Question: please complete the case study Case Study Two: A Credit Analyst (CA) for Major Corporate Banking Group (MCBG) is conducting a review of a client's

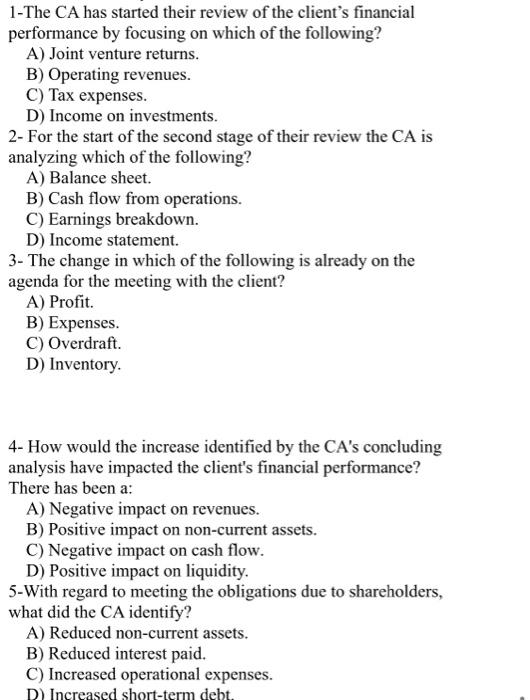

Case Study Two: A Credit Analyst (CA) for Major Corporate Banking Group (MCBG) is conducting a review of a client's latest financial statements. The review is required because the client's facilities are due for renewal and a meeting has already been arranged between the client and the MCBG relationship manager for two weeks' time. The CA has started the review by focusing on the client's 'above the line' performance. For the second stage of the review, the CA begins by investigating the clients share premium account. Having reassured themselves, the CA turns their attention to the client's current assets, which have increased significantly during the financial year. The CA has identified the specific item that has changed but needs to understand why. The item is already on the draft agenda for the upcoming meeting with the client. In concluding the review, the CA is analyzing the cash flow statement and has identified a significant Increase in dividends paid by the client. Because the client did not have sufficient cash resources to cover the dividend payments it needed to take other action to meet these obligations to its shareholders. The CA was also able to identify this in the cash flow statement. 1-The CA has started their review of the client's financial performance by focusing on which of the following? A) Joint venture returns. B) Operating revenues. C) Tax expenses. D) Income on investments. 2- For the start of the second stage of their review the CA is analyzing which of the following? A) Balance sheet. B) Cash flow from operations. C) Earnings breakdown. D) Income statement. 3- The change in which of the following is already on the agenda for the meeting with the client? A) Profit. B) Expenses. C) Overdraft. D) Inventory 4- How would the increase identified by the CA's concluding analysis have impacted the client's financial performance? There has been a: A) Negative impact on revenues. B) Positive impact on non-current assets. C) Negative impact on cash flow. D) Positive impact on liquidity. 5-With regard to meeting the obligations due to shareholders, what did the CA identify? A) Reduced non-current assets. B) Reduced interest paid. C) Increased operational expenses. D) Increased short-term debt

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts