Question: Please complete the missing fields and also balance sheet/income statement The current liabilities section of the December 31, 2020, balance sheet of Pharoah Company included

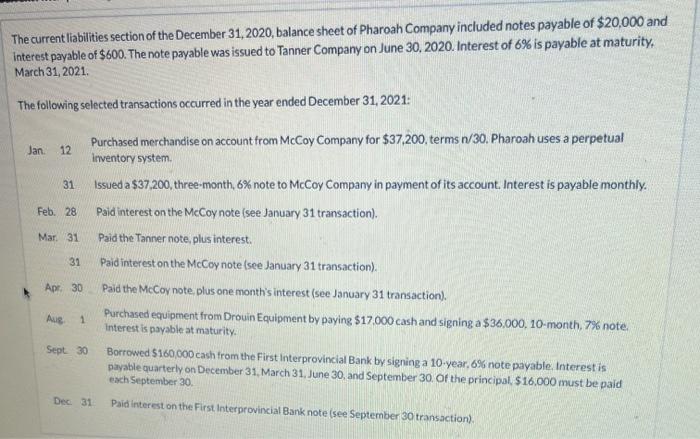

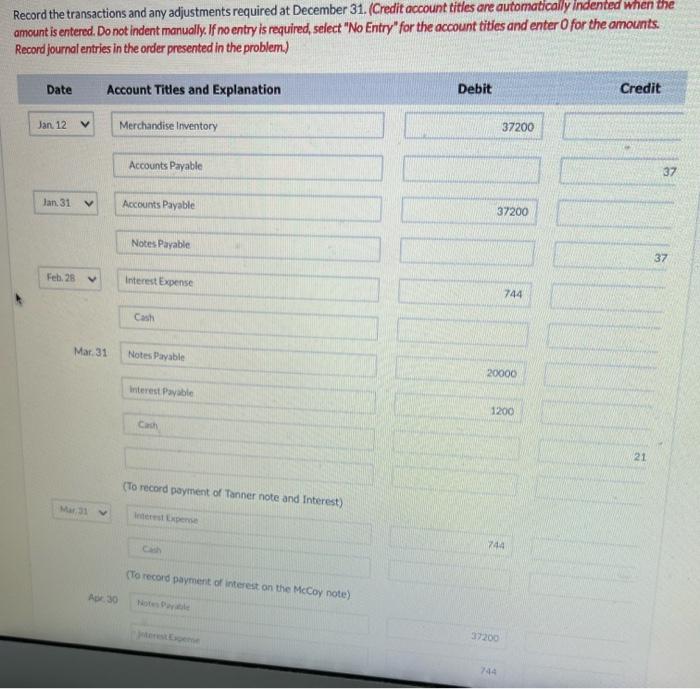

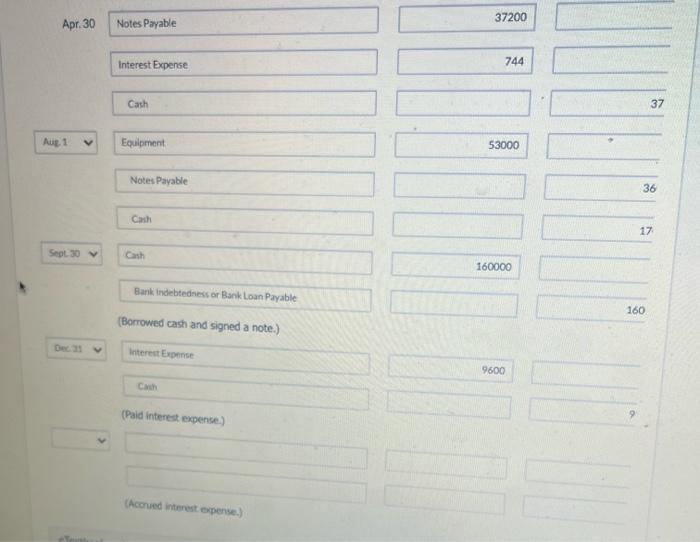

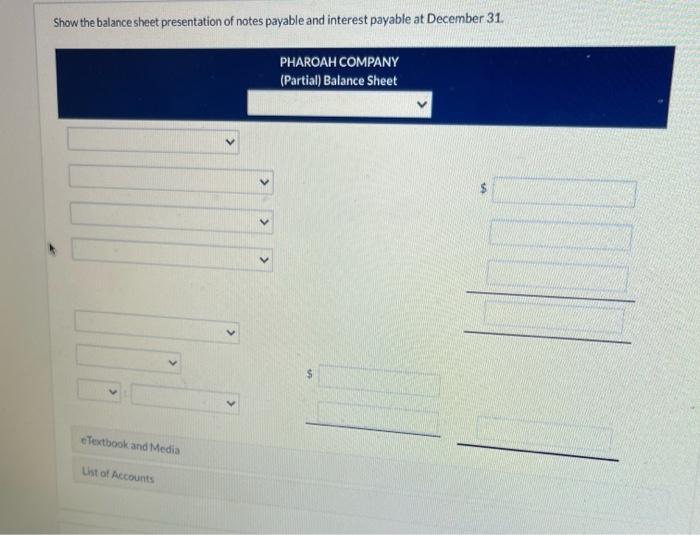

The current liabilities section of the December 31, 2020, balance sheet of Pharoah Company included notes payable of $20,000 and interest payable of $600. The note payable was issued to Tanner Company on June 30, 2020. Interest of 6% is payable at maturity. March 31, 2021 The following selected transactions occurred in the year ended December 31, 2021: Purchased merchandise on account from McCoy Company for $37,200 terms n/30. Pharoah uses a perpetual Jan. 12 Inventory system 31 Issued a $37.200, three-month, 6% note to McCoy Company in payment of its account. Interest is payable monthly. Feb. 28 Paid interest on the McCoy note (see January 31 transaction). Mar 31 Paid the Tanner note, plus interest. 31 Paid interest on the McCoy note (see January 31 transaction). Apr 30 Paid the McCoy note, plus one month's interest (see January 31 transaction). Purchased equipment from Drouin Equipment by paying $17.000 cash and signing a $36,000. 10-month, 7% note. Aug Interest is payable at maturity. Sept 30 Borrowed $160,000 cash from the First Interprovincial Bank by signing a 10 year, 6% note payable Interest is payable quarterly on December 31, March 31, June 30, and September 30. Of the principal $16,000 must be paid each September 30 Dec 31 Paid interest on the First Interprovincial Banknote (see September 30 transaction) 8 1 Record the transactions and any adjustments required at December 31. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry"for the account titles and enter for the amounts. Record journal entries in the order presented in the problem.) Date Account Titles and Explanation Debit Credit Jan 12 Merchandise Inventory 37200 Accounts Payable 37 Jan. 31 Interest Expense 744 Cash Mar 31 Notes Payable 20000 Interest Payable 1200 Cash 21 (To record payment of Tanner note and Interest) Mar Expert 7:44 (To record payment of interest on the McCoy note) A 30 Notes 37200 744 37200 Apr. 30 Notes Payable Interest Expense 744 Cath 37 Aug 1 Equipment 53000 Notes Payable 36 Cach 17 Sept 30 Cash 160000 Bank indebtedness or Bank Loan Payable 160 (Borrowed cash and signed a note.) Interest Expense 9600 Cash (Paid interest expense) Accrued interest expense.) Show the balance sheet presentation of notes payable and interest payable at December 31. PHAROAH COMPANY (Partial) Balance Sheet $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts