Question: Please complete question G through excel and show how you found your answers, thank you - BOND VALUATION Clifford Clark is a recent retiree who

Please complete question G through excel and show how you found your answers, thank you

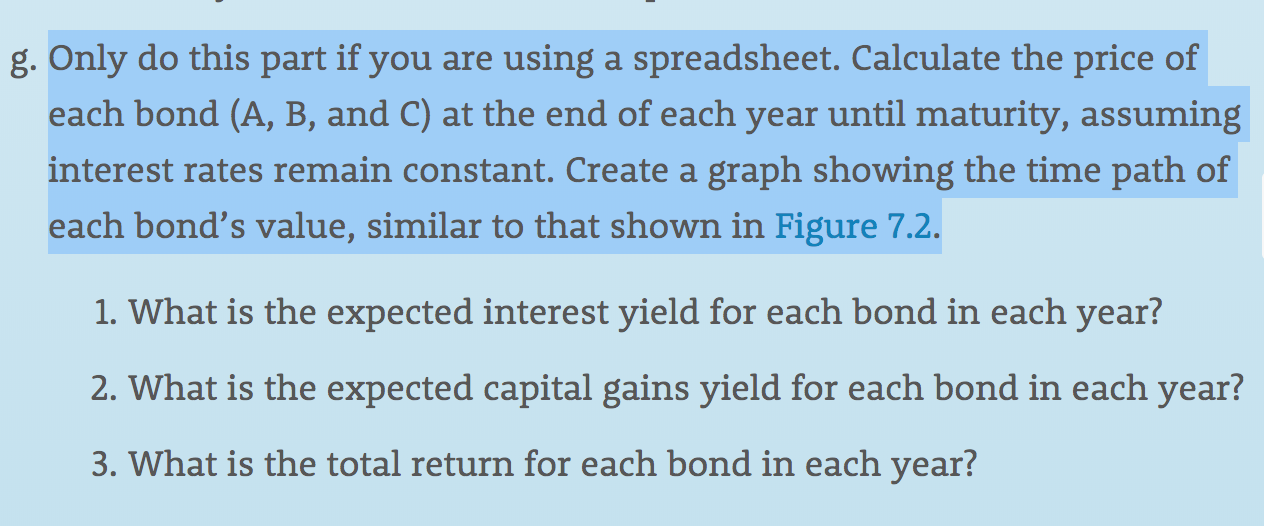

- BOND VALUATION Clifford Clark is a recent retiree who is interested in investing some of his savings in corporate bonds. His financial planner has suggested the following bonds: Bond A has a 7% annual coupon, matures in 12 years, and has a $1,000 face value. Bond B has a 9% annual coupon, matures in 12 years, and has a $1,000 face value. Bond C has an 11% annual coupon, matures in 12 years, and has a $1,000 face value. Each bond has a yield to maturity of 9%. g. Only do this part if you are using a spreadsheet. Calculate the price of each bond (A, B, and C) at the end of each year until maturity, assuming interest rates remain constant. Create a graph showing the time path of each bond's value, similar to that shown in Figure 7.2. 1. What is the expected interest yield for each bond in each year? 2. What is the expected capital gains yield for each bond in each year? 3. What is the total return for each bond in each year? - BOND VALUATION Clifford Clark is a recent retiree who is interested in investing some of his savings in corporate bonds. His financial planner has suggested the following bonds: Bond A has a 7% annual coupon, matures in 12 years, and has a $1,000 face value. Bond B has a 9% annual coupon, matures in 12 years, and has a $1,000 face value. Bond C has an 11% annual coupon, matures in 12 years, and has a $1,000 face value. Each bond has a yield to maturity of 9%. g. Only do this part if you are using a spreadsheet. Calculate the price of each bond (A, B, and C) at the end of each year until maturity, assuming interest rates remain constant. Create a graph showing the time path of each bond's value, similar to that shown in Figure 7.2. 1. What is the expected interest yield for each bond in each year? 2. What is the expected capital gains yield for each bond in each year? 3. What is the total return for each bond in each year

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts