Question: Please complete the two Schedules shown in the pictures using the information provided in the 1st picture. please make the answer look like the actual

Please complete the two Schedules shown in the pictures using the information provided in the 1st picture. please make the answer look like the actual schedules.

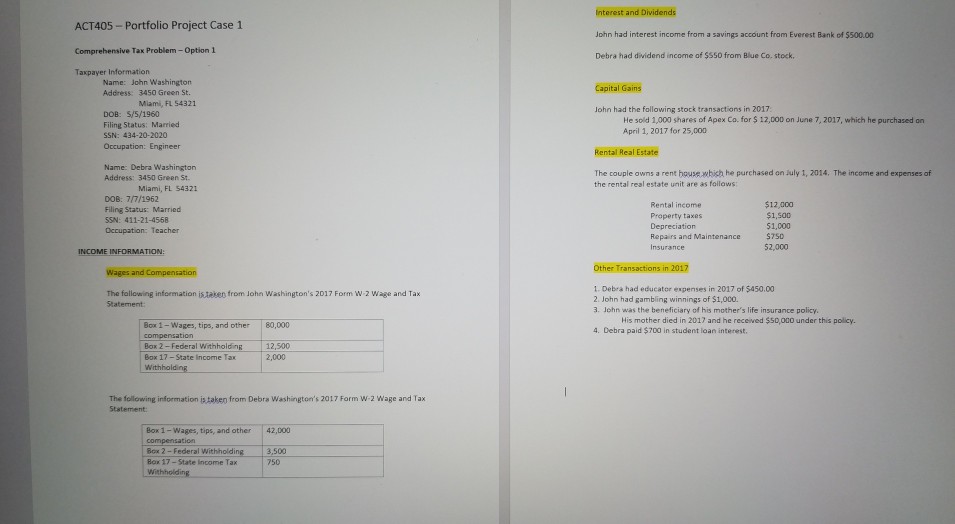

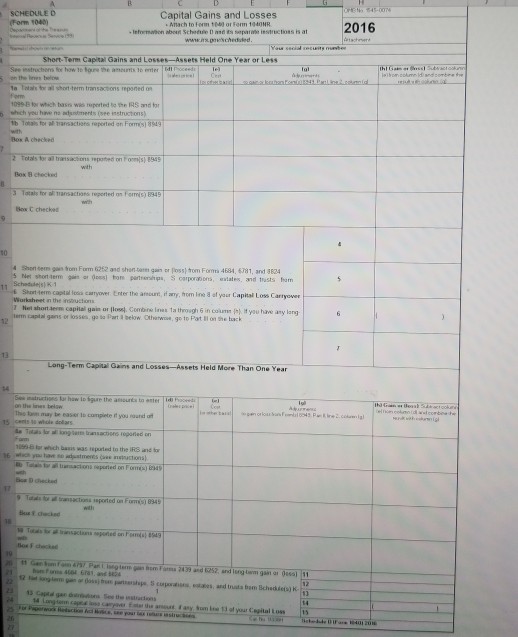

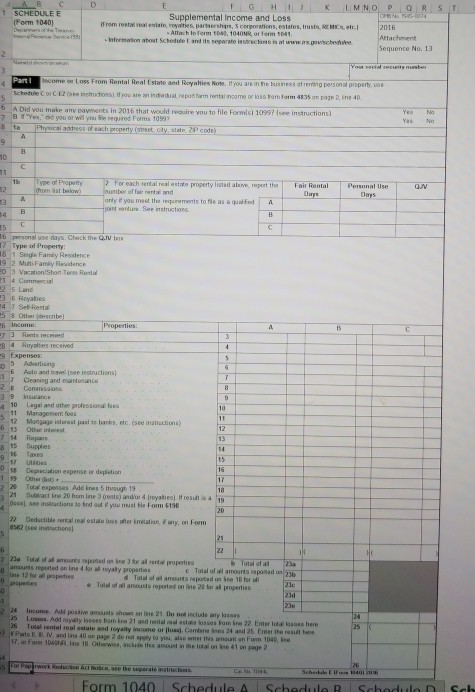

ACT405-Portfolio Project Case 1 Comprehensive Tax Problem- Option 1 Taxpayer Information Interest and Dividends John had interest income from a savings account from Everest Bank of $500.00 Debra had dividend income of $550 from Blue Co. stock, Name: John Washington Address: 3450 Green St Capital Gains Miami, FL 54321 lohn had the following stock transactions in 2017 DOB: S/5/1960 He sold 1,000 shares of Apex Co. for April 1, 2017 for 25,000 12,000 on June 7, 2017, which he purchased an Filing Status: Married SSN: 434-20-2020 Occupation: Engineer Rental Real Estate Name: Debra Washington Address: 3450 Green St. The couple owns a rent house which he purchased on July 1, 2014. The income and expenses of the rental real estate unit are as follows Miami, FL 54321 DOB: 7/7/1962 Filing Status: Married SSN: 411-21-4568 Occupation: Teacher $12,000 $1,s00 51,000 $750 52,000 Rental income Property taxes Repairs and Maintenance INCOME INFORMATION: Other Transactions in 2017 Wages and Compensation The following information Statement 1. Debra had educator expenses in 2017 of $450.00 2. John had gambling winnings of $1,000. 3. John was the beneficiary of his mother's life insurance policy. taken frorn lohn Washington's 2017 Form wa wagi i nd Ta His mother died in 2017 and he received $50,000 under this policy. Box 1-Wages, tips, and other 80,000 4. Debra paid $700 in student loan interest. Box 2-Federal Box 17 -State Income Tax 12,500 2,000 The following information is taken from Debra Washington's 2017 Form W-2 Wage and Tax Statement Box 1-Wages, tips, and other 42,000 Box 2 Federal Box 17- State income Tax 3,500 750 ACT405-Portfolio Project Case 1 Comprehensive Tax Problem- Option 1 Taxpayer Information Interest and Dividends John had interest income from a savings account from Everest Bank of $500.00 Debra had dividend income of $550 from Blue Co. stock, Name: John Washington Address: 3450 Green St Capital Gains Miami, FL 54321 lohn had the following stock transactions in 2017 DOB: S/5/1960 He sold 1,000 shares of Apex Co. for April 1, 2017 for 25,000 12,000 on June 7, 2017, which he purchased an Filing Status: Married SSN: 434-20-2020 Occupation: Engineer Rental Real Estate Name: Debra Washington Address: 3450 Green St. The couple owns a rent house which he purchased on July 1, 2014. The income and expenses of the rental real estate unit are as follows Miami, FL 54321 DOB: 7/7/1962 Filing Status: Married SSN: 411-21-4568 Occupation: Teacher $12,000 $1,s00 51,000 $750 52,000 Rental income Property taxes Repairs and Maintenance INCOME INFORMATION: Other Transactions in 2017 Wages and Compensation The following information Statement 1. Debra had educator expenses in 2017 of $450.00 2. John had gambling winnings of $1,000. 3. John was the beneficiary of his mother's life insurance policy. taken frorn lohn Washington's 2017 Form wa wagi i nd Ta His mother died in 2017 and he received $50,000 under this policy. Box 1-Wages, tips, and other 80,000 4. Debra paid $700 in student loan interest. Box 2-Federal Box 17 -State Income Tax 12,500 2,000 The following information is taken from Debra Washington's 2017 Form W-2 Wage and Tax Statement Box 1-Wages, tips, and other 42,000 Box 2 Federal Box 17- State income Tax 3,500 750

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts