Question: please complete the chart thumbs up will be given a. Equipment with a book value of $82,000 and an original cost of $161,000 was sold

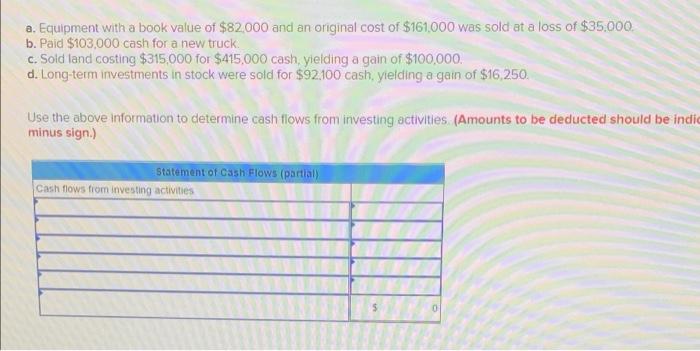

a. Equipment with a book value of $82,000 and an original cost of $161,000 was sold at a loss of $35.000 b. Paid $103,000 cash for a new truck c. Sold land costing $315,000 for $415,000 cash, yielding a gain of $100,000. d. Long-term investments in stock were sold for $92,100 cash, yielding a gain of $16,250. Use the above information to determine cash flows from investing activities (Amounts to be deducted should be indie minus sign) statement of Cash Flows (partial Cash flows from investing activities

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts