Question: please solve using excel format Fle Home Vs incent Page Layout Formula . . Data Review Velo - X Calibri Coments 11 A A A-

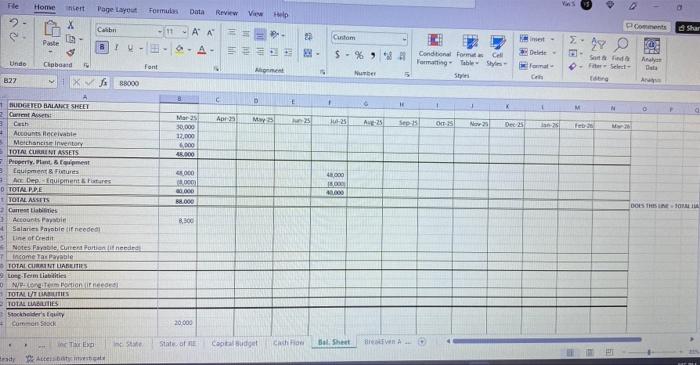

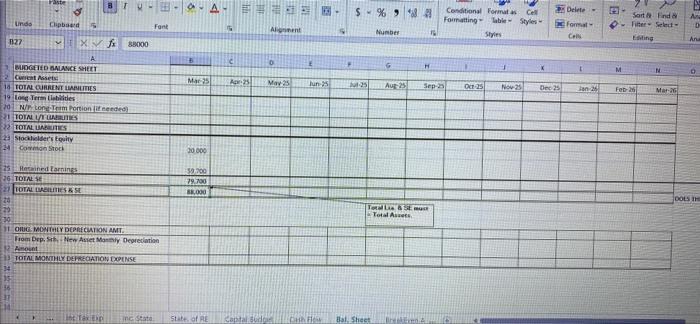

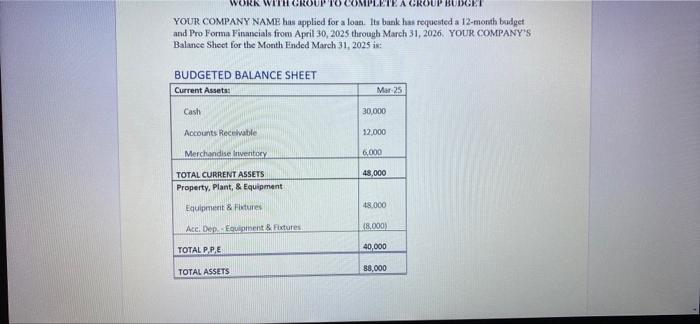

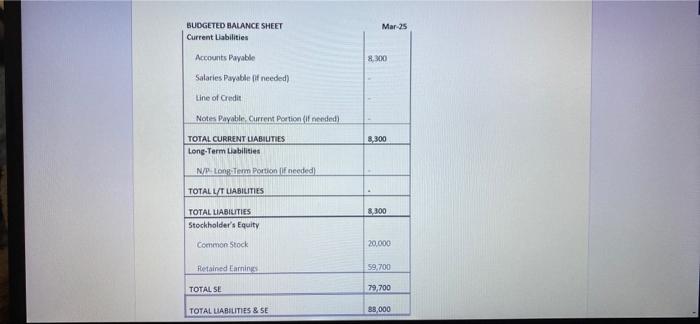

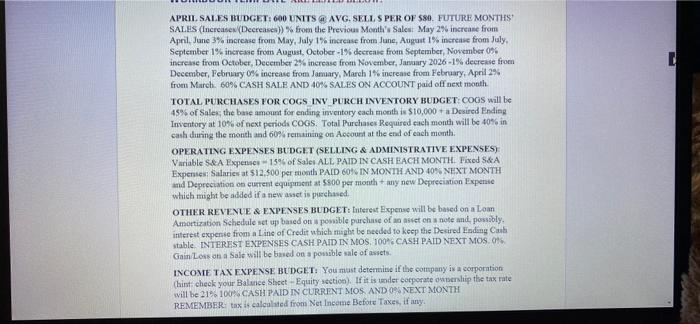

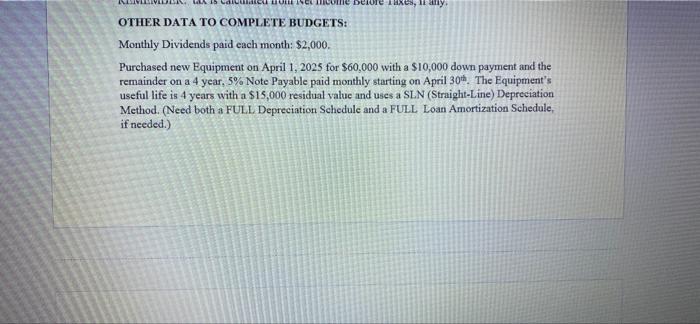

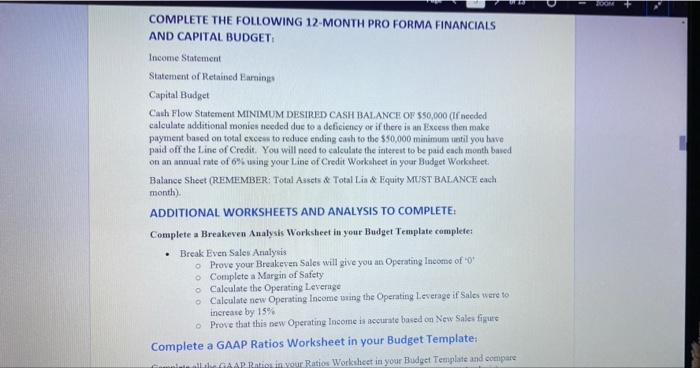

Fle Home Vs incent Page Layout Formula . . Data Review Velo - X Calibri Coments 11 A A A- === 23 Custom Paste 299 8 ! O A $ - %% Conditional Format Cell Formatting Table Styles net - De- Font Sort Undo Cioband font Select- Home Date AN 827 XG 88000 B . E 1 1 M N 0 Api May -25 A-25 Mar 25 30,000 12.000 Sep OS Dec 23 18.000 000 000 0 000 2.000 48.000 15.000 40.000 DOES THE BUDGETED BALANCE SHEET Current Asses: Ceth Accounts Receivable Merchandise retary TOTAL CURLINTASSETS Property. Plant 6 farmest Ecument Funds ACE Depuipment statures TOTAL PPE TOTAL ASSETS Carretas Accounts we Salaries Payable if needed S line of credit Notes. Fayable Cuneta del Income Tax Payable TOTAL CURRENT LAREITS Long Term Latitis Demonteerd TOTAL UTILITIES TOTAL ABILITIES Stockholder's Como SKK 8,300 20 000 State of Cataludget Cacho Bal Sheet WA TI Abate BT , $ % 92 Delete- forma EO Linds Conditional Format Cell Formatting able Styles Styles Clipboard 5 Font Sorte Find Filter Select- Esting D AL Number CAN 127 XV An B000 c 0 E G H t M N . Mars A 251 Mar 25 uns 25 Aug 25 Sep Oct 25 Nov 25 Dec 25 on 2 Feb Mar 26 A MIDGETED BALANCE SHEET 2 Assets 14 TOTAL CURRENT LILITIES 19 Long Term Cabides 20 None Portion needed 21 TOTALTIES 2 TOTAL LATES 2 Stader's Equity 24 Common Stock 20 000 59,00 79.700 1000 DOLS IH 25 Rednings 36 TOTAL 21 TOTAL MISS 20 29 30 11 ONE MONTHLY DEPRECIATION AMT From Dep New Asset My Depreciation Point 13 TOTAL MONTHLY DEPRECATION DOINSE 14 TER Total Assets 16 11 It i nc Stato State of RE Canal de Bal Sheet WORK A GROUP BUIXGEI YOUR COMPANY NAME has applied for a loan. Its bank has requested a 12-month budget and Pro Forma Financials from April 30, 2025 through March 31, 2026. YOUR COMPANY'S Balance Sheet for the Month Ended March 31, 2025 is: BUDGETED BALANCE SHEET Current Assets Mar 25 Cash 30,000 Accounts Receivable 12,000 Merchandise inventory 6,000 48,000 TOTAL CURRENT ASSETS Property, Plant, & Equipment Equipment & Fixtures 48.000 Ace. Dep.. Equiment & Fixtures 8.000) TOTAL PPE 40,000 TOTAL ASSETS 88,000 Mar 25 BUDGETED BALANCE SHEET Current Liabilities Accounts Payable 8200 Salaries Payable if needed) Line of Credit Notes Payable. Current Portion (if needed 8,300 TOTAL CURRENT LIABILITIES Long-Term Liabilities NP Long Term Portion of needed TOTALL/T LIABILITIES 8.300 TOTAL LIABILITIES Stockholder's Equity Common Stock 20.000 Retained Carning 59,700 TOTAL SE 79.700 TOTAL LIABILITIES & SE 88,000 L APRIL SALES BUDGET: 600 UNITS AVG. SELLS PER OF 580. FUTURE MONTHS SALES (Increase (Decreases)) % from the Previous Month's Sales May 2% increase from April, June 3% increase from May, July 1% increase from June, August 1% increase from July, September 1% increase from August, October -1% decrease from September, November 0% increase from October, December 2% increase from November, January 2026-1% decrease from December, February 0% increase from January, March 1% increase from February, April 2% from March. 60% CASH SALE AND 40% SALES ON ACCOUNT paid off next month TOTAL PURCHASES FOR COGS INV PURCH INVENTORY BUDGET: COGS will be 45% of Salex the base amount for ending inventory cach month is $10,000+ Desired Ending Inventory at 10% of next periods COGS. Total Purchases Required cach month will be 40% in cash during the month and 60% remaining on Account at the end of each month OPERATING EXPENSES BUDGET (SELLING & ADMINISTRATIVE EXPENSES) Variable S&A Expenses 15% of Sales ALL PAID IN CASH EACH MONTH. Fixed S&A Expenses Salaries at $12.500 per month PAID 60%. IN MONTH AND 40% NEXT MONTH and Depreciation on current equipment 500 per month any new Depreciation Expensie which might be added if a new avietis chased OTHER REVENUE & EXPENSES BUDGET: Interest Expense will be based on a Loan Amortization Schedule set up based on posible parcurse of a set on note and possibly, interest expense from a line of Credit which might be needed to keep the Desired Ending Cash stable. INTEREST EXPENSES CASH PAID IN MOS. 100% CASH PAID NEXT MOS. 0% Gain Los on a Sale will be based on a posible sale of awes INCOME TAX EXPENSE BUDGET: You must determine if the company is a corporation Chint: check your Balance Sheet -Equity section. If it is under corporate ownership the tax rate will be 21% 100% CASH PAID IN CURRENT MOS. AND 0% NEXT MONTH REMEMBER: tax is calculated from Net Income Before Taxes, if any. Home Decote XCS, 11 any. OTHER DATA TO COMPLETE BUDGETS: Monthly Dividends paid each month: $2,000. Purchased new Equipment on April 1, 2025 for $60,000 with a $10,000 down payment and the remainder on a 4 year, 5% Note Payable paid monthly starting on April 30. The Equipment's useful life is 4 years with a $15,000 residual value and uses a SLN (Straight-Line) Depreciation Method. (Need both a FULL Depreciation Schedule and a FULL Loan Amortization Schedule, if needed.) ZOOM COMPLETE THE FOLLOWING 12 MONTH PRO FORMA FINANCIALS AND CAPITAL BUDGET. Income Statement Statement of Retained Farning Capital Budget Cash Flow Statement MINIMUM DESIRED CASH BALANCE OF $50,000 (If needed calculate additional monies needed due to a deficiency or if there is an Excess then make payment based on total excess to reduce ending cwh to the $50,000 minimum istil you have paid off the line of Credit. You will need to calculate the interest to be paid each month based on an annual rate of 6% using your line of Credit Worksheet in your Budget Worksheet Balance Sheet (REMEMBER: Total Assets & Total Lin & Equity MUST BALANCE each month) ADDITIONAL WORKSHEETS AND ANALYSIS TO COMPLETE Complete a Breakeven Analysis Worksheet in your Budget Template complete: Break Even Sales Analysis Prove your Breakeven Sales will give you an Operating Income of "0" Complete a Margin of Safety Calculate the Operating Leverage Calculate new Operating Income wing the Operating Leverage if Sales were to increase by 15% Prove that this new Operating Income is accurate based on New Sales figure Complete a GAAP Ratios Worksheet in your Budget Template: AAP Ratio invour Ratios Worksheet in your Budget Template and compare

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts