an expected rate of return of 18%, with a standard deviation of 22% Gold offers an expected return of 10% with a standard deviation of 30%. In light of the apparent inferiority of gold with respect to both mean return and volatility, why would anyone hold gold? Question 8 The standard deviation of the market-index portfolio is 10%. Stock A has a beta of 2.70 and a residual standard deviation of 20% a. Calculate the total variance for an increase of 0.10 in its beta b. Calculate the total variance for an increase of 1.33% in its residual standard deviation. Question 9 Investors expect the market rate of return this year to be 17.50%. The expected rate of return on a stock with a beta of 1.4 is currently 24.50%. If the market return this year turns out to be 15.90%, how would you revise your expectation of the rate of return on the stock

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts