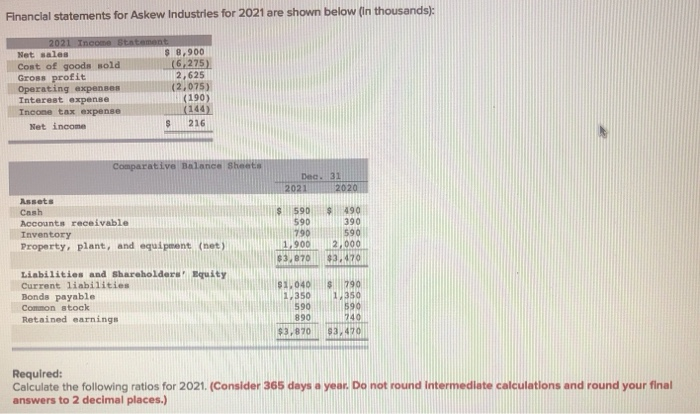

Question: please complete the entire chart. it is one question. i will thumbs up for complete work (complete entire chart) and correct answers :) Financial statements

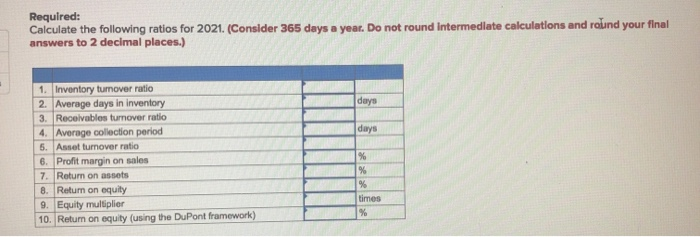

Financial statements for Askew Industries for 2021 are shown below (In thousands): 2021 Income Statement Net salas $ 8,900 Cost of goods sold (6,275) Gross profit 2,625 Operating expenses (2,075) Interest expense (190) Income tax expense (144) Net income s 216 Comparative Balance Sheets Dec. 31 2021 2020 Assets Cash Accounts receivable Inventory Property, plant, and equipment (net) $ 590 590 790 1,900 $3,870 $ 490 390 590 2,000 $3.470 Liabilities and Shareholders' Equity Current liabilities Bonds payable Common stock Retained earnings $1,040 1,350 590 890 $3,870 790 1350 599 740 $3,420 Required: Calculate the following ratios for 2021. (Consider 365 days a year. Do not round intermediate calculations and round your final answers to 2 decimal places.) Required: Calculate the following ratios for 2021. (Consider 365 days a year. Do not round Intermediate calculations and round your final answers to 2 decimal places.) days days 1. Inventory tumover ratio 2. Average days in inventory 3. Receivables turnover ratio 4. Average collection period 5. Asset turnover ratio 6. Profit margin on sales 7. Return on assets 8. Return on equity 9. Equity multiplier 10. Return on equity (using the DuPont framework) % % % times %

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts