Question: please correct the mistakes in red. (Do not copy another answer from Chegg, which was wrong) Flint Ltd. is a Canadian publicly-traded business with a

please correct the mistakes in red. (Do not copy another answer from Chegg, which was wrong)

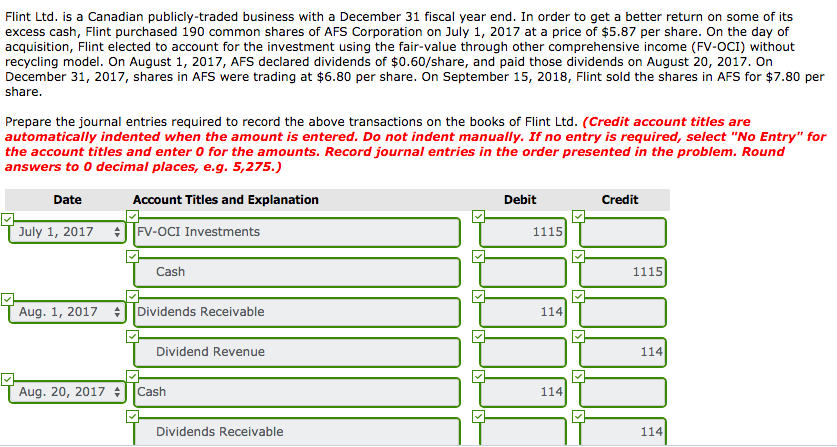

Flint Ltd. is a Canadian publicly-traded business with a December 31 fiscal year end. In order to get a better return on some of its excess cash, Flint purchased 190 common shares of AFS Corporation on July 1, 2017 at a price of $5.87 per share. On the day of acquisition, Flint elected to account for the investment using the fair-value through other comprehensive income (FV-OCI) without recycling model. On August 1, 2017, AFS declared dividends of $0.60/share, and paid those dividends on August 20, 2017. On December 31, 2017, shares in AFS were trading at $6.80 per share. On September 15, 2018, Flint sold the shares in AFS for $7.80 per share Prepare the journal entries required to record the above transactions on the books of Flint Ltd. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. Record journal entries in the order presented in the problem. Round answers to O decimal places, e.g. 5,275.) Date Account Titles and Explanation Debit Credit July 1, 2017 FV-OCI Investments 1115 Cash 1115 Aug. 1, 2017 Dividends Receivable 114 Dividend Revenue 114 Aug. 20, 2017 # | | Cash 114 Dividends Receivable 114

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts