Question: Please consider the following statement -- Suppose we use the sample average of observed log-returns to estimate the mean log-return for a portfolio. We know

- Please consider the following statement -- "Suppose we use the sample average of observed log-returns to estimate the mean log-return for a portfolio. We know that the observed sample average will almost certainly differ from the true mean return, but a confidence interval based on the sample average has some positive probability of including the true mean return." Do you agree with this statement? Please explain your response.

- Suppose you manage a portfolio and you want to conduct a hypothesis test of the claim that your mean portfolio return exceeds the benchmark return. What are the advantages of changing the Type I error rate for the test from 5% to 10%? Are there any disadvantages to this change in the Type I error rate? Please explain your responses.

- Suppose you manage a portfolio and your average return equals the benchmark return. What is the value of the information ratio in this case? Suppose you manage a second portfolio that has an average return that always exceeds the benchmark return, but the tracking risk is expected to increase in 2022 due to market volatility. What will happen to the information ratio in the coming year? Please explain your responses.

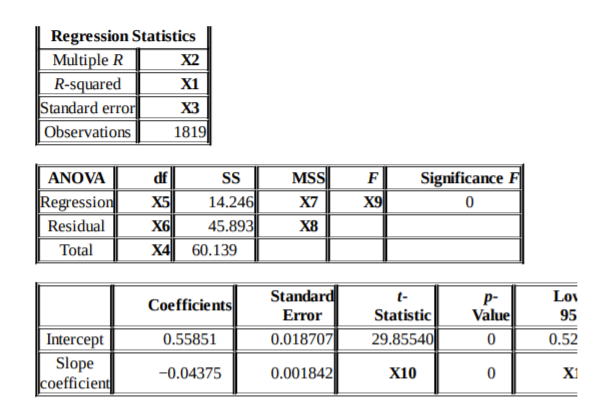

- The bid-ask spread for stocks depends on the market liquidity for stocks. One measure of liquidity is a stock's trading volume. Below are the results of a regression analysis using the bid-ask spread at the end of 2002 for a sample of 1,819 NASDAQ-listed stocks as the dependent variable and the natural log of trading volume during December 2002 as the independent variable. The below presents the output from a linear regression model, and one implication of the regression output is that the bid-ask spread for NASDAQ-listed stocks declines by nearly one-half cent per share if the trading volume increases by 10%. Does is make sense that there should be a negative relationship between the bid-ask spread and trading volume? Does the magnitude of this estimated relationship (i.e., -$0.005 per share given a 10% increase in volume) seem reasonable to you? If not, would you expect the magnitude to be larger or smaller? Please explain your responses.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock