Question: Please complete the question fully, ill be sure to upvote! Thank you :) 1. 2. Mauro Products distributes a single product, a woven basket whose

Please complete the question fully, ill be sure to upvote! Thank you :)

1.

2.

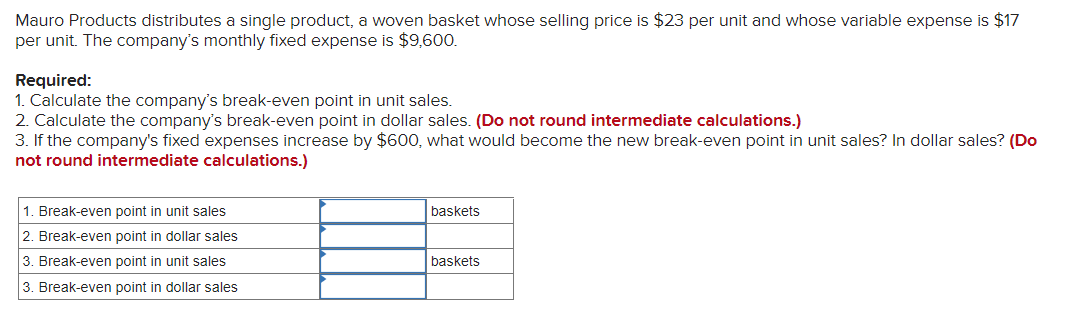

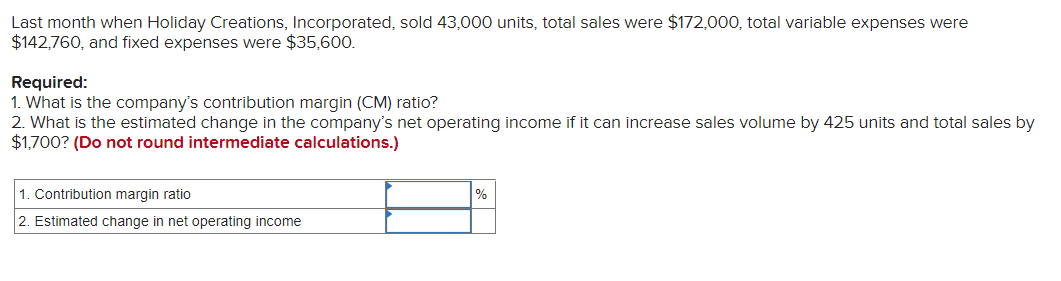

Mauro Products distributes a single product, a woven basket whose selling price is $23 per unit and whose variable expense is $17 per unit. The company's monthly fixed expense is $9,600. Required: 1. Calculate the company's break-even point in unit sales. 2. Calculate the company's break-even point in dollar sales. (Do not round intermediate calculations.) 3. If the company's fixed expenses increase by $600, what would become the new break-even point in unit sales? In dollar sales? (Do not round intermediate calculations.) Last month when Holiday Creations, Incorporated, sold 43,000 units, total sales were $172,000, total variable expenses were $142,760, and fixed expenses were $35,600. Required: 1. What is the company's contribution margin (CM) ratio? 2. What is the estimated change in the company's net operating income if it can increase sales volume by 425 units and total sales b $1,700? (Do not round intermediate calculations.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts