Question: Please complete the depreciation for years 2022 and 2023 using rates from 2022 or 2021 if not identifiable. Please also list all computations so I

Please complete the depreciation for years 2022 and 2023 using rates from 2022 or 2021 if not identifiable. Please also list all computations so I may follow along while practicing. Also please take into account 179 Expenses

Thank you so much!

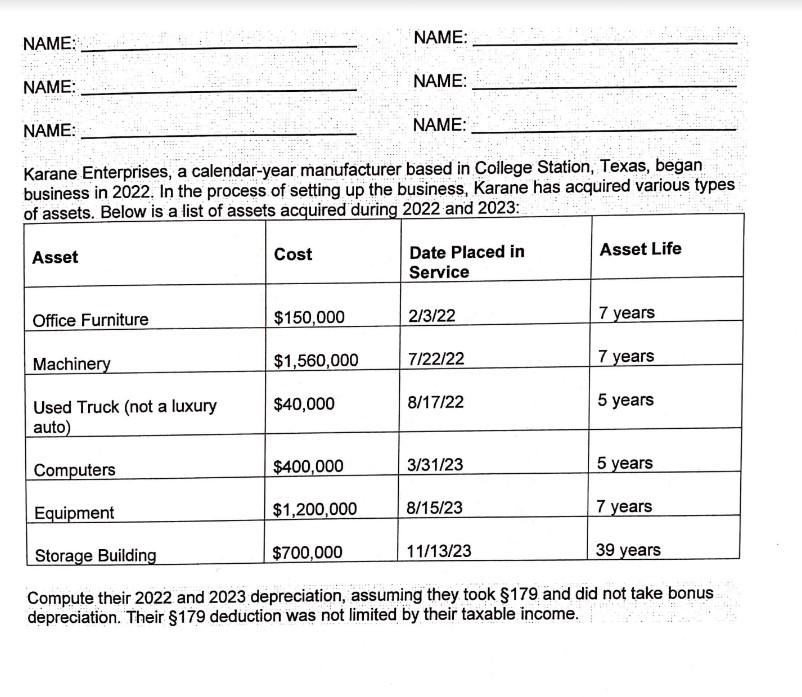

NAME: NAME: NAME: NAME: NAME: NAME: Karane Enterprises, a calendar-year manufacturer based in College Station, Texas, began business in 2022. In the process of setting up the business, Karane has acquired various types af noeste Rolnw is a liet of ascets acrulired durina 2022 and 2023 : Compute their 2022 and 2023 depreciation, assuming they took $179 and did not take bonus depreciation. Their 179 deduction was not limited by their taxable income. NAME: NAME: NAME: NAME: NAME: NAME: Karane Enterprises, a calendar-year manufacturer based in College Station, Texas, began business in 2022. In the process of setting up the business, Karane has acquired various types af noeste Rolnw is a liet of ascets acrulired durina 2022 and 2023 : Compute their 2022 and 2023 depreciation, assuming they took $179 and did not take bonus depreciation. Their 179 deduction was not limited by their taxable income

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts