Question: please complete questions 3-5 as I completed the first two and confused on the rest. please show all work and please complete the problem! thanks!!

please complete questions 3-5 as I completed the first two and confused on the rest. please show all work and please complete the problem! thanks!!

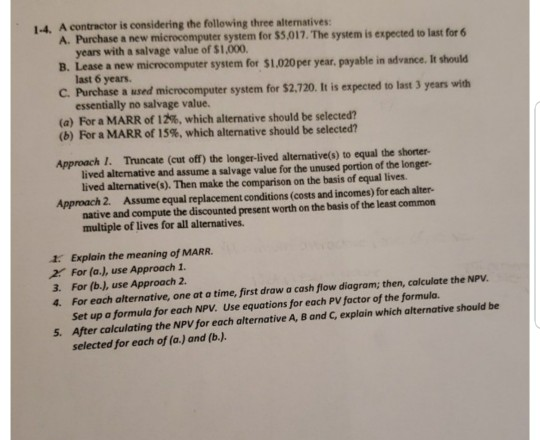

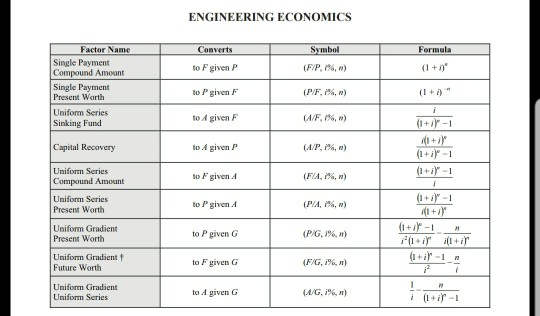

1-4. A contractor is considering the following three alternatives: A. Purchase a new microcomputer system for $5,017. The system is expected to last for 6 years with a salvage value of $1,000 last 6 years. essentially no salvage value. B. Lease a new microcomputer system for $1.020per year. payable in advance. It should C. Purchase a used microcomputer system for $2,720. It is expected to last 3 years with (a) For a MARR of 2%, which alternative should be selected? (b) For a MARR of 15%, which alternative should be selected? Approach 1. Truncate (cut off) the longer-lived altermative(s) to equal the shorter lived alternative and assume a salvage value for the unused portion of the longer- lived alternative(s). Then make the comparison on the basis of equal lives. Approach 2. Assume equal replacement conditions (costs and incomes) for each alter- native and compute the discounted present worth on the basis of the least common multiple of lives for all alternatives. 1. Explain the meaning of MARR. 2 For (a.), use Approach 1 3. For (b.), use Approach 2 4. For each alternative, one at a time, first draw a cash flow diagram; then, calculate the NPV. Set up a formula for each NPV. Use equations for each PV factor of the formula. After colculating the NPV for each alternative A, B and C, explain which alternative should be selected for each of (a.) and (b.J 5. ENGINEERING ECONOMICS Factor Name Symbol Formula Converts to F given P to P given F to A given F Single Payment Compound Amount Single Payment (P/F, i%, n) Present Worth Uniform Series Sinking Fund Capital Recovery to A given P to F given A to P given 4 to P given G to F given G Unifom Series Compound Amount Unifom Series Present Worth (F/A, i%, n) (P/A, i%, n) Uniform Gradient Present Worth i+r-1 (P/G,i%, n) Uniform Gradient Future Worth Unifom Gradient Uniform Series to A given G (A/C, i%, n)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts