Question: please (correctly) answer AND explain steps through this problem Reference Data table expansion would be a good investment. Assume Rouse Valley's managers developed the following

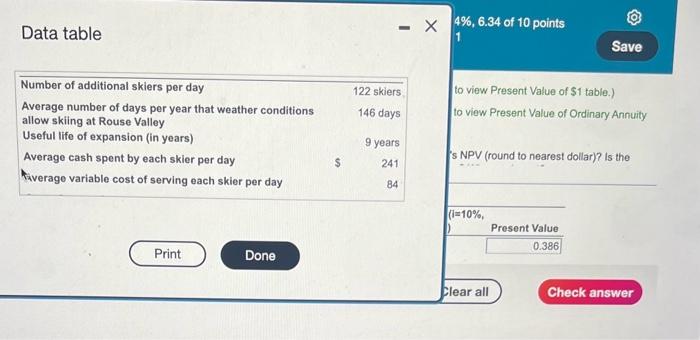

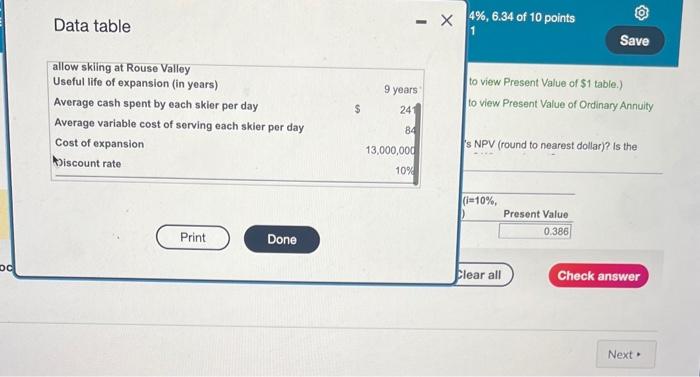

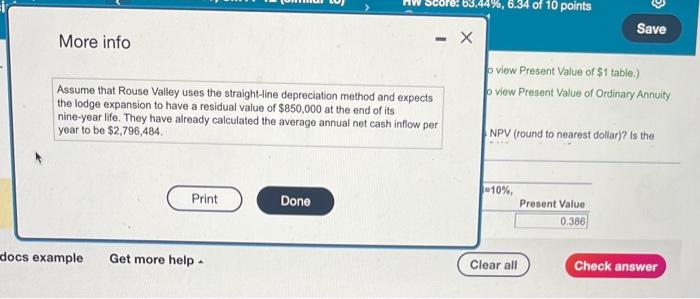

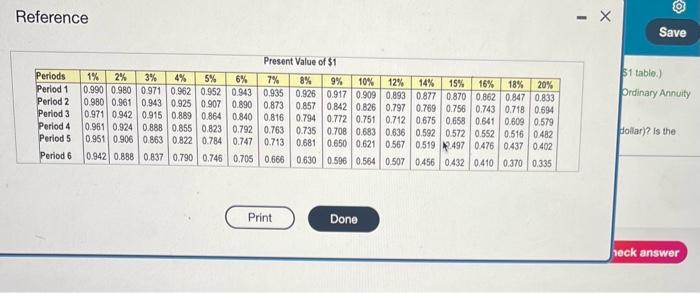

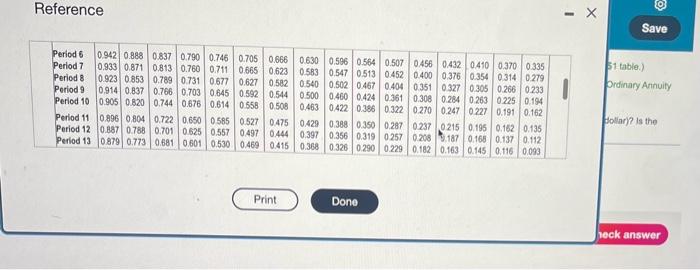

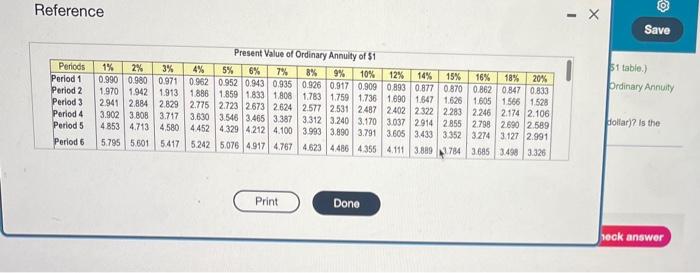

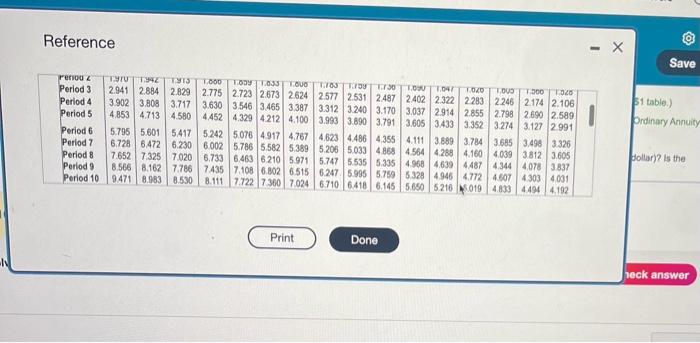

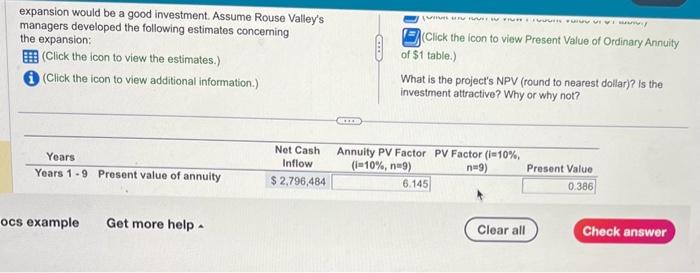

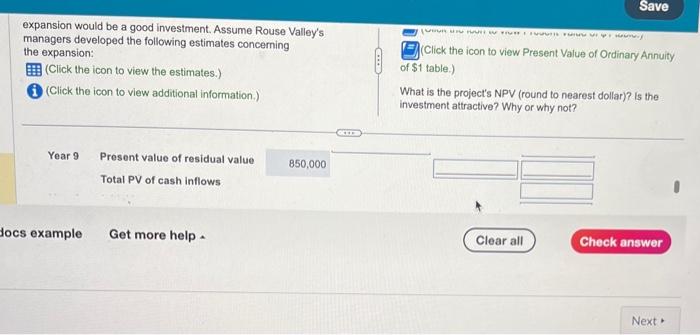

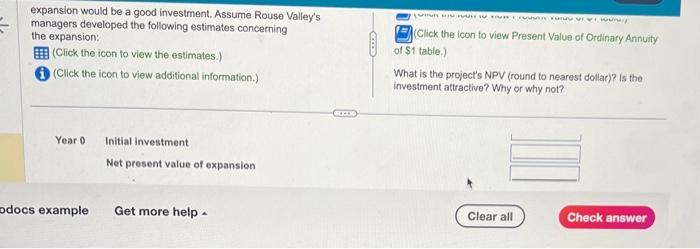

Reference Data table expansion would be a good investment. Assume Rouse Valley's managers developed the following estimates concerning the expansion: (Click the icon to view Present Value of Ordinary Annuity (Click the icon to view the estimates.) (Click the icon to view additional information.) of \$1 table.) What is the project's NPV (round to nearest dollar)? Is the investment attractive? Why or why not? Yoar 0 Initial investment Net present value of expansion More info Assume that Rouse Valley uses the straight-line depreciation method and expects the lodge expansion to have a residual value of $850,000 at the end of its nine-year life. They have already calculated the average annual net cash inflow per year to be $2,796,484. docs example Get more help. Reference 51 table.) Prdinary Annuity follar)? is the expansion would be a good investment. Assume Rouse Valley's managers developed the following estimates concerning the expansion: (Click the icon to view the estimates.) (1) (Click the icon to view additional information.) (Click the icon to view Present Value of Ordinary Annuity of \$1 table.) What is the project's NPV (round to nearest dollar)? is the investment attractive? Why or why not? \begin{tabular}{ccccc} \hline Years & NetCashInflow & AnnuityPVFactorPVFactor(i=10%,(i=10%,n=9) & n=9) & Present Value \\ \hline Years 1-9 & Present value of annuity & $2,796,484 & 6.145 & 0.386 \\ \hline \end{tabular} ocs example Get more help. Clear all Check answer Reference Present Valina of ts (31 table.) Prdinary Annuity follar)? is the Data table expansion would be a good investment. Assume Rouse Valley's managers developed the following estimates concerning the expansion: (Click the icon to view the estimates.) (Click the icon to view additional information.) (Click the icon to view Present Value of Ordinary Annuity of $1 table.) What is the project's NPV (round to nearest dollar)? is the investment attractive? Why or why not? Reference Present Value of Ordinarv Annuitu of st

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts